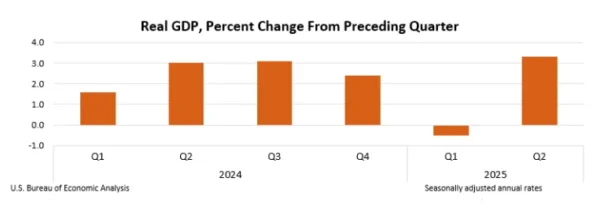

Real gross domestic product (GDP) increased at an annual rate of 3.3 percent (0.8 percent at a quarterly rate) in the second quarter of 2025 (April, May, and June), according to the second estimate released by the U.S. Bureau of Economic Analysis. In the first quarter, real GDP decreased 0.5 percent.

Source: US Bureau of Economic Analysis

The economy grew in the second quarter, mainly because the country imported fewer goods and services, and people spent more money. However, this growth was limited by businesses investing less and the country exporting less.

The initial estimate of economic growth was later corrected to be a bit higher. This correction happened because it was found that businesses invested more and people spent more than first thought, but this was partly canceled out by the government spending less and the country importing more than initially estimated.

Compared to the first quarter, the second quarter’s growth was a result of a sharp drop in imports and faster consumer spending, which were partly countered by a decrease in investment.

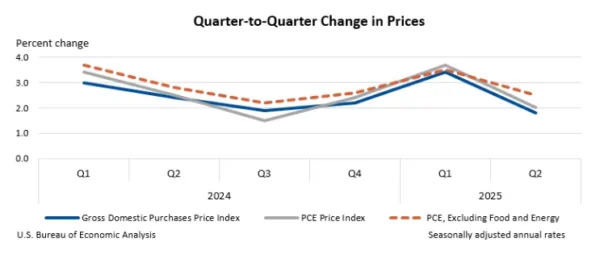

A key measure of private-sector activity, which adds up what consumers and businesses spent, grew by 1.9 percent, which was a significant upward correction from the earlier number. Prices for goods and services bought in the country went up by 1.8 percent, which was a slightly smaller increase than first thought.

The prices that consumers paid went up by 2.0 percent, also a bit less than first estimated. When you remove volatile food and energy costs, consumer prices went up by 2.5 percent, which was the same as the first estimate.

Source: US Bureau of Economic Analysis

Market Reaction – US Dollar

The US Dollar Index seemed largely unfazed by the data release as it continued its decline once the data was released.

The index is now within touching distance of the recent swing low which is a key area of support resting at 97.70.

A break and candle close below this support level could open up the door for a retest of the Year-to-date lows around 96.37 and may be worth monitoring.

Gold (XAU/USD) Analysis

Gold prices continued their rise today as the precious metal peaked back above the $3400/oz level.

The previous bullish pennant breakout played out to perfection.

The question now will be whether the precious metal can gain acceptance above the $3400/oz before making a run toward the all-time highs.

If it does there is a key level in and around the $3430-$3440 with a candle close above this handle seen as clearing a path for a retest of the ATH at $3500/oz.

There is a golden cross pattern developing on the four-hour as the 50-day MA eyes across above the 100-day MA. While this is a lagging signal it still shows that momentum may currently be favoring a bullish move.

Gold (XAU/USD) Four-Hour Chart, August 27, 2025

Source:TradingView.com

Client Sentiment Data – Gold

Looking at OANDA client sentiment data and market participants are Long on XAU/USD with 51% of traders net-long. I prefer to take a contrarian view toward crowd sentiment, however the reading of 51% net-long shows the indecision and concern by market participants that Gold can hold above the $3400/oz handle.