The Japanese yen gapped sharply lower over the weekend, following Prime Minister Shigeru Ishiba’s resignation after the elections fallout.

This announcement came a day before his Liberal Democratic Party (LDP) was scheduled to hold an internal leadership vote that could have forced him out of power.

Key Takeaways

- Short-lived tenure: Japan PM Ishiba resigned after less than a year in office, following two crushing electoral defeats that stripped the ruling LDP of its parliamentary majorities

- Electoral disasters: The LDP-Komeito coalition lost its majority in both the lower house (October 2024) and upper house (July 2025) elections

- Timing considerations: Ishiba delayed his resignation until after securing a US trade deal that reduced tariffs on Japanese car imports from 27.5% to 15%

- Political instability: Japan faces a leadership contest with potential successors including conservative Sanae Takaichi and agricultural minister Shinjiro Koizumi, with polls likely due early October

- Economic challenges: The resignation comes amid cost-of-living pressures, with rice prices doubling over the past year and the cabinet’s approval rating falling to 32.7%

Analysts noted that the 68-year-old leader’s departure deepened political uncertainty in the world’s fourth-largest economy, as it grapples with rising regional tensions and economic headwinds. The Prime Minister’s approval rating had steadily declined, reaching 32.7% in the most recent poll—a reflection of mounting economic pressures on Japanese households.

With the LDP remaining the largest party in the lower house despite losing its majority, policy continuity appears probable regardless of who emerges as the next party leader before the next elections, which are likely to take place in early October.

Conservative candidate Sanae Takaichi, who narrowly lost to Ishiba in last year’s leadership contest, represents a more hawkish approach to both fiscal policy and China relations. Meanwhile, Shinjiro Koizumi, son of former Prime Minister Junichiro Koizumi, offers a younger face for the party but with less clear policy differentiation.

Market Reaction

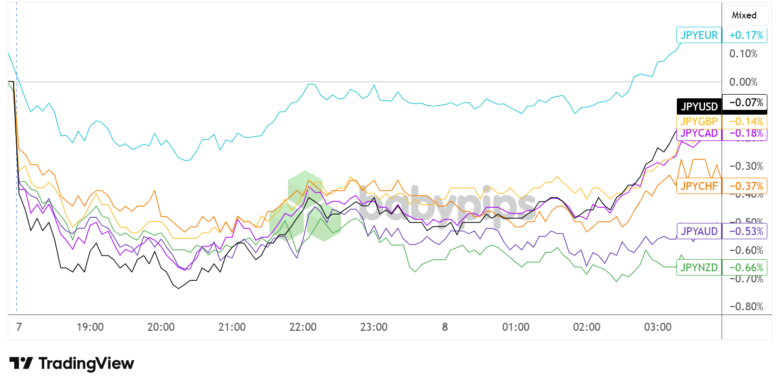

Japanese Yen vs. Major Currencies: 5-min

Overlay of JPY vs. Major Currencies Chart by TradingView

The Japanese yen gapped lower across the board on Monday in response to the resignation announcement, sustaining its bearish momentum halfway into the Asian trading session before finding a bottom.

The currency managed to pull higher as the session progressed, moving tentatively sideways a few hours before London markets opened. Still, JPY remained broadly in the red, chalking up its largest losses to NZD (-0.66%) and AUD (-0.53%) while limiting declines against USD (-0.07%) and GBP (-0.14%).