- US CPI and PPI data to take centre stage ahead of Fed decision.

- ECB to likely hold rates, might signal long pause.

- OPEC decision and Chinese data to shape sentiment at start of week.

- Bond markets on alert for Treasury auctions and French budget vote.

US inflation data eyed before September FOMC

A 25-basis-point rate cut at the Fed’s September gathering is a near certainty. What there is less certainty about is the pace of cuts thereafter, while some market pundits are betting on a surprise 50-bps cut on September 17. In his keynote address at Jackson Hole, Fed Chair Jerome Powell indicated that the downside risks to employment could be becoming greater than the upside risks to inflation, warranting a shift in the policy stance.

However, whilst the balance of risks is undoubtedly tilting, it’s not clear how fast the labour market is slowing and what the full scale of impact of the higher tariffs will be on prices. So, the picture formed over the next few months from the incoming employment and inflation reports will be crucial for how quickly the Fed removes policy restriction.

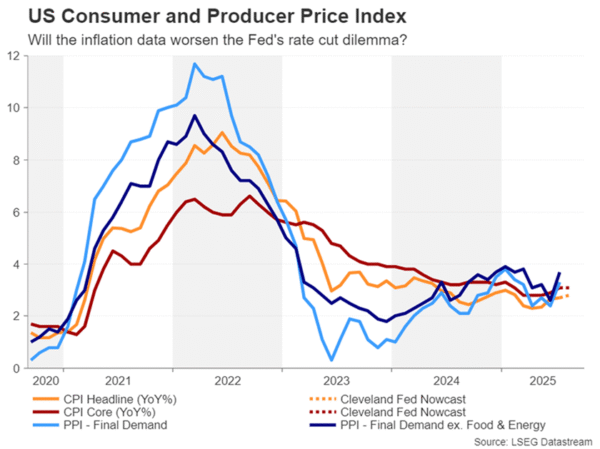

For the September meeting, both Wednesday’s producer price index (PPI) and Thursday’s consumer price (CPI) index will be important in influencing the new dot plot, even if policymakers don’t add too much weight on them for the decision itself.

PPI, which measures the price of goods leaving factories, is considered to be somewhat more forward looking than CPI. Hence, as seen for the July numbers, if there’s another bigger-than-expected increase in August PPI, investors could pare back some of their more dovish expectations for Fed rate cuts.

For now, however, the tariff effect on goods prices appears to be modest, and potentially a bigger headache for the Fed is the recent pickup in services inflation. According to the Cleveland Fed’s Nowcast model, headline CPI is estimated to have edged up 0.1 percentage points to 2.8% y/y in August, while core CPI likely stayed unchanged at 3.1% y/y.

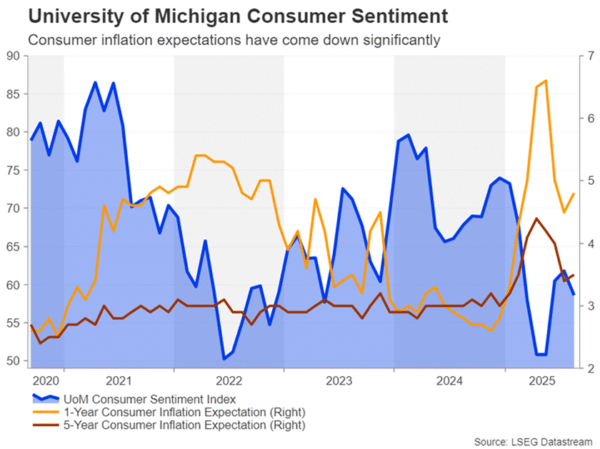

Also on investors’ radar is the preliminary consumer sentiment survey by the University of Michigan on Friday. Consumer inflation expectations turned higher in the August survey, after falling sharply in the prior months. If they continue to rise in September, this would not be a very encouraging sign.

Should the overall evidence on inflation not be very supportive of rate cuts, this could again lead to a steepening of the US yield curve, whereby short-term yields decline on the expectation of lower rates soon but longer-term yields rise on worries that inflation will spiral out of control in the future.

