Today in crypto, Kanye West’s YZY token crashed over 80% after launch, leaving 51,000 traders with $74M in losses while a handful of insiders profited millions. Spot Ether ETFs have clocked their fifth consecutive day beating their Bitcoin counterparts, with data revealing its inflows are ten times higher than Bitcoin ETFs since Thursday. Meanwhile, the US Commodity Futures Trading Commission is rolling out Nasdaq’s market surveillance tool to crack down on market abuse.

Kanye West’s YZY token: 51,000 traders lost $74M, while 11 netted $1M

Kanye West’s YZY (YZY) token has left most investors in the red, with over 51,000 traders losing a combined $74 million while only 11 wallets booked profits of more than $1 million, data from Bubblemaps shows. The Solana-based token, launched on Aug. 21, surged 1,400% in its first hour before dropping more than 80%.

As of now, YZY is trading at $0.55, down over 80% from its peak, with fewer than 20,000 holders, according to Nansen. Former kickboxer Andrew Tate lost $700,000 after opening a leveraged short on the token, Cointelegraph reported.

Bubblemaps flagged possible insider trading around the launch, naming Hayden Davis, previously linked to the Libra token scandal, who reportedly profited $12 million. Other groups of early buyers also recorded outsized gains.

The incident highlights risks tied to celebrity-backed cryptocurrencies. Over 30 such tokens launched on Solana in 2024 — backed by figures including 50 Cent, Caitlyn Jenner, Iggy Azalea and Ronaldinho — have dropped by more than 70% since launch.

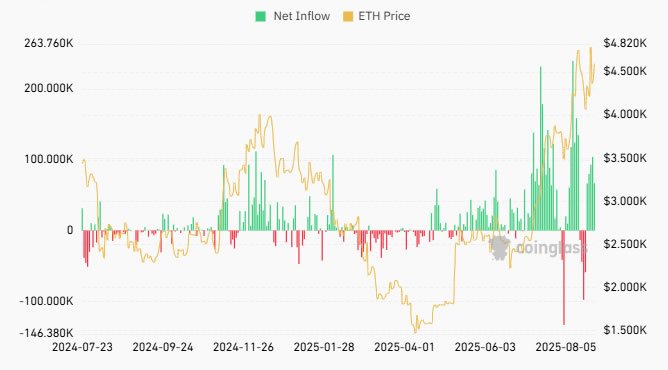

Ether ETFs captured 10x more inflows than Bitcoin in last 5 days

Over the past five trading days, spot Ether ETFs have seen a whopping $1.83 billion in inflows, whereas Bitcoin funds have taken just a tenth of that with $171 million in inflows, according to CoinGlass.

Wednesday was the fifth consecutive trading day that spot Ether ETFs outperformed spot Bitcoin ETFs in the US in terms of inflows.

The aggregate inflow for the nine Ether (ETH) funds was $310.3 million, with BlackRock’s iShares Ethereum Trust (ETHA) taking the lion’s share with a $265.7 million inflow on Wednesday.

Meanwhile, the eleven-spot Bitcoin (BTC) funds saw just $81.1 million in inflows yesterday, with BlackRock’s iShares Bitcoin Trust (IBIT) taking 62% of that with $50.7 million.

US regulator integrates Nasdaq surveillance tool to combat market manipulation

The Commodity Futures Trading Commission (CFTC), a US financial regulator, is integrating a financial surveillance tool developed by stock exchange company Nasdaq in a bid to overhaul its 1990s infrastructure.

Nasdaq’s software is focused on detecting market abuse, including insider trading activity and market manipulation in equities and crypto markets, Tony Sio, head of regulatory strategy and innovation at Nasdaq, told Cointelegraph. He said:

“Tailored algorithms detect suspicious patterns unique to digital asset markets. It offers real-time analysis of order book data across crypto trading venues and cross-market analytics that can correlate activities between traditional and digital asset markets.”

The data fed into the monitoring system will be “sourced by the CFTC through their regulatory powers,” Sio said.