After holding fire in July, the ECB looks like it may have shut the door on further rate cuts for now. Inflation is still sitting just above target, and growth prospects, while modest, aren’t dire enough to push the Governing Council into more easing. Turkey’s central bank is moving in the opposite direction. The CBRT is expected to trim its one-week repo rate further, leaning into a cycle of monetary support as it tries to steady the economy.

European Central Bank (ECB) – 2.00%

The ECB has been on pause since July, after eight rate cuts in the space of a year. The latest interest rate decision wasn’t particularly contentious, but some policymakers were keen to slip in a warning: inflation might end up undershooting expectations. Instead, the official line was that growth risks were skewed to the downside, while the inflation outlook was “more uncertain than usual”.

Fresh survey data backs that up. The ECB’s Survey of Professional Forecasters (SPF) suggested inflation could run a little cooler this year and next than previously thought, before hovering around the 2% target further out. Growth, meanwhile, looks slightly more resilient: the survey now sees the Euroland expanding by 1.1% in 2025, compared with an earlier 0.9%.

That mix, steady inflation near target and growth that isn’t falling apart, helps explain why some on the Governing Council (GC) are questioning whether more rate cuts are really needed. Market participants are picking up on that too, with pricing now expecting the central bank to stay on the sidelines later this week, while only around 14 basis points of easing expected by the end of 2026.

The ECB’s July meeting Accounts added some colour: officials were split on whether inflation risks leaned higher or lower. That debate is likely to intensify in the coming months, setting the stage for some lively discussions at the GC table.

Upcoming Decision: September 11

Consensus: Hold

FX Outlook: EUR/USD is attempting to break above its consolidative range in place since August, with the immediate upside target at the YTD peaks north of 1.1800 the figure. With the ECB largely anticipated to keep rates unchanged this week, the main driver for the pair’s price action will come from the Federal Reserve’s meeting on September 17.

Central Bank of the Republic of Türkiye (CBRT) – 43.00%

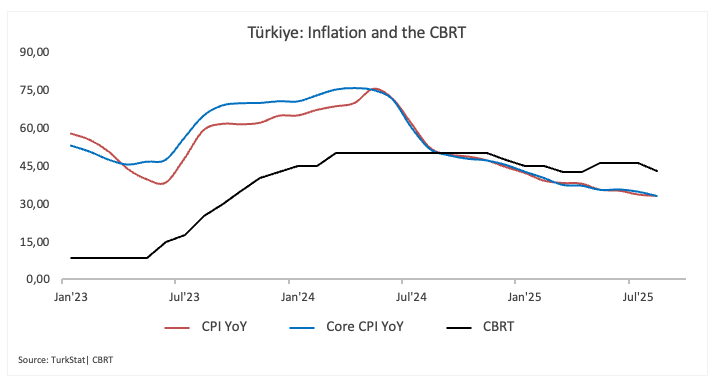

Turkey’s central bank surprised markets in July with a deeper-than-expected rate cut, slashing borrowing costs by 300 basis points to 43%. The move marked a return to its easing cycle, which had been put on ice earlier this year amid political turbulence. With markets calmer and disinflation still in play, policymakers are back on the front foot.

The bank signalled it will tread carefully from here, setting the pace of future cuts “prudently” and deciding meeting by meeting. It also narrowed the top end of its interest-rate corridor, trimming the ceiling to 46% from 49%.

Following the release of the bank’s Quarterly Inflation Report, officials rolled out a new communication strategy. Inflation targets are now being separated from forecast ranges, which the bank says should make policy direction clearer and build market trust. The goal is ambitious: bring inflation down to 16% by the end of 2026 and single digits by 2027.

CBRT Governor Fatih Karahan stressed that this year’s official target remains 24%, even though the bank sees actual inflation running between 25% and 29%. The mismatch, he explained, reflects the shift to the new system, which no longer pins the target to the midpoint of the forecast range.

Markets’ consensus expects the central bank to further reduce its One-Week Repo Rate this week, while implied rates see around 862 basis points of easing by year-end.

Upcoming Decision: September 11

Consensus: 200 basis point cut

FX Outlook: There seems to be no stopping for the selling pressure on the Turkish Lira (TRY). Indeed, USD/TRY navigates the area of all-time highs near 41.30. TRY has been on a sustained depreciation since 2020, with the trend gathering steam since late 2021.