Australian Dollar is holding its ground as one of the strongest performers in FX markets this week, buoyed by upbeat economic data and comments from RBA Governor Michele Bullock.

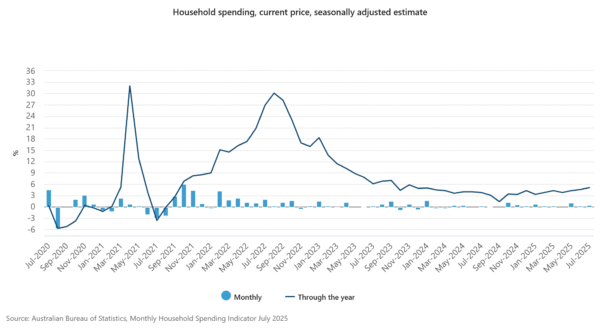

Australian consumer spending rose 5.1% yoy in July, according to the ABS released today, led by demand for health services, hotels, travel, and restaurants. The data point to resilient household demand despite tighter financial conditions and underline a growing willingness among households to spend after a prolonged stretch of caution.

That strength follows Wednesday’s GDP report, which showed growth of 0.6% in Q2. Discretionary spending surged 1.4% in the quarter, the fastest pace in three years, highlighting that consumption is now a meaningful driver of Australia’s recovery.

Responding to the GDP data, Governor Bullock cautioned overnight that sustained strength in consumption could limit scope for further easing. “If it keeps going, then there may not be many interest rate declines yet to come. But it all depends,” she said.

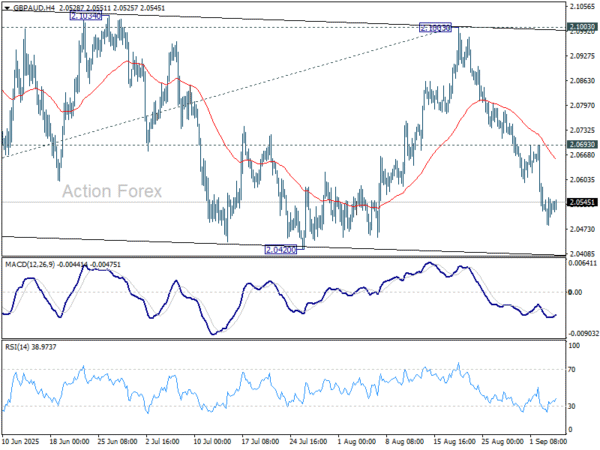

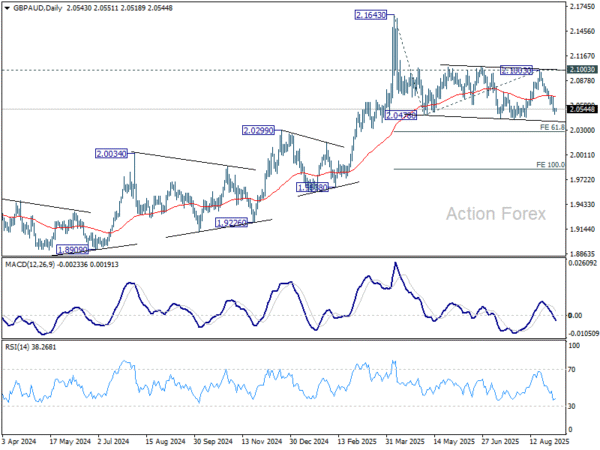

Aussie’s strength stands in contrast to Sterling, which has been weighed down by fiscal concerns. Technically, GBP/AUD extended its decline from 2.1003 this week. Momentum is easing slightly near 2.0420 support level as seen in 4H MACD. But risks remain tilted lower as long as 2.0693 resistance holds. Current fall should be in progress through 2.0420 to 61.8% projection of 2.1643 to 2.0478 from 2.1003 at 2.0283.

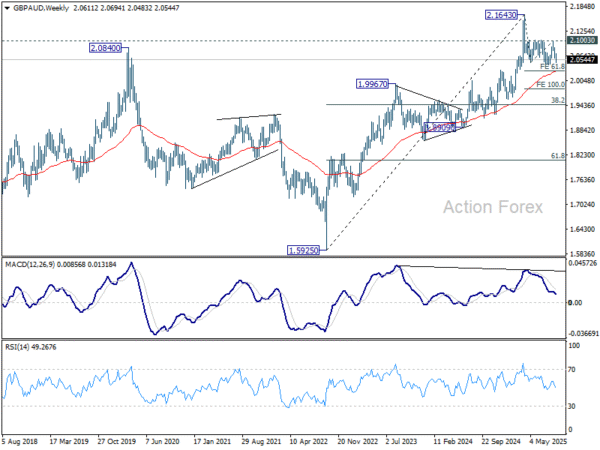

The 2.0283 area aligns closely with 55 W EMA now at 2.0265. Decisive move through that zone would suggest that the decline from 2.1643 is evolving into a medium-term downtrend, even if it’s just a correction to the rise from 1.5925 (2022 low).