Further pressuring long-term bonds recently are the concerns about unsustainable budget deficits, not just in the United States, but in several advanced economies such as Japan, France and the United Kingdom. The US 30-year yield briefly spiked to a one-and-a-half-month high in the past week amid a global bond rout. There could be further volatility over the coming week as the US Treasury is scheduled to auction three-, 10- and 30-year notes.

ECB set to stay on pause

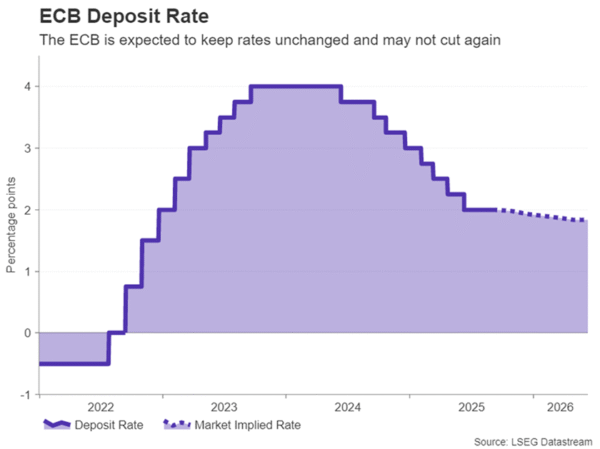

The European Central Bank is widely anticipated to maintain its deposit rate at 2.0% on Thursday when it concludes its two-day monetary policy meeting. With inflation at or close to its 2.0% target since the spring, the ECB can afford to adopt a wait-and-see stance, especially now that the immediate threat of the trade war has dissipated following the EU-US trade deal.

Policymakers appear to be split on whether or not interest rates will need to be cut again. A couple of policymakers – Schnabel and Dolenc – have warned that the next move could be up, while others, such as Olli Rehn, think that inflation could surprise to the downside.

President Christine Lagarde will probably try to strike a neutral tone in her press conference and may refrain from commenting on future policy. However, any hints that the ECB could stay on hold for the rest of the year would probably be viewed as slightly hawkish by the markets, as it would validate the current expectations that a final rate cut may not come before the middle of next year.

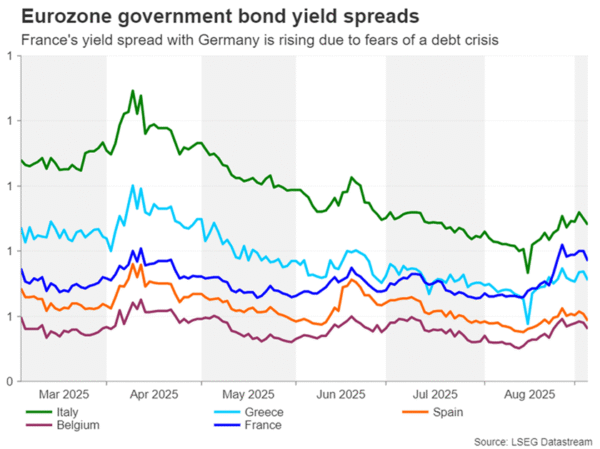

Lagarde will also be likely quizzed about the recent spike in Eurozone bond yields amid the jitters about mounting national debt levels. Whilst these concerns have been lingering in the background for some time, they’ve been fuelled lately by the increased political risks in France and Japan, and the UK government’s reluctance to carry out meaningful spending reforms.

Is France headed for a new political crisis?

For now, there doesn’t seem to be much danger of contagion beyond France as far as the Eurozone is concerned, and the direct hit on the euro has been minimal. However, it may not stay that way if the French government loses a confidence vote in parliament on Monday. Lawmakers will decide if they want to approve Prime Minister Francois Bayrou’s budget for 2026, which includes spending cuts of almost $44 billion.

Rejecting it could lead to a snap election, raising the risk that the next government won’t be as tough tackling the deficit, which stood at 5.8% of GDP in 2024. Over the past year, France’s 10-year yield spread with German bunds has widened to above those of Spain and Greece and is approaching Italy’s. A fresh political crisis runs the risk of pushing the spread even higher and sparking a selloff in the euro.

