Canadian Highlights

- July’s trade data poured some cold water on the idea that diversifying exports away from the U.S. would be anything short of a gargantuan task.

- With the trade shock reverberating, the Canadian labour market is struggling, with unemployment rising and 39,000 jobs lost since January.

- Ongoing trade disruptions and labour market slack are likely to keep inflation subdued, leaving room for two more Bank of Canada rate cuts this year.

U.S. Highlights

- Financial markets were volatile this week. Bonds and equities sold off at the start of the week only to reverse course later as soft labor market data started to trickle in.

- ISM manufacturing and non-manufacturing indexes moved higher on month, driven by gains in new orders, however, employment subcomponents remained in contractionary territory.

- The job market continued to lose momentum in August, with payrolls gains disappointing and downward revisions to prior months. The unemployment rate also rose to a new cycle high.

Canada – Tracing the Trade Shock

The labour day shortened week has been a wild ride, as concerns about fiscal pressures pushed U.S. bond yields higher to start the week, taking the rest of the world’s debt markets along with them. However, things have since sharply cooled off, as economic data have stoked growth worries. The Canadian 10-year yield is down to 3.28% – lower than where it finished last week. For Canada, this first week of September was an update on the ongoing effects of the generational disruptions with U.S. trade.

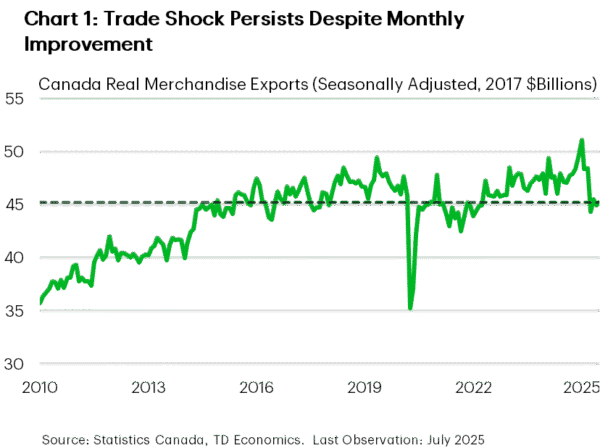

July’s trade update poured some cold water on the idea that diversifying trade away from the United States would be anything short of a gargantuan task. A jump in shipments to the U.S. offset a steep decline in exports to the rest of the world. The monthly move is good news, but the scale of the ongoing disruption is pronounced (Chart 1). Total goods export volumes are down 4% year-on-year, to levels last seen in mid-2022. Importantly, after the shock in the second quarter, July’s print looks more like a blip, rather than the start of a new trend.

Looking forward, Canadian exporters continue to enjoy a relative tariff advantage in the U.S. market compared to most countries. Of the goods crossing the border, many continue to enter duty free. However, progress on trade discussions with the U.S. administration has been slow. Together with the relative tariff advantage, this suggest that relief may yet be a ways away.

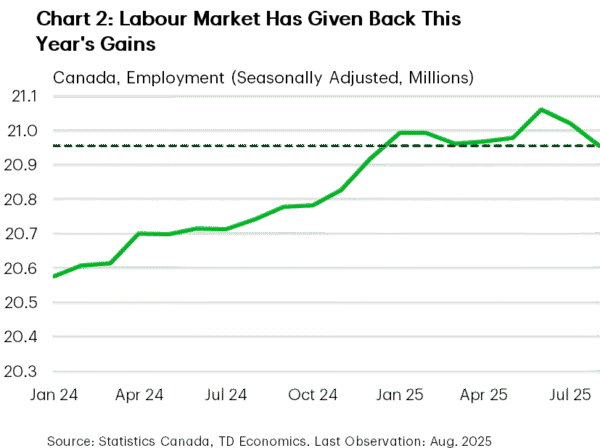

Friday’s Labour Force Survey report reaffirmed the scale of the disruption underway. The unemployment rate rose to 7.1%, while the labour market lost roughly 100k jobs in July and August. Overall, the country’s job market has flat lined in 2025 (Chart 2), shedding 39k jobs since January. With growth expected to linger below trend through 2025 we expect the unemployment rate to continue to rise in the coming months.

However, it’s not all doom and gloom. While there are significant challenges, the slowdown in population growth means there is limited scope for the unemployment rate to rise. With fewer people on the sidelines of the labour market, excess capacity won’t be able to rise as high as would have otherwise been expected. The federal government is also expected to prioritize infrastructure projects “of national interest”, some of which should help facilitate more global trade, in its budget expected next month. Moreover, the housing market appears on a path to a modest recovery, with home sales rising from April through July.

