The U.S. Producer Price Index unexpectedly fell 0.1% m/m in August, bringing annual wholesale inflation to 2.6% – well below economist expectations.

The core PPI, which excludes volatile food and energy prices, also declined 0.1% monthly and rose 2.8% y/y, missing forecasts.

The surprisingly soft inflation data confirmed that businesses are absorbing tariff costs rather than passing them through to consumers, providing the Fed with additional justification for monetary policy easing.

Key Takeaways from U.S. PPI Report:

- Headline PPI: -0.1% m/m, +2.6% y/y (vs. +0.3% m/m, +3.3% y/y expected)

- Core PPI: -0.1% m/m, +2.8% y/y (vs. expectations of +3.5% y/y)

- Services prices declined 0.2% month-over-month, driven by a 1.7% drop in trade services margins

- Goods prices edged up just 0.1% m/m despite tariff pressures

- Energy prices fell 0.4% m/m, providing disinflationary pressure

- Tariff-exposed goods showed mixed results: Beef surged 6.0% m/m and coffee jumped 6.9% m/m, but overall goods inflation remained subdued

Link to the official U.S. August PPI Report

Despite widespread concerns about inflationary pressure from trade policy implementations, the August data suggest corporations are continuing to absorb most tariff costs rather than passing them through.

The 1.7% decline in trade services margins – matching the biggest drop since 2009 – indicates retailers and wholesalers are compressing their profit margins.

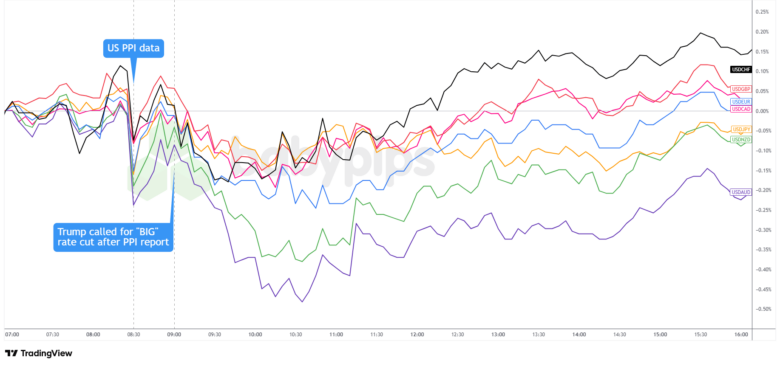

Market Reaction

U.S. Dollar vs. Major Currencies: 5-min

Overlay of USD vs. Majors Chart by TradingView

The U.S. dollar, which was trading in ranges ahead of the release, dropped broadly and sharply when the PPI reports were published.

After a brief recovery attempt, the Greenback resumed its decline around 09:00 AM ET following President Trump’s social media post declaring “No Inflation!!!” and demanding immediate aggressive rate cuts from the Fed, while calling Powell “a total disaster.”

Commodity currencies AUD and NZD led gains against the dollar, while safe havens showed more resilience. The selling pressure persisted through most of the session before moderating near the London close, likely due to position adjustments before Thursday’s CPI data.

By day’s end, USD performance was mixed – strengthening versus EUR, CAD, CHF, and JPY but weakening against “risk” currencies like GBP, AUD, and NZD.

With markets fully pricing a 25 basis point Fed rate cut for the September 17-18 meeting, focus shifts to Thursday’s CPI report for further inflation clarity.