Australia’s July CPI report delivered a substantial upside surprise, printing at 2.8% annually versus 2.0% expected. This hot inflation reading temporarily reduced RBA easing expectations and provided support for the Australian dollar during a week dominated by Fed independence concerns and mixed risk sentiment.

Let’s examine which pairs from our watchlist capitalized on this environment of reduced RBA dovishness and broad USD weakness to determine if our bullish AUD bias delivered profitable opportunities.

Watchlists are price outlook & strategy discussions supported by both fundamental & technical analysis, a crucial step towards creating a high quality discretionary trade idea before working on a risk & trade management plan.

If you’d like to follow our “Watchlist” picks right when they are published throughout the week, check out our BabyPips Premium subscribe page to learn more!

The Setup

- What We Were Watching: Australia’s Consumer Price Index (CPI) for July 2025

- The Expectation: Headline CPI to accelerate from 1.9% y/y to 2.0% y/y

- Data outcome: CPI surged to 2.8% y/y, significantly beating expectations and marking the highest inflation rate in twelve months

- Market environment surrounding the event: Neutral risk sentiment; traders remained cautious about Trump’s attempt to fire Fed Governor Lisa Cook while positioning ahead of Nvidia’s earnings and the US core PCE report

Event Outcome

Australia delivered a substantial upside surprise with July CPI jumping to 2.8% annually, well above the 2.0% forecast and June’s 1.9% reading. The acceleration was primarily driven by electricity price movements linked to government energy bill relief timing, though underlying inflation measures also rose concerningly.

Key points from the Australia CPI report:

- Headline inflation at 2.8% y/y, the highest since July 2024

- Electricity prices surged 13.1% annually vs. 6.3% decline previously

- Core inflation measures jumped: CPI excluding volatile items reached 3.2% (up from 2.5%)

- Annual trimmed mean increased to 2.7% (from 2.1%)

- Housing costs remained the largest contributor at 3.6%

- Rental price growth moderated to 3.9% annually, the lowest since November 2022

ABS noted that, excluding government rebates, electricity prices would have risen 23.0% since June 2023. The temporary nature of the electricity-driven inflation initially tempered market reactions, though the broad-based acceleration in core measures kept RBA easing expectations in check.

Fundamental Bias Triggered: Bullish AUD setups

Markets navigated a complex environment during the week, dominated by unprecedented Fed independence concerns following Trump’s attempt to fire Governor Lisa Cook. The political drama created significant uncertainty about central bank independence and potential politically driven monetary policy decisions.

The dollar exhibited persistent weakness despite stronger-than-expected US GDP data showing 3.3% growth (vs 3.0% initially reported), as traders increasingly positioned for Fed rate cuts. The Chinese yuan’s rise to its strongest level since November 2024, with the PBOC setting stronger reference rates, added to USD weakness through cross-currency flows.

Risk sentiment remained cautiously defensive throughout the week. Geopolitical tensions stayed elevated with stalled Russia-Ukraine peace negotiations and escalating drone attacks. Gold advanced steadily toward $3,415, supported by Fed rate cut expectations and safe-haven demand. Oil rallied on supply concerns, while Bitcoin remained range-bound near $111,500.

The wait for Nvidia’s earnings and Friday’s core PCE data kept many traders on the sidelines, though broad USD weakness from political uncertainty provided underlying support for risk assets. This created an environment where reduced RBA easing expectations could shine through despite the overall risk-off lean.

Friday saw the dollar remained on track for a monthly decline, as core PCE inflation met expectations at with a 0.3% m/m read (as expected) and maintained 85% odds for September Fed rate cuts. Treasury yields exhibited mixed behavior with the 10-year rising marginally to 4.22% (but still down for the week), while gold futures moved higher to finish up the week up over 2.89%—as month-end positioning and continued safe-haven demand from ongoing Fed independence concerns offset the in-line inflation data.

AUD/USD: Net Bullish AUD Event outcome + Risk-On Scenario = Arguably the best odds of a net positive outcome

AUD/USD 1-hour Forex Chart by TradingView

The setup played out exceptionally well. AUD/USD initially spiked on the hot CPI print, briefly testing the descending triangle resistance at 0.6500 before pulling back as traders digested the temporary nature of the electricity-driven inflation surge.

The pair found solid support at the pivot point (0.6480) level as discussed in the watchlist, and by the London session on CPI release day, AUD/USD turned decisively higher, breaking above the targeted resistance area identified in our analysis.

The combination of reduced RBA easing expectations and persistent USD weakness created ideal conditions for the bullish scenario. The pair extended gains to reach the R1 target at 0.6540.

What’s particularly notable is how AUD outperformed most major currencies post-CPI event, signaling that Australian fundamentals carried observable weight despite broader risk-off headwinds from geopolitical tensions and pre-Nvidia caution. This resilience demonstrated that the inflation surprise partially weathered exogenous drivers, validating the bullish thesis even in a challenging market environment.

Not Eligible to move beyond Watchlist – Bearish AUD Setups and Long AUD/CAD Setup

AUD/CAD: Net Bullish AUD Event Outcome + Risk-Off Scenario

AUD/CAD 1-hour Forex Chart by TradingView

With the broad risk environment generally neutral around the time of release, AUD/CAD didn’t make the cut to move beyond the Watchlist stage…but it was close.

Still, this pair performed moderately well with the bullish AU catalyst, though not as cleanly as AUD/USD. The ascending triangle pattern held initially, with AUD/CAD finding support near the 0.8960 pivot point after the CPI release as predicted.

The hot Australian inflation data, combined with existing BOC rate cut expectations, created a favorable policy divergence. However, oil price strength (likely supporting CAD) and the apparent reversion to behaving as beta currencies as risk sentiment improved are the likely arguments for why AUD/CAD stayed in a tight range through the end of the the week.

