XRP (XRP) has rebounded nearly 25% from the $2 psychological level in the past week, with tailwinds from strong daily ETF inflows exceeding $164 million following the launch of Grayscale’s GXRP and Franklin Templeton’s XRPZ.

Key takeaways:

-

XRP stays bullish above $2, with chart technicals pointing toward $3.30–$3.50.

-

Resistance at $2.23–$2.50 could bring back the bears for a drop to $1.82.

Multiple XRP signals open the way for a 50% rally

On Friday, XRP defended the $1.95–$2.05 support band of a prevailing parallel channel.

This zone has repeatedly acted as support since December 2024, with each retest leading to bounces of 75%-90% to the channel’s upper boundary near $3.50.

The XRP/USD pair may gain as much as another 57% by year’s end if the setup plays out as intended.

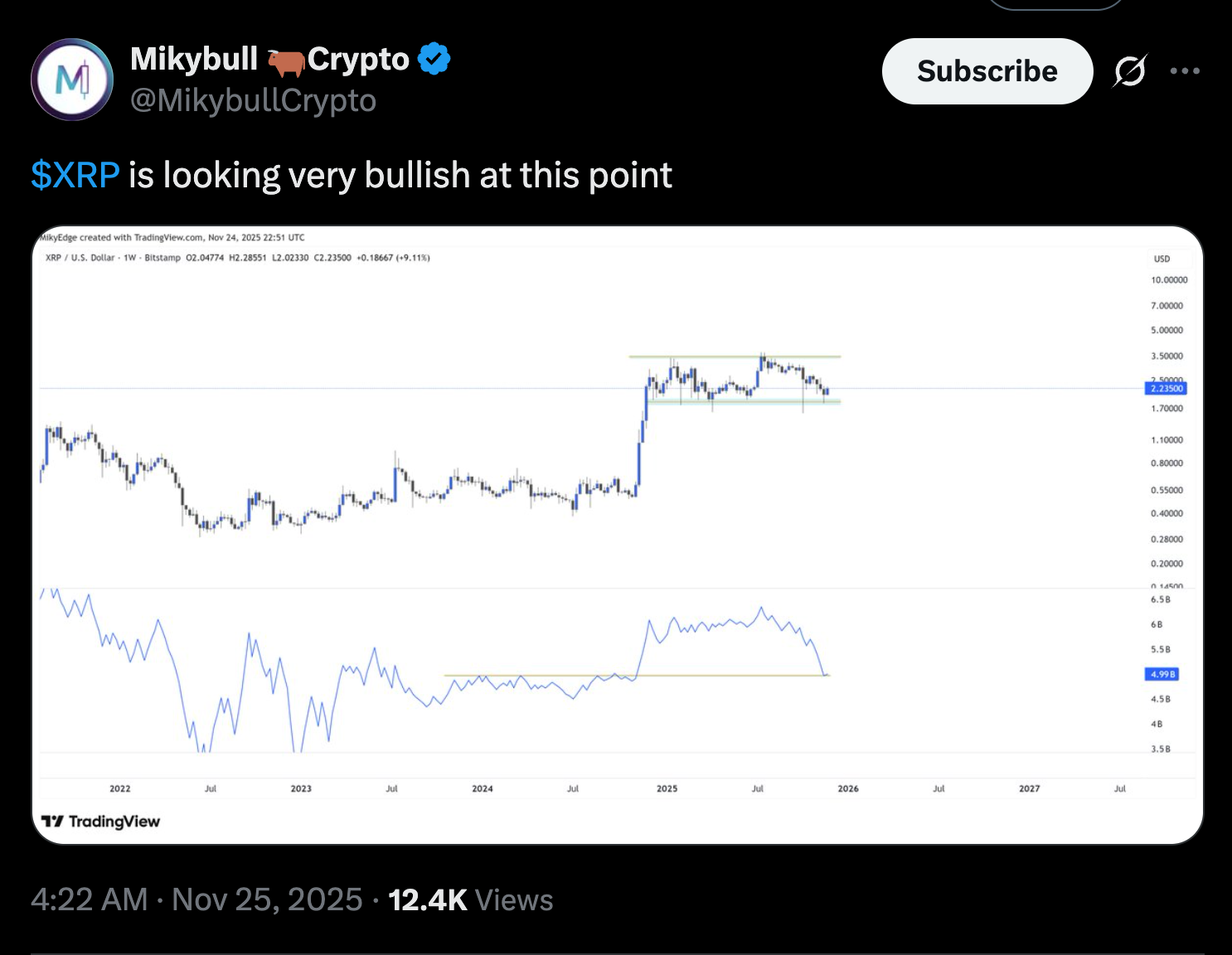

Analyst Mikybull Crypto further cited the behavior of on-balance volume (OBV) as a key reason for the bullish shift.

OBV is a straightforward method for determining whether actual buying or selling is occurring behind the scenes. When it rises, it means genuine buyers are stepping in; when it drops, sellers are in control.

For XRP, OBV bounced from a major support area right as the price touched $2. That’s important because it shows real spot buyers stepped in, instead of exiting, said Mikybull.

XRP’s 2017 fractal setup reiterates $3.50 target

XRP’s current structure closely mirrors the setup that sparked its explosive 2017 breakout, according to analyst GalaxyBTC.

In a Tuesday post, he noted that the $2 region is behaving much like the mid-range support XRP reclaimed just before its historic rally eight years ago.

XRP is once again bouncing within a familiar green accumulation zone while still respecting the broader breakout structure established earlier in 2025.

With prices stabilizing around $2 and buyers stepping back in, GalaxyBTC saw the potential for XRP to revisit the upper boundary near $3.30–$3.50, echoing the expansion phase that followed a similar technical setup in 2017.

What could change the bullish XRP view?

Despite the improving sentiment, XRP still needs to clear several technical hurdles to confirm a sustained upside move.

As of Tuesday, the token was testing the 0.236 Fibonacci retracement level near $2.23 as resistance.

A decisive breakout above this level would then face the following significant barriers: the 50-day EMA (red) and 200-day EMA (blue), both of which have capped XRP’s upside attempts since early October.

However, these EMAs sit almost exactly at the upper trendline of XRP’s descending channel, in a pattern that has guided the price lower since the summer.

If this pattern holds, XRP price will rotate back to the channel’s lower boundary, with a potential drop toward the 0.0 Fib line near $1.82 by the end of the year.

Related: How low can XRP’s price go after falling under $2?

Such a move would weaken the bullish setup and suggest the bounce was only temporary or a “dead cat.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.