The monthly release for US August jobs is at 22K vs 75K Expectations – Job growth is almost flat in the past 4 months!

The prior month came at 74K vs 110K expectations, but the biggest surprise was to the downside revisions which turned a 291K increase in two months to an-only 33K increase.

With the unemployment rate rising to 4.3%, there really is a decent slowdown happening in the US.

EDIT: As things are unfolding, the Market is pricing a 100% chance of a cut on September 17 and starting to price chances of a 50 bps (currently around 14%).

July Jobs revised at 79K (vs 74K) and June months actually at -12K vs 14K on the second revisions.

Canadian jobs also regressed quite largely at -65K vs 10K expectations, sending the Loonie down vs other majors.

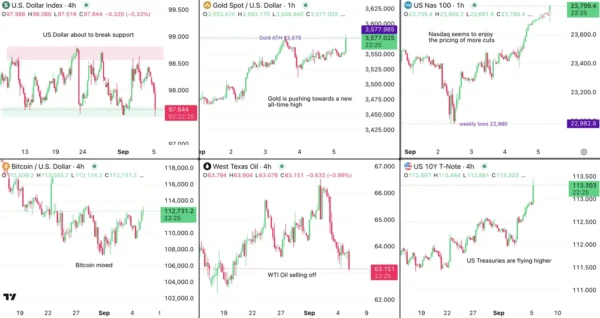

The US Dollar is falling off, about to break support, equities are rallying but mixed : a more than 25 bps is starting to price but still has low probabilities of happening.

The data still shows an increase, albeit a very small one.

Check out the reactions to the US Dollar, a few FX Charts and Equities Futures.

Market reactions

Market overview, September 5, 2025 – Source: TradingView

It will be essential to log in after the Market open to see reactions when most volumes enter the market.

For now, it’s USD and CAD down, risk-assets up but mixed, US Treasuries and Gold flying higher.

Current FX Picture after NFP

FX currency performance, September 5, 2025 – Source: Finviz

Look at the current pricing for FOMC Cuts for the rest of the year:

Cut Pricing for the rest of the year – Source: FEDWatch Tool

Markets just added about 17 bps of extra cut pricing to the rest of the year, which takes the 2.1 cuts to just about 3 cuts.

Let’s see how this progresses and what influence it will have on Markets.

Safe Trades!