Pound vulnerable to worsening debt problem

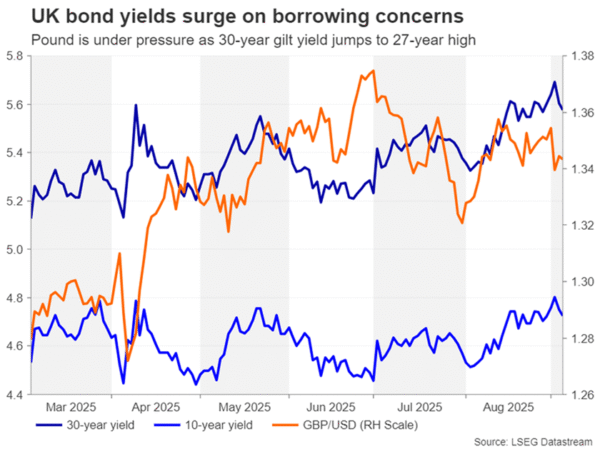

As for the UK’s debt woes, the government has set November 26 as the date of the Autumn Budget, which is later than usual. This suggests Chancellor Rachel Reeves needs more time to prepare the budget as she scrambles to find alternative revenue sources and areas for spending reductions. The markets aren’t holding their breath, however, as even if Reeves manages to fill the fiscal hole that could potentially be as high as £50 billion, the gap would almost certainly be covered by higher taxation than lower spending, dampening growth in the economy.

The pound has been extremely choppy since late August and plunged last Tuesday when the yields on both the 10- and 30-year gilts soared, with the latter reaching the highest since 1998. Investors questioning the ability of governments to repay their debt could be much more damaging for sterling than the other currencies in the danger zone right now – the euro and yen – due to the UK’s twin deficit problem.

But with the bond market scare starting to ease, there could be more relief for the pound and gilts next week if Friday’s monthly GDP readings for July don’t disappoint.

OPEC+ may prefer lower prices

Oil futures have not been immune to the recent volatility, although prices are being driven for different reasons. Just as the receding hopes of a direct dialogue between Ukraine and Russia on ending the war and the prospect of more US sanctions on Russian oil exports have given prices a leg up, OPEC+ has delivered a fresh blow to the bulls.

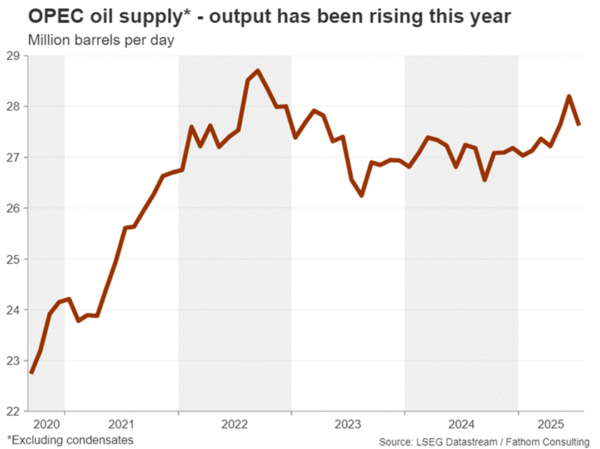

OPEC+ sources have told Reuters that the cartel is not done raising output and will consider additional increases when member countries meet on Sunday to discuss quota levels.

OPEC producers have already unleashed 2.5 million barrels per day of new supply into the market this year but had hinted that September’s increase of 547,000 bpd was going to be the last. Should they proceed with another output hike for October rather than pause, this may signify that their goal isn’t just to balance the market but to also price out the competition from non-OPEC+ countries.

Oil prices could come under pressure if OPEC+ announces higher quotas or strongly signals it for one of the upcoming meetings.

Busy start to the week

Investors will also be watching Chinese trade figures first thing on Monday. So far, there’s been no notable impact from the trade war with the US on China’s exports, at least not according to the official data. However, now that the dust has started to settle, investors may not necessarily react much even if there’s a slowdown in August export growth, although a very weak print could spur some negative reaction.

More Chinese data will follow on Wednesday with the CPI and PPI readings for August.

Meanwhile, Japan will publish revised GDP estimates for the second quarter on Monday, and corporate goods prices for August might attract some attention on Thursday.