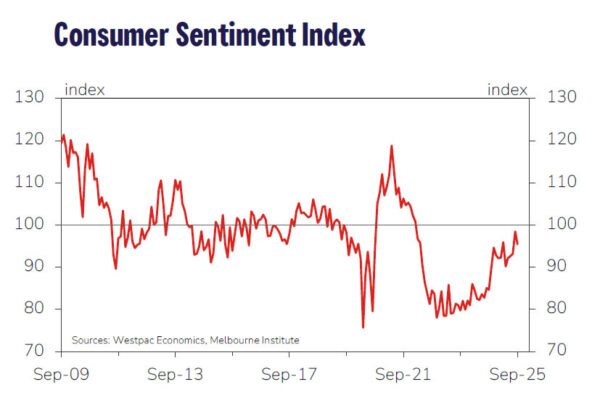

Australia’s Westpac Consumer Sentiment Index dropped -3.1% mom to 95.4 in September, reversing part of last month’s boost from the RBA’s third rate cut. While sentiment remains modestly above July levels and well above the April tariff-driven low, the index has slipped back into “cautiously pessimistic” territory. Westpac said outright optimism remains “elusive”, with households still uneasy about the path ahead despite relief from the cost-of-living crisis.

The RBA is expected to keep its cash rate steady at 3.6% when it meets later this month. Westpac noted recent data on inflation and demand came in “somewhat firmer than expected”, reinforcing the case for caution. Policymakers are seen waiting for further confirmation that underlying trends remain benign before resuming cuts.

For now, consumer recovery looks sluggish, and Westpac expects “further easing will likely be needed” to sustain momentum. It forecasts another 25bp cut in November and two additional moves in 2026, underscoring the gradual path ahead for both sentiment and policy.