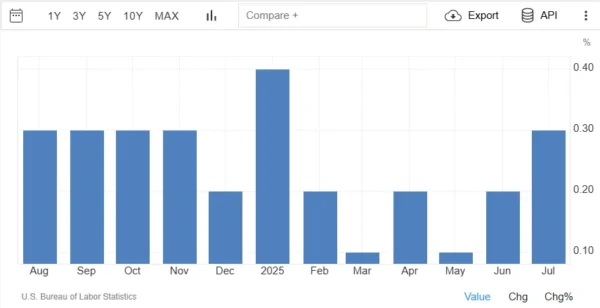

The CPI outlook looks shaky and this week’s print may show a rise of about 0.3% this past month, which could lift the annual rate to roughly 2.9%. Some analysts even think it might hit 3% year‑over‑year.

The boost seems tied to higher food and energy costs. One estimate even points to a 2% jump in gas prices month‑to‑month, therefore pressure stays on and shoppers likely notice higher costs at checkout.

US Core CPI Debate

The real debate, though, centers on core CPI numbers – the ones that leave out the wild food and energy swings. Different analysts see two paths ahead. One camp thinks we’ll see a 0.3 % rise from month to month, which would leave the annual rate stuck around 3.1 %. The other, more cautious group, pictures a 0.4 % jump, the biggest since January and the second biggest in almost two years. That tiny gap between 0.3 and 0.4 isn’t just a math detail; it could change how we read inflation.

A 0.3 increase might still be called “sticky,” yet it could be part of a rough but steady slowdown in price growth. A 0.4 rise, however, seems to signal a clear push back up, shaking the idea that inflation is finally easing.

If that happens, the question is will the Fed change its policy stance? My answer is no but markets would probably react quickly, and investors might demand higher yields on bonds.

Source: TradingEconomics

Underlying Drivers: Where the Inflationary Pressures Originate

The rise in inflation looks like it will be spread across many items, not just a few. A bounce back in core goods prices may add about 0.25 % from month to month, which could push the annual rate up to its biggest point since May 2023. Parts of this push could be new cars, clothing, sports gear, and even phones or tablets.

At the same time, the hoped‑for relief from slower service inflation appears to be fading. Forecasts suggest core services might go up roughly 0.30 % in August, with travel‑related services—especially hotel costs—showing a strong climb of around 1.0 %. This broader strength in both goods and services therefore hints that price pressures are no longer limited to narrow sectors but may be more rooted in the overall economy.

Policymakers will be watching these trends closely even as the labor market dominates the discussion at the moment.

The Fed’s Policy Puzzle: A Rough Road Ahead

The road ahead for the Federal Reserve is expected to be a bumpy one. Concerns about Fed independence, worsening labor market conditions and political drama will keep the Fed the center of attention for the remainder of 2025.

As things stand, the labor market is going to be the center of focus for now. However, if inflation begins to rise again as tariffs begin to start filtering through and companies pass the increases to consumers, inflation could play a much bigger role later in the year.

Potential Implications for the US Dollar and Rate Cut Expectations

Two things mainly push the dollar when a CPI report comes out. First, interest‑rate gaps – the difference between U.S. Treasury yields and the yields you see in other countries. Those gaps decide where money moves.

Second, Fed‑policy guesses – how people see the chances of the Fed raising or lowering rates. Those guesses shift the gaps. When CPI numbers change what folks expect the Fed will do, they also change how attractive U.S. assets look. That can lift the dollar or drop it.

When the CPI looks “hot” – say the core number is 0.4 % or higher – it hints that inflation is still strong. That may mean the Fed will keep tightening or even go harder. Traders then want more dollars, Treasury yields climb, and the DXY (the dollar index) usually goes up. At the same time, stocks can feel pressure because borrowing costs look higher.

But a “cool” CPI – core 0.3 % or lower – suggests price growth is slowing. The market may turn more dovish, thinking the Fed could pause or cut rates sooner. Lower expected yields make the dollar less tasty, so it often slides down. Treasury yields tend to fall, and risk assets like equities might get a boost from cheaper money.

In short, the dollar’s move is a straight line from CPI‑driven belief changes to interest‑rate gaps, then to the dollar’s strength.

What could happen based on those ideas:

- Hot CPI (core 0.4 %+): Dollar likely goes up against other currencies (DXY climbs); Treasury yields rise; stocks may drop.

- Cool or Neutral CPI (core ≤0.3 %): Dollar may sell off; Treasury yields fall; equities could rally.

If the CPI lands right at the expected 0.3 % core, markets sometimes do a “buy the rumor, sell the fact” trick. If people already priced in a hawkish Fed, the on‑target number can cause a quick, technical dip in the dollar. That shows why the headline number and how it differs from consensus both matter.

So, in the current climate markets are expecting a slight uptick in inflation. Meaning if we do get a softer print, the immediate reaction could see the probability of a 50 bps rate cut on September 17 rise. This will lead to a selloff in the US Dollar but is unlikely to last as markets will likely cool off once the data has been fully digested.

US Equities may attract a lot of interest as they have continued to rise in recent trading sessions. I expect that the volatility we see with US equities will outweigh volatility elsewhere irrespective of whether the data is positive or negative.

US Dollar Index (DXY) Daily Chart, September 9, 2025

Source: TradingView.com (click to enlarge)