Japanese equities surged at the start of the week, with the Nikkei jumping more than 800 points in early trade and holding firm through the morning session. The index now sits within striking distance of a fresh record high. Risk-on appetite spilled over into currency markets, sending Yen sharply lower and leaving it vulnerable to further pressure if sentiment holds.

The trigger was the surprise resignation of Prime Minister Shigeru Ishiba over the weekend. Ishiba said the timing was deliberate, coming days after he secured the formal reduction of U.S. auto tariffs from 27.5% to 15%. “Now that negotiations on U.S. tariff measures have reached a conclusion, I believe this is the appropriate moment to resign,” he told reporters. His departure marks a sudden end to a premiership that began less than a year ago but was hampered by his coalition losing control of the lower house.

Nevertheless, Ishiba’s exit opens the door to fresh leadership amid hopes that new faces could re-energize both the party and the electorate. Koizumi Shinjiro, agricultural minister and son of former prime minister Junichiro Koizumi, is widely viewed as a frontrunner, with his youth and broad appeal resonating with markets. Takaichi Sanae, closely aligned with the late Abe Shinzo, is also expected to be a serious contender. The leadership race is expected to fuel speculation of policy continuity combined with a push for fresh fiscal initiatives.

Investors are betting that the incoming administration will prioritize expansionary fiscal measures to secure opposition cooperation, given the LDP-led coalition still commands only a minority. Such expectations have buoyed equities further and reinforced the risk-on backdrop weighing on Yen.

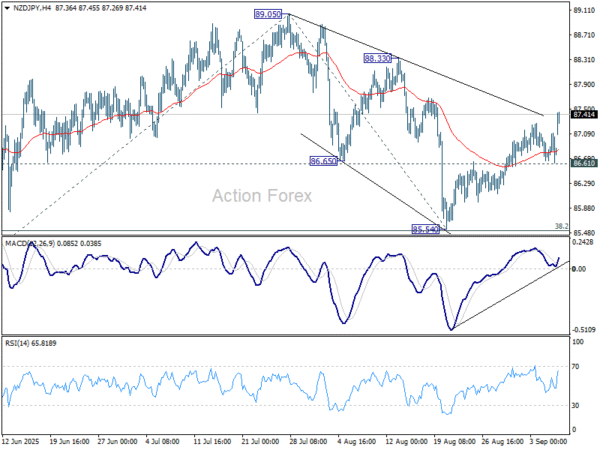

