Gold (XAU/USD) edged lower after rising more than 2% in the previous week but stabilized above $4,000. Diminishing bets of a Federal Reserve (Fed) interest rate cut could keep the bulls at bay as markets wait for the US economic data backlog to clear.

Gold declines on hawkish FOMC Minutes

Gold benefited from the risk-averse market atmosphere to start the week and kept its footing on Monday and Tuesday. Meanwhile, the weekly data published by Automatic Data Processing showed on Tuesday that private employers shed an average of 2,500 jobs a week in the four weeks ending November 1.

The minutes of the Fed’s October meeting showed on Wednesday that many policymakers thought that, under their outlooks, it would be appropriate to keep rates unchanged for the rest of the year. “Most participants noted further rate cuts could add to the risk of higher inflation becoming entrenched or could be misinterpreted as a lack of commitment to the 2% inflation objective,” the publication read.

According to the CME FedWatch Tool, the probability of a 25-basis-points (bps) Fed rate cut in December declined to nearly 35% from about 50% earlier in the week. In turn, the US Dollar (USD) gathered strength and caused XAU/USD to lose its traction in the second half of the day.

On Thursday, the US Bureau of Labor Statistics (BLS) reported that Nonfarm Payrolls (NFP) rose by 119,000 in September. This print followed the 4,000 decrease recorded in August and surpassed the market expectation of 50,000. On a negative note, the BLS noted that the change in NFP for July and August was revised down by 7,000 and 26,000, respectively. Other details of the report showed that the Unemployment Rate edged higher to 4.4% in September from 4.3%, while the annual wage inflation, as measured by the change in the Average Hourly Earnings, held steady at 3.8%. As the employment report failed to influence Fed interest rate expectations in a significant way, Gold found it difficult to stage a rebound.

Heading into the weekend, the data from the US showed that the business activity in the private sector expanded at a healthy pace in November, with the S&P Global’s preliminary Composite Purchasing Managers’ Index (PMI) edging higher to 54.8 from 54.6 in October. As this report supported the USD, Gold remained in the lower half of its weekly range.

Gold investors to focus on Fed commentary ahead of blackout

The US economic calendar will feature Retail Sales and Producer Price Index (PPI) data on Tuesday and the Durable Goods Orders report on Wednesday. However, these data are unlikely to trigger a significant market reaction because they will be for September, as part of the US Census Bureau and the BLS’s process of clearing the data backlog that built up during the Government shutdown.

The Conference Board will publish the Consumer Confidence Index data for November on Tuesday. In case the Present Situation Index of the survey, which is based on consumers’ assessment of current business and labour market conditions, declines sharply, the immediate reaction could hurt the USD and help XAU/USD edge higher.

Investors will pay close attention to comments from Fed policymakers before the blackout period starts on November 29. The market positioning suggests that there is room for additional USD strength in case Fed officials continue to voice their opposition against a rate cut in December. Conversely, Gold could gain traction if policymakers emphasize worsening labor market conditions and argue for another rate cut at the last policy meeting of the year.

Gold technical analysis

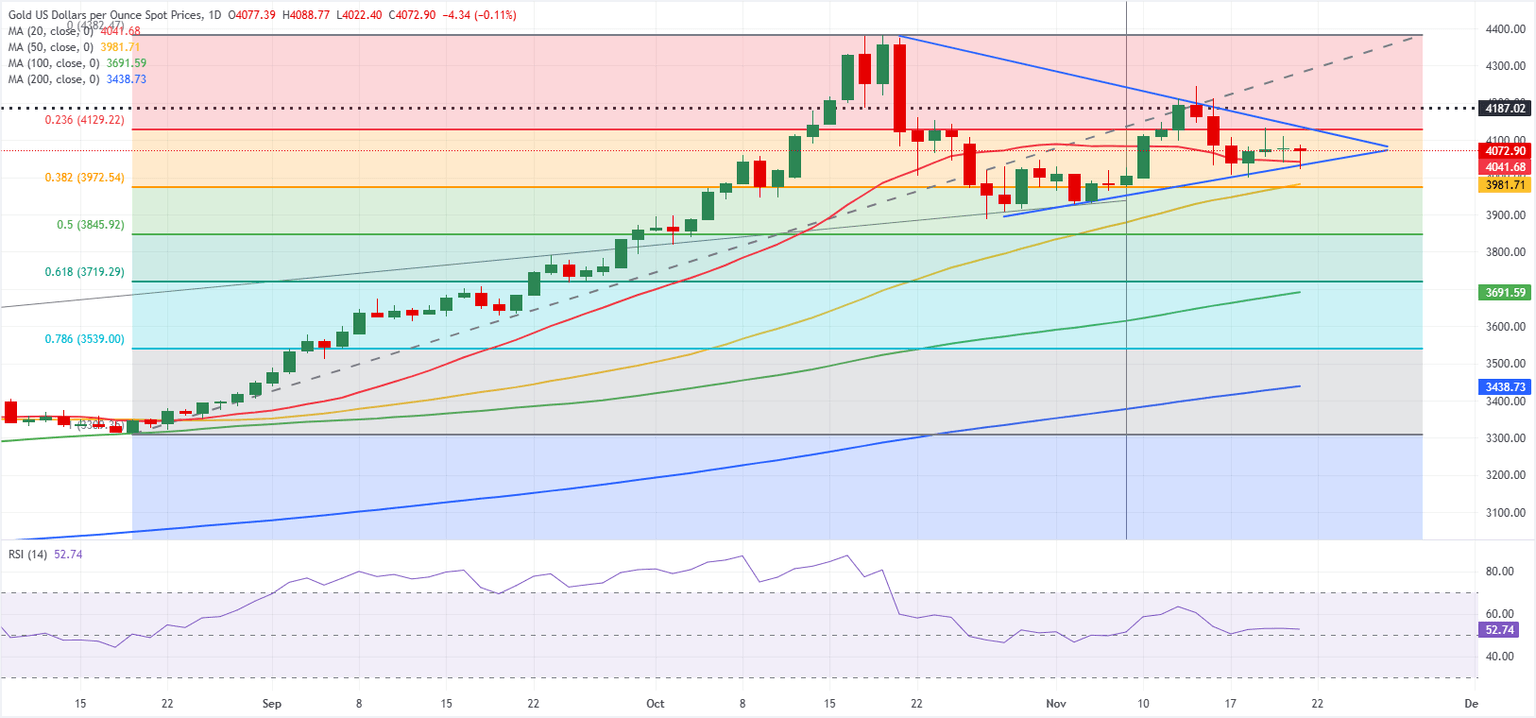

The technical outlook points to a neutral stance in the near term. On the daily chart, Gold fluctuates at around the 20-day Simple Moving Average (SMA) while trading within a symmetrical triangle pattern, and the Relative Strength Index (RSI) moves sideways near 50, reflecting the indecisiveness.

On the downside, the Fibonacci 38.2% retracement of the August-October uptrend and the 50-day SMA form the initial support area at $3,980-$3,970 before $3,900 (round level) and $3,845 (Fibonacci 50% retracement). Looking north, resistance levels could be spotted at $4,130 (Fibonacci 23.6% retracement, descending trend line), $4,245 (November 13 high) and $4,300 (round level).

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.