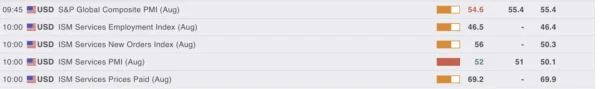

US ISM Services PMIs just got released at 52 vs 51 expectations, a positive surprise.

Prices paid are still way too high for a comfortably dovish FED, but it seems like this component isn’t accelerating anymore.

For the rest, nothing shocking: The employment component is still in contraction but not disastrous and new orders are increasing again, a positive after the tariff-led decrease.

Next step will be tomorrow’s NFP release which will shape up, with the September FOMC Meeting (September 18), the tone for the rest of the year.

Don’t forget to stay in touch with the views from NY FED’s Williams coming up at 12:05 (holds high influence on the FED and votes at every meeting) and later today Goolsbee’s meetings (voter in 2025).

For now the US picture looks like a cooling one (far from catastrophic!).

Except for a major downward surprise tomorrow, there shouldn’t be any reason to panic.

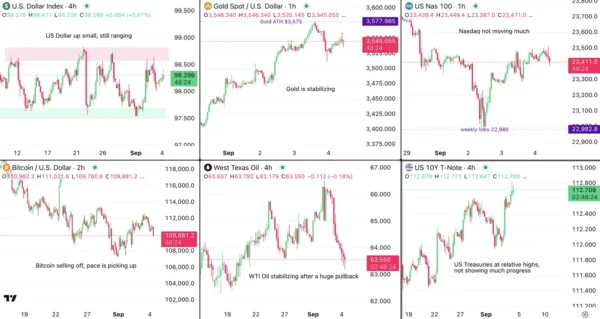

Reactions are small: A global market view

Market Overview, September 4, 2025 – Source: TradingView

Market reactions are very muted as Participants stay put for tomorrow’s session – Anxiety is still high.

Only notable move would be Cryptocurrencies still seeing some profit-taking flows.

Safe Trades!