Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Good morning. Was it a coincidence that US stock markets had a terrible day yesterday when the financial capital of the world, New York City, was poised to elect a socialist mayor? Probably, but the timing amuses us all the same. Unhedged will be staying put in New York, not moving to the suburbs, or Miami. Will you? Email us: unhedged@ft.com

The junk rally revisited

Last week, our colleague Robin Wigglesworth wrote about how South Korean retail investors had pushed the AI trade to new extremes. Shares in a fried chicken restaurant chain and other poultry-adjacent names briefly surged after Nvidia’s Jensen Huang, along with Samsung and Hyundai CEOs, were spotted eating fried chicken in Seoul.

But this may be less about AI and more about how crazy Korean retail investing activity has become. As Owen Lamont of Acadian Asset Management told Unhedged,

For at least 10 or 15 years . . . the Korean stock market has been a crazy place. Maybe not the vanilla part of the Korean stock market, but for the fringe stocks. So that’s why the chicken thing didn’t seem like a bad sign to me. It just seemed like business as usual in Korea . . . Completely crazy, nonsensical price moves in reaction to random events.

Some other similar instances of risky, speculative activity from the Korean retail investing crowd include the short-lived pen-maker stock rally and big bets on leveraged ETFs.

Several unique qualities of the Korean market have contributed to its eccentric side. Retail investors account for a significant portion of trading activity, and social media has played a bigger role for longer in Korea, which has contributed to its, um, vibrant investing culture.

There are echoes here of the meme stock frenzy of 2020 in the US, but back then everyone was locked up at home with a trading app and a stimulus cheque. And the big meme trades back then started as short squeezes, which have elements of rationality, unlike throwing money at whatever Jensen Huang ate recently. Recently, however, the US market is also seeing what Lamont calls “positive dumb alpha” and “perverse stock selection ability.”

Goldman Sachs’ speculative trading indicator has picked up on the rise in risk-seeking activity in the US: an increased share of trading value in penny stocks, unprofitable stocks and stocks with high EV/sales multiples. This Goldman chart comes from a note released on October 10:

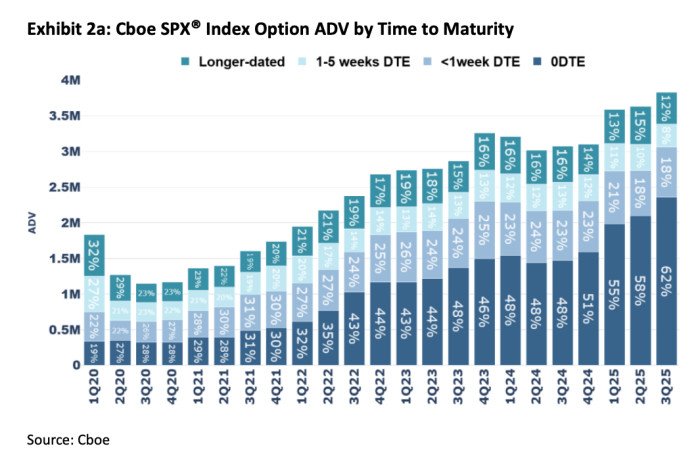

And the volume of options trading is also increasing, Joe Mazzola of Schwab noted to Unhedged. S&P 500 options trades rose to a record 4.26mn contracts per day in September, with zero-day options accounting for a significant proportion, according to Cboe:

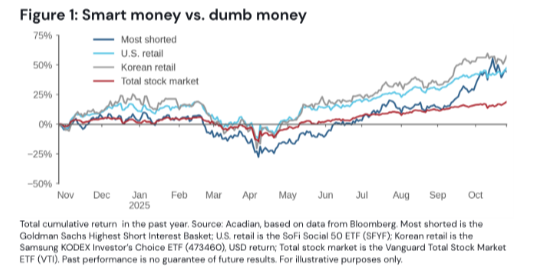

Until quite recently, Korean and US retail investors have done quite well. This chart from Acadian Asset Management shows the performance of basket of stocks favoured by the two groups, and of the most shorted stocks:

The contrarian behaviour of retail investors after earnings announcements contributes to “post earnings announcement drift”, according to a recent research paper by Patrick Luo, Enrichetta Ravina, Marco Sammon and Luis Viceira. Retail investors tend to trade against the news, buying shares of companies that have reported bad results, thinking they’re cheap, and selling positive earnings surprises. This prolongs the “drift” away from fundamental value.

“Since the dumb money is winning, you know that the smart money must be losing. Short sellers have been among the smartest money, historically . . . But lately, short sellers have been losing,” says Lamont.

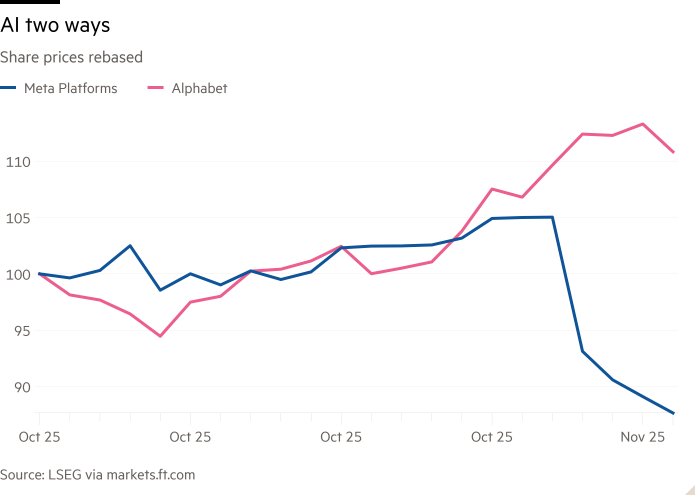

How long can retail craziness — what Unhedged has recently called the “junk rally” — last? Irrationality is by definition hard to predict, but also by definition does not last for ever. However, there are some early indications that it might just be ending right now. The market has recently demonstrated, by slapping Meta around while rewarding Alphabet, that it cares about Big Tech profits and cash flow, not just AI hype. Yesterday’s hostile market response to Palantir’s earnings reinforced that message.

Meanwhile, two of this market’s favoured speculative vehicles — unprofitable tech stocks and gold — have peaked and turned over in recent weeks, while bitcoin has broken through the bottom of its sideways trend.

This emergent market discipline could turn out to be a blip. But rationality shares an important characteristic with irrationality: if it persists long enough, it takes on a life of its own.

A correction: tech earnings

In last Friday’s newsletter about Big Tech earnings, there was a table of historical and prospective quarterly earnings growth at Alphabet, Amazon, Apple, Meta and Microsoft. It was wrong. In building the table, Rob mixed GAAP historical earnings with non-GAAP earnings estimates. This led to historical growth that looked too high and prospective growth that looked much too low. Unhedged bitterly regrets the mistake.

But the broad picture remains consistent with what we argued in that letter: earnings growth at Alphabet, Meta and Amazon is slowing, and at Meta, in particular, free cash flow is under pressure. And the market is taking notice.

One good read

The price of convenience.

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.