The Bank of Canada is focused on managing inflation, and the balance between the inflationary impacts of tariffs and the building slack in the economy is critical. From our lens, the labour market will continue to face headwinds as the trade shock reverberates. A moderate recovery in domestic demand is unlikely to absorb the accumulated slack, putting downward pressure on inflation. This reinforces our view that the BoC will be able to deliver two more cuts this year.

U.S. – Low Hiring, Low Firing… Lower Fed Funds Rate

This was a short but volatile week in financial markets. Earlier in the week, equities and bonds sold off amid growing concerns about the long-term sustainability of government debt in the U.S. and other developed nations. These concerns stemmed from increased borrowing needs and reduced demand for government bonds, particularly from central banks. Long-dated bonds were particularly under pressure, with the gap between 30-year and 10-year Treasuries rising to 0.7 percentage points—the highest since 2021.

In the U.S., fears were amplified by questions around the Federal Reserve’s independence and inflation risks linked to tariffs. Adding to the fiscal alarm was a court ruling that IEEPA tariffs were imposed illegally. The case now heads to the Supreme Court, and if the decision stands, it could jeopardize this revenue stream and leave the government liable for billions in refunds.

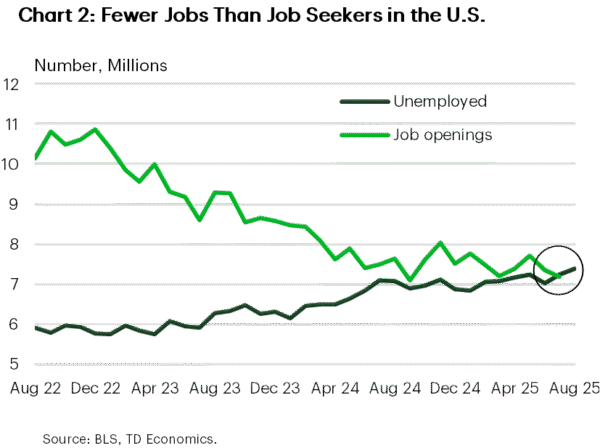

However, sentiment reversed on Wednesday, with bond yields falling and equities rising. It was a classic case of “bad news is good news,” as softer-than-expected economic data – namely the lower job openings in the JOLTS report – boosted expectations of more aggressive rate cuts from the Fed. Given last month’s downward payroll revisions and modest job gains, investors were already on alert for signs of ongoing labor market weakness ahead of Friday’s payroll report. They didn’t have to look too hard.

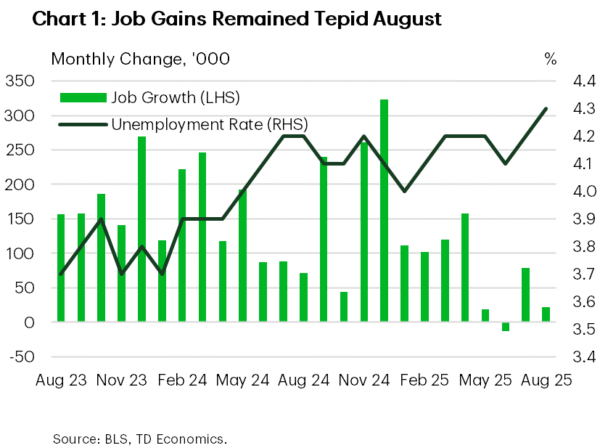

August’s payroll report confirmed that the labor market is softening quite quickly (Chart 1). Job growth was well below expectations in August, with just 22k new jobs added, and has averaged only 29k over the past three months. Goods-producing industries, especially those exposed to tariffs, continued to shed jobs for a fourth straight month. Government employment also declined. The services sector added 63k jobs, but gains were not broad-based. Education & health added 46k jobs and 28k were in leisure & hospitality. While employers are not rushing to hire, they aren’t cutting jobs en masse either. Still, the jobless rate edged up to 4.3% from 4.2% the prior month, reaching a new post-pandemic cyclical high.

Playing second fiddle to the payrolls number, the July JOLTS data also surprised with weaker-than-expected job openings, which declined to 7.18 million from 7.36 million. Openings also fell below the number of unemployed for the first time since 2021—though the margin has been narrow since mid-2024 (Chart 2). Quits and layoffs were little changed, suggesting the economy remains in a “low hiring, low firing” state.

Fed officials have recently become more concerned about the downside risks to the labor market, and the August payrolls report shows these concerns are valid. As such, we maintain our view that the Federal Reserve would need to deliver 75 basis points in rate-relief this year, with the first one coming in less than two weeks.