Summary

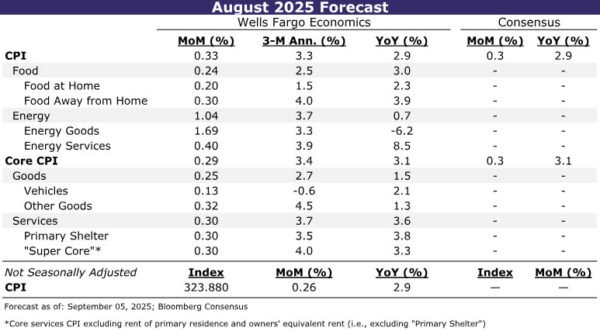

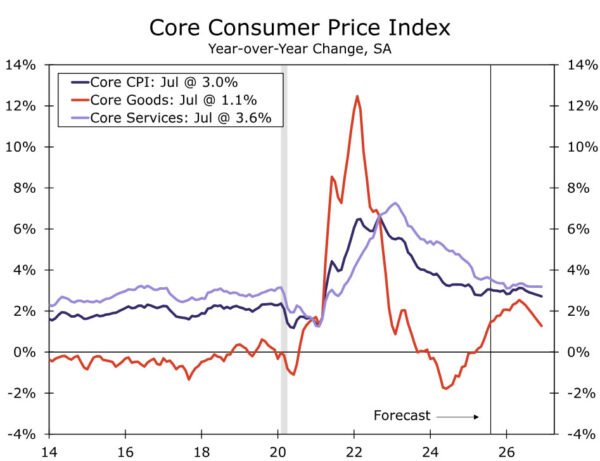

The July CPI indicated that tariffs are not the only challenge to the Fed finishing its fight against inflation. Sticky services inflation alongside the rebound in goods prices has stymied the disinflationary trend of the past two years and pushed inflation further from the FOMC’s target. We expect the firmer trend to continue in August and look for the core CPI to rise another 0.3%, keeping the year-over-year rate at 3.1%. A pickup in food and energy prices should support the headline CPI as well, which we forecast to rise 0.3% over the month and 2.9% relative to a year ago.

Further ahead, we suspect higher tariff rates are here to stay as the administration has authority to increase customs duties beyond the International Emergency Economic Powers Act currently under legal scrutiny. The spillovers from stronger goods inflation to services inflation should remain limited, however. Physical inputs are only a small portion of service firms’ overall costs, the jobs market continues to soften and inflation expectations remain generally anchored. We expect the core CPI and PCE to run around a 3% annualized pace over the next six months or so before resuming its downward trend in the spring of next year.

Inflation Keeping the Fed in an Uncomfortable Place

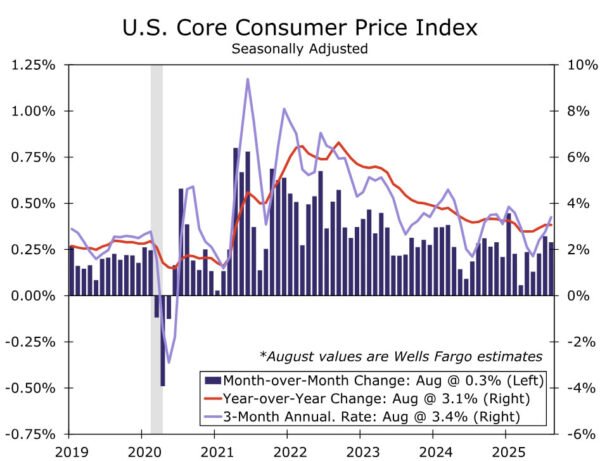

The July CPI offered further evidence of the difficult road ahead for the Federal Reserve. Core inflation quickened with broad-based strength across goods and services, illustrating that tariffs are not the only forces keeping inflation sticky. We expect the firmer trend to continue in August and look for the core CPI to rise another 0.3%, keeping the year-over-year rate at 3.1% (Figure 1). A pickup in food and energy prices should support the headline CPI as well, which we forecast to rise 0.3% over the month and 2.9% relative to a year ago.

