- The US Jobs Report (NFP) is expected to show job growth of 75,000, with unemployment rising to 4.3%.

- US job growth is slowing, with recent revisions showing underlying weakness.

- The Fed faces a dilemma between faltering job creation and persistent wage growth.

- A weak report could solidify the case for a Fed rate cut, boosting stocks and gold.

US Labor Market Backdrop

The August 2025 Non‑Farm Payrolls report looks set to become a turning point for both the U.S. job market and the Fed’s policy path. Most analysts think about +75,000 jobs will be added, only a little more than July’s +73,000 and clearly slower than the fast pace earlier this year.

At the same time the labor‑force participation rate fell to a 31‑month low, and factories lost workers for three months in a row – about 36,000 jobs gone. Yet the unemployment rate still sits around a historic low of 4.2 percent, suggesting the market still has some strength.

NFP Preview: What to Expect

The consensus for the August NFP report is centered around the addition of 75,000 jobs, a figure that is only marginally higher than the 73,000 jobs added in July, which was itself a substantial miss from the 110,000 forecast.

The unemployment rate is projected to tick up by a tenth of a percentage point to 4.3%, and average hourly earnings are expected to cool slightly to a 3.7% year-on-year increase from 3.9% in the prior period.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar. Time used is British Standard Time (BST) (click to enlarge)

The US job market is clearly slowing down and is weaker than the main numbers suggest. The biggest warning sign is that the job figures for May and June were revised to be much lower, it turns out 258,000 fewer jobs were created than was first reported. This proves the job market was in worse shape than we originally thought and that the trend is getting worse.

Even though the official unemployment rate seems low, other signs also point to weakness. A smaller percentage of people are actively working or looking for jobs, which makes the unemployment rate look better than it really is. On top of that, key areas like manufacturing have been cutting jobs.

All of this together shows the job market is on shaky ground, and it now seems more likely that the unemployment rate will be on the rise in the months ahead.

The Federal Reserve Conundrum

The NFP report presents a challenge for the Federal Reserve and comes at a time when Fed independence has been questioned. Pressure has been mounting from the US administration for aggressive rate cuts.

The current environment, marked by a cooling jobs market and persistent wage growth, creates an uneven backdrop for policymakers. Jobs are starting to cool, yet wages keep rising. That mix may mean the Fed could see a wage‑price spiral, a situation where higher pay fuels more inflation. If that happens, cutting rates could become much harder still.

The Fed has until now cited the uncertainties around tariffs and its impact on inflation as an ongoing concern. However, following the revised labor numbers of late are now unable to ignore the situation with Fed Chair Powell’s de facto admission at Jackson Hole that labor market concerns now outweigh inflation, a clear sign of the challenge and thinking of a divided Fed.

Market expectations are already heavily skewed toward a rate cut. A 25 basis point (bps) cut at the September Federal Open Market Committee (FOMC) meeting is nearly fully priced in, with over 57 bps of cuts anticipated by December 2025.

The upcoming report could serve to sway some Fed policymakers as we heard from Rafael Bostic who said “I am not ruling out a September rate cut depending on the coming jobs report and other data.” This highlights the magnitude of the data release.

Potential implications for the US Dollar Index (DXY), Dow Jones and Gold

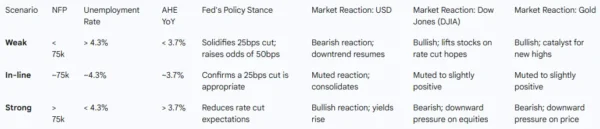

The market’s reaction to the NFP report will not be uniform, but rather dependent on the deviation from consensus forecasts. These are the potential reactions we could see depending on how the data comes out and is received.

Source: Table Created by Zain Vawda, Data from LSEG

Many of the assets above are at interesting areas what we would call inflection points with the next moves likely dependent on tomorrow’s data.

US Dollar Index (DXY)

The broader bias for the US Dollar Index (DXY) remains bearish into the fourth quarter, predicated on the expectation of further Fed easing. A weak NFP report, particularly one with capped wage growth, would likely be the trigger that pushes the dollar below its key 97.45 support level, allowing its downtrend to resume.

US Dollar Index (DXY) Daily Chart, September 4, 2025

Source: TradingView (click to enlarge)

Dow Jones Index (DJIA)

The Dow has moved a lot lately, driven by hopes of Fed cuts. After the July NFP disappointment, the index fell hard, then bounced back when the data “re‑ignited hopes” for more cuts. This pattern suggests an inverse link: weaker jobs data can actually lift stocks in the current setting.

Dow Jones Index Daily Chart, September 4, 2025

Source: TradingView (click to enlarge)

Gold (XAU/USD)

Gold stays near historic highs, a move mainly fueled by thoughts of an upcoming Fed cut. A soft NFP report would likely act as a strong push for more gold buying, reinforcing the case for monetary easing and making a non‑yielding metal more attractive.