Lead plaintiffs and an investor have voluntarily dismissed their lawsuit against Bitcoin treasury company Strategy, permanently ending the case, according to a court filing obtained by Cointelegraph. The move represents a potential win for crypto treasury companies, with Strategy standing as the industry’s largest player.

According to a Thursday court filing, two lead plaintiffs, Michelle Clarity and Mehmet Cihan Unlusoy, and an investor representing other shareholders, submitted the stipulation for dismissal.

“The dismissal with respect to Co-Lead Plaintiffs’ claims and Anas Hamza’s claims, but not absent class members’ claims, is with prejudice,” the court document reads. In addition, “the Action has not been certified as a class action.”

The dismissal with prejudice means that “plaintiff does not get a second bite at the apple — they cannot amend the complaint and refile the suit. The case is over and cannot be re-filed in the same court, or any court, on the same claim,” Brandon Ferrick, general counsel for Duoro Labs, told Cointelegraph.

The Hamza lawsuit against Strategy was initially filed in May 2025. Within weeks, at least eight law firms jumped in, trying to sign up unsatisfied investors.

The complaints against Strategy were similar across the lawsuits, alleging that the company and defendants made misleading statements about profitability and risks of its digital asset investments on Bitcoin (BTC).

Strategy started accumulating Bitcoin in August 2020 and holds 632,457 BTC worth $68.4 billion at this writing, according to BitcoinTreasuries.NET.

Related: Bitcoin treasury flops: These firms fumbled their BTC bets

Crypto treasury firms diversify beyond Bitcoin

Since the company started buying BTC, crypto treasury companies have sprung up across different industries, accumulating a range of digital assets. Popular cryptocurrencies now appearing on corporate balance sheets include Ether (ETH), Solana (SOL), BNB (BNB) and Tron (TRX).

Crypto lawyer Tyler Yagman, an associate at The Ferraro Law Firm, previously told Cointelegraph that transparency is key for crypto treasury companies.

“We’re now seeing an emergence of crypto-based treasury companies that operate like actively managed ETFs, but in a company structure… management team needs to be as transparent as humanly possible and as direct as humanly possible, because you’re dealing with a market segment that is known to be volatile.”

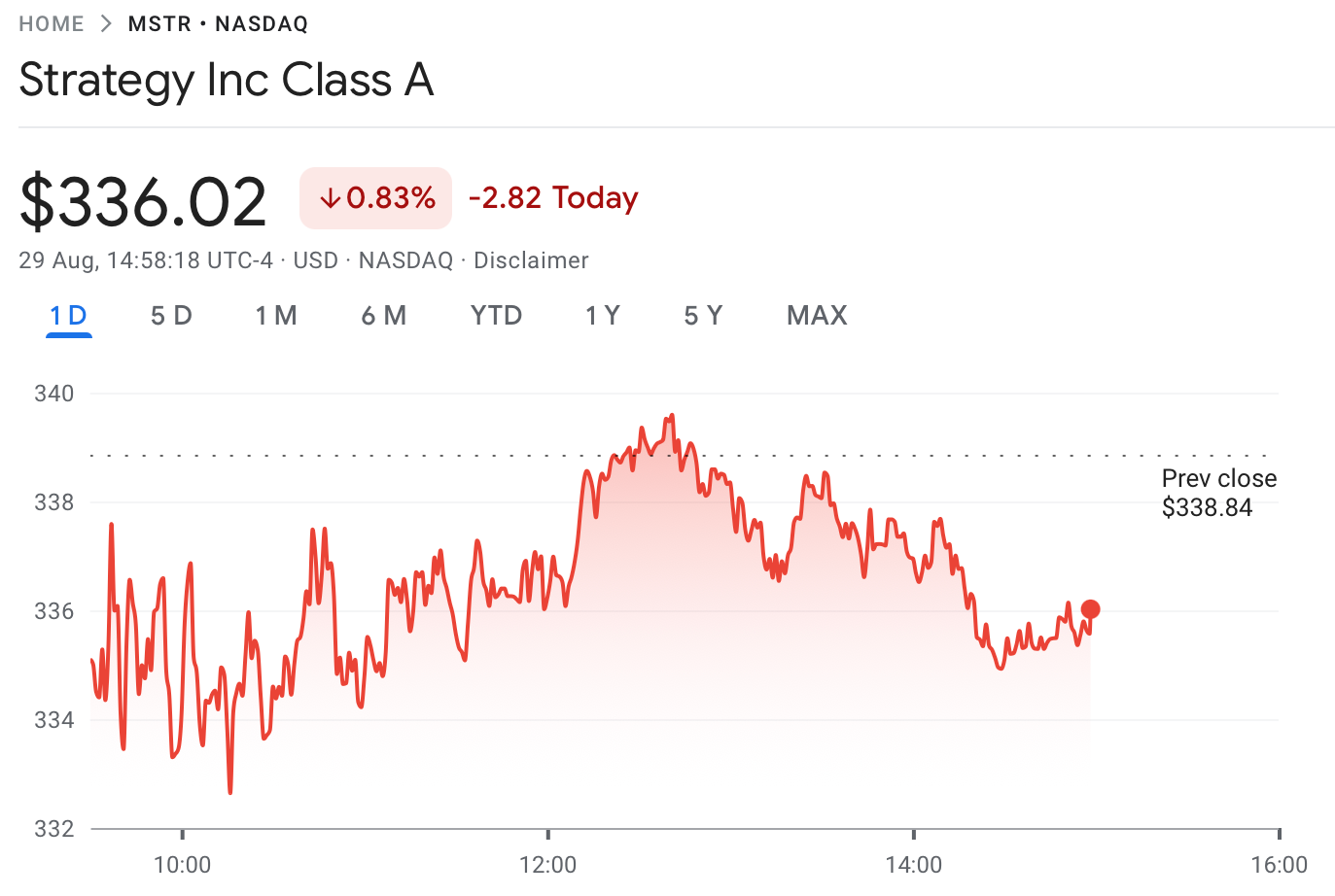

According to Google Finance, Strategy’s share price has remained largely unchanged on Friday, declining -0.8% in line with the Nasdaq Index.

Magazine: How Ethereum treasury companies could spark ‘DeFi Summer 2.0’