GBP/AUD Short: Net Bearish AUD Event outcome + Risk-On Scenario

GBP/AUD 1-hour Forex Chart by TradingView

The hot CPI print invalidated this bearish AUD setup from the outset. Thanks to the stronger Australian inflation data combined, with souring sentiment on the British pound due to fiscal concerns, GBP/AUD extended its ongoing decline from 2.0850 towards the 2.0600 major psychological handle.

While GBP/AUD was originally looked at as a bearish AUD setup due to divergent monetary policy expectations, this pair turned out to be a solid pro-AUD play. The shift from relatively less dovish BOE expectations to structural concerns about UK debt levels and “stinging interest payments” is another good reminder that sometimes it pays to pay attention to these shifts in fundamental focus as the shifts in fundamental narrative sometimes result in solid intraweek moves.

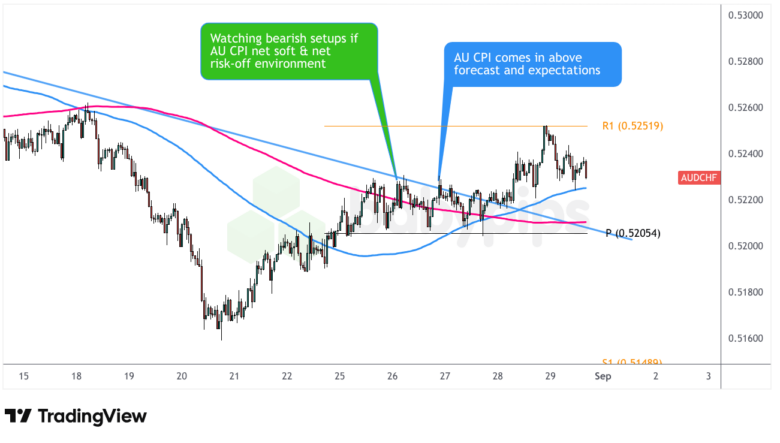

AUD/CHF: Net Bearish AUD Event outcome + Risk-Off Scenario

AUD/CHF 1-hour Forex Chart by TradingView

Similarly, this setup was invalidated from moving beyond the Watchlist by the bullish AUD event outcome. Despite periodic risk-off flows that tend to favor the Swiss franc, the Australian dollar’s fundamental strength from reduced RBA easing expectations kept AUD/CHF supported above 0.5200 and the pivot point level.

The pair eventually pushed towards the R1 Pivot area and 0.5250 minor psychological level, but pulled back on Friday with other risk assets as market sentiment soured heading into the weekend.

The Verdict

The Australian CPI surprise created increased probability for fundamentally driven bullish behavior for the Australian dollar, with AUD/USD emerging as the pair with the highest odds of potential success as broad risk sentiment shifted slowly from risk-off/neutral to neutral/risk-on, and broad dollar sentiment looked shaky to due to the battle between US President Trump and Fed Governor Cook.

AUD/USD behaved favorably for bulls post event confirmation as the pair closed the week well above the post event price. Various trade management strategies could have been employed (either a buy after the pullback/hold at the pivot area, or the buy after sustained break above resistance) and still likely resulted in a net positive outcome, which is why we rated the AUD/USD Watchlist discussion as “highly likely” of supporting a net positive outcome.

Key Takeaways:

1. Flexibility in Trade Management Based on Post-Event Price Action

The successful AUD/USD trade offered multiple entry strategies after the initial CPI release: buying the pullback at the pivot level (0.6480) or buying the sustained break above resistance. The analysis emphasizes that “various trade management strategies could have been employed and still likely resulted in a net positive outcome.” This flexibility, rather than rigid entry rules, contributed to the setup’s success.

Application: Prepare multiple trade management scenarios for post-event price action. Don’t commit to just one entry method – be ready to adapt your execution based on how the market digests the news, whether through immediate breakouts or pullback opportunities at key technical levels.

2. Continuously Reassess Fundamental Narratives Throughout the Week

The GBP/AUD example perfectly illustrates why traders must remain flexible and regularly reassess their fundamental assumptions. Initially categorized as a “bearish AUD setup due to divergent monetary policy expectations,” this pair actually became a solid bullish AUD opportunity as the fundamental focus shifted during the week. The analysis notes that sentiment on the British pound soured due to emerging “structural concerns about UK debt levels and ‘stinging interest payments,’” causing GBP/AUD to extend its decline toward the 2.0600 psychological level.

Application: Don’t set your fundamental thesis in stone at the beginning of the week. Markets are dynamic, and new information or shifting focus areas can completely change the risk-reward profile of your setups. Schedule regular check-ins (daily or mid-week) to reassess whether the original fundamental drivers are still valid or if new themes have emerged that could create better opportunities in different instruments. What starts as a bearish setup for one currency can quickly become a bullish setup if the opposing currency’s narrative deteriorates faster than expected.

Disclaimer: The forex analysis content provided in Babypips.com is intended solely for informational purposes only. The technical and fundamental scenarios discussed are presented to highlight and educate on how to spot potential market opportunities that may warrant further independent research and due diligence. This content shows how we cover a portion of the full trading process, and does not constitute that we ever give specific investment or trading advice. The setups and analyses presented on Babypips.com are very likely not suitable for all portfolios or trading styles.

Trade and risk management are the sole responsibility of each individual trader. All trading decisions and their subsequent outcomes are the exclusive responsibility of the individual making them. Please trade responsibly.

Trading responsibly means knowing as much as you can about a market before you think about taking on risk, and if you think this kind of content can help you with that, check out our BabyPips Premium subscribe page to learn more!