The U.S. economy saw an uptick in its August CPI figure from 2.7% year-on-year to 2.9% as expected while the core version of the report also came in line with consensus, according to data released by the Bureau of Labor Statistics.

On a monthly basis, the headline CPI rose 0.4% in August 2025, marking the largest monthly increase since January. The reading exceeded economist expectations of 0.3% and highlighted persistent price pressures across multiple sectors.

Key Takeaways

- Headline CPI: Rose 0.4% month-over-month, up from 0.2% in July; annual rate climbed to 2.9% from 2.7%

- Core CPI: Increased 0.3% monthly, matching July’s pace; yearly rate ticked higher to 3.1% from previous 2.8%

- Shelter dominance: Housing costs rose 0.4% and accounted for the largest contribution to the monthly increase

- Food prices surge: Food index jumped 0.5% after remaining flat in July, with grocery prices climbing 0.6%

- Energy gains: Energy costs advanced 0.7% following a 1.1% decline in July, driven by 1.9% gasoline price increase

- Service sector strength: Core services excluding housing continued upward momentum with broad-based increases

Link to official U.S. Consumer Price Index (August 2025)

While previous months showed limited tariff pass-through to consumer prices, August’s report suggests trade-related price pressures may be gaining traction.

Several import-sensitive categories including apparel, used vehicles, and household furnishings showed meaningful increases, though analysts note these effects remain contained compared to earlier projections.

The shelter component, representing over one-third of the core CPI basket, continues to drive inflation momentum. Owners’ equivalent rent climbed 0.4% monthly, while primary residence rent increased 0.3%. However, recent data from real-time rent trackers suggests this pressure may moderate in coming quarters.

Market Reactions

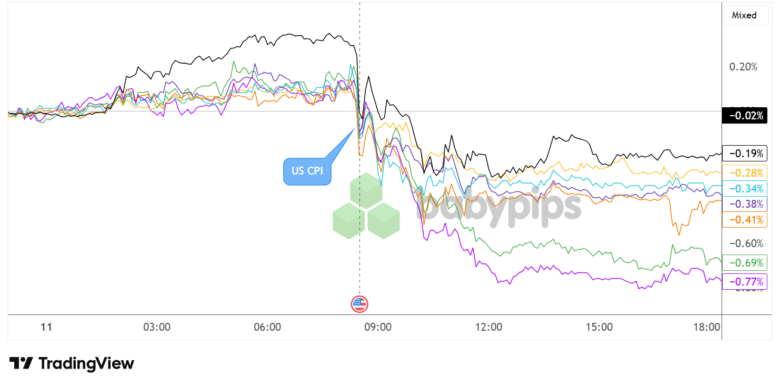

United States Dollar vs. Major Currencies: 5-min

Overlay of USD vs. Major Currencies Chart by TradingView

The Greenback, which was cruising slightly higher leading up to the U.S. CPI release, dipped upon seeing the numbers simply come mostly in line with expectations. It appears the results barely dented dovish Fed expectations, with the CME FedWatch tool suggesting a 92.5% chance of a rate cut later this month versus the pre-CPI likelihood of 91.1%.

USD sustained its decline in the hours that followed, chalking up its steepest losses to commodity currencies AUD (-0.69%) and NZD (-0.77%). The dollar also stayed in the red against the European currencies until the end of the New York session while limiting losses against JPY (-0.19%) and CAD (-0.28%).