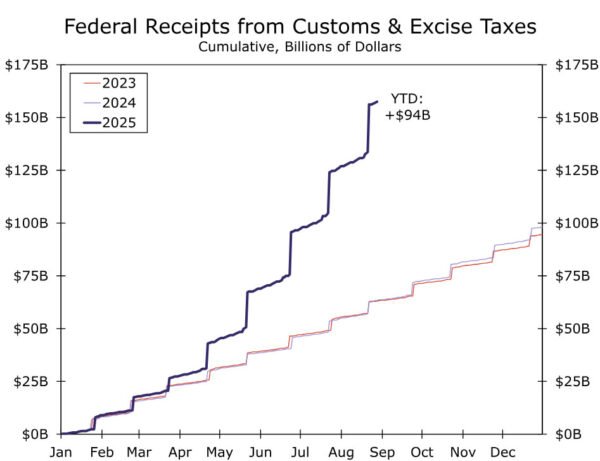

The burst of inventory front-running in the first quarter has allowed businesses to gradually adjust selling prices as they await to see where tariff rates ultimately land and avoid alienating consumers in the meantime. Yet, as stockpiles have dwindled, merchandise imports have started to rebound with U.S. firms seeing steep increases in customs’ bills. Year-to-date, tariff revenues are up $94 billion, or about 150% from this point last year (Figure 2). The rising cost burden has been highlighted in earnings calls, our conversations with clients and within the Federal Reserve’s latest Beige Book, and leads us to expect further strength in goods inflation in the months ahead.

We look for core goods prices to rise 0.25% in August, marginally stronger than last month’s increase. New vehicle inflation, which has been tame, is poised to strengthen as a rebound in auto sales has helped to reduce inventory and the use of incentives has slowed. Price growth for other import-heavy items, such as apparel, recreational goods and communication hardware, should remain solid as well with another 0.3% increase. The further pickup in core goods prices is expected to push the year-over-year rate up to 1.5% in August, which would be its highest since May 2023.

Slower services inflation helped to counteract the upward pressure from stronger goods inflation over the first half of the year. We suspect the offset is now fading and look for core services prices to rise 0.30% in August. Travel-related service prices started to rebound in July, and we estimate another solid gain in August (+1.0%), led by lodging away from home. While spending on discretionary services remains generally weak, consumers’ appetite for travel shows signs of rebounding with hotel occupancy and TSA screenings up again on a year-ago basis, suggestive of some stabilization in consumer demand.

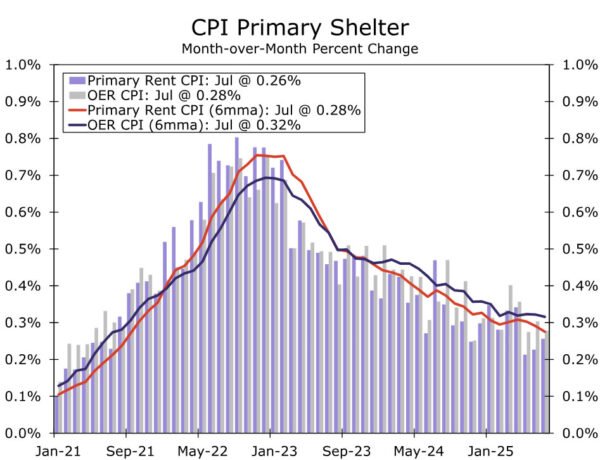

Elsewhere, medical care services inflation appears due for a moderation after posting its largest increase in nearly three years in July. Forward-looking measures of rent growth suggest primary shelter inflation should run a touch under its 0.31% year-to-date average through the remainder of 2025, which will allow the year-over-year rate to gradually recede to 3.6% by December (Figure 3). Meantime, ongoing softening in the labor market is likely to limit upward pressure on wage growth, which we expect to help keep a lid on personal services inflation as well.

Looking further ahead, we suspect higher tariff rates are here to stay even if the use of the International Emergency Economic Powers Act (IEEPA) to institute “reciprocal” rates is not held up in court. There are other avenues the administration can pursue to levy tariffs on the legal grounds of national security (Section 232), unfair trade practices (Section 301) and serious trade deficits (Section 122). A shift from country-focused to product-focused duties will further complicate the supply chain adjustment process, but keep price pressures turned up.

We still expect spillovers into services to be limited, however (Figure 4). While services PMIs show a significant net share of services firms report higher input costs, physical inputs are a small portion of overall costs. More important for services inflation is the ongoing softening in labor conditions, which is helping to slow compensation growth. That said, real incomes continue to rise, preventing a collapse in demand and making additional disinflation in the service sector slow-going (Figure 5). We thus continue to expect the core CPI and PCE to run around a 3% annualized pace over the next six months or so before resuming its downward trend in the spring of next year.