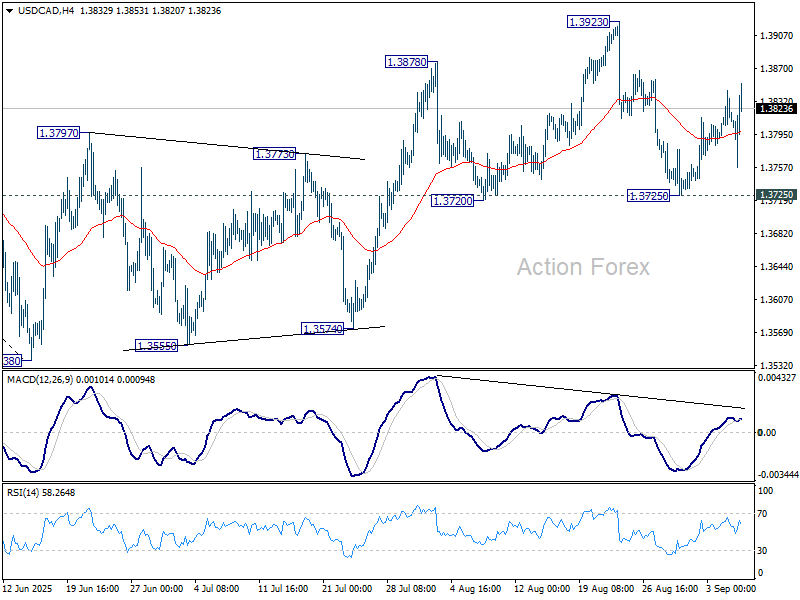

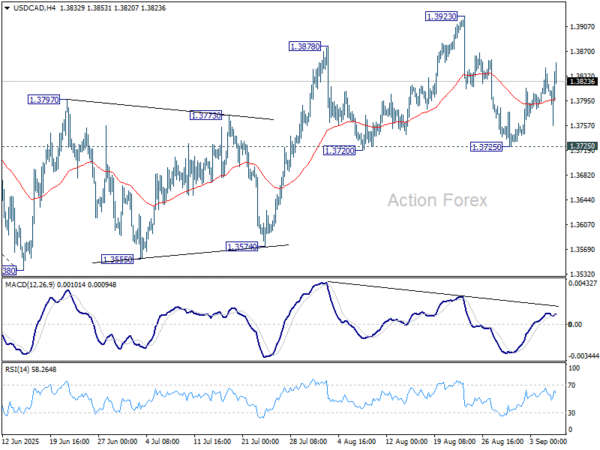

USD/CAD’s strong rebound last week suggests that pullback from 1.3923 short term top has completed at 1.3725, after defending 1.3720 support. The development indicates that corrective rebound from 1.3538 is not completed yet. Initial bias stays on the upside this week for retesting 1.3923 first. For now, risk will stay on the upside as long as 1.3725 support holds, in case of retreat.

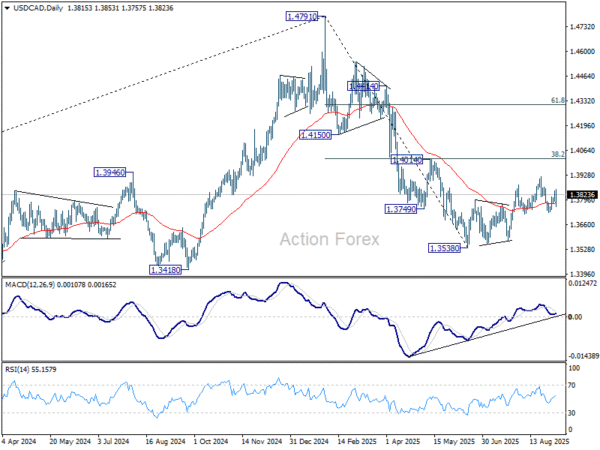

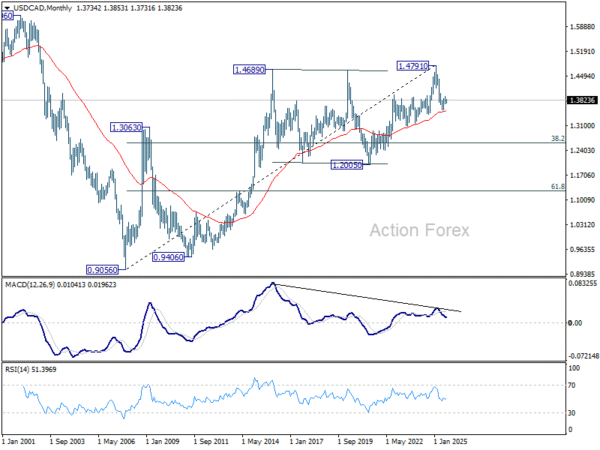

In the bigger picture, price actions from 1.4791 medium term top could either be a correction to rise from 1.2005 (2021 low), or trend reversal. In either case, further decline is expected as long as 1.4014 cluster resistance (38.2% retracement of 1.4791 to 1.3538 at 1.4017) holds. Next target is 61.8% retracement of 1.2005 (2021 low) to 1.4791 at 1.3069.

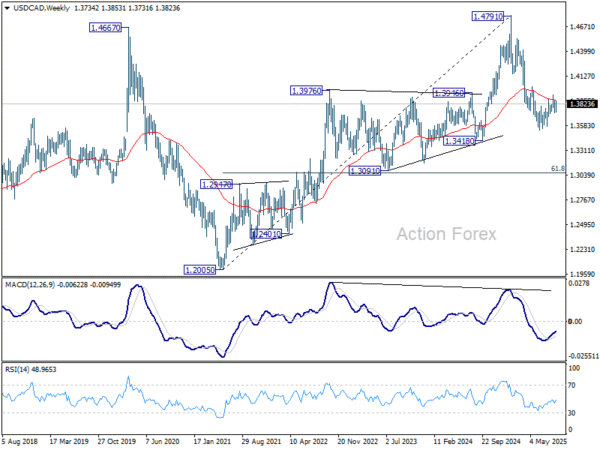

In the long term picture, considering bearish divergence condition in M MACD, up trend from 0.9506 (2027 low) might have completed with five waves up to 1.4791. Sustained trading below 55 M EMA (now at 1.3511) will solidify this case and bring deeper medium term fall to 38.2% retracement of 0.9056 to 1.4791 at 1.2600, even as a correction. Nevertheless, strong rebound from the 55 E MEA will retain bullishness for up trend resumption through 1.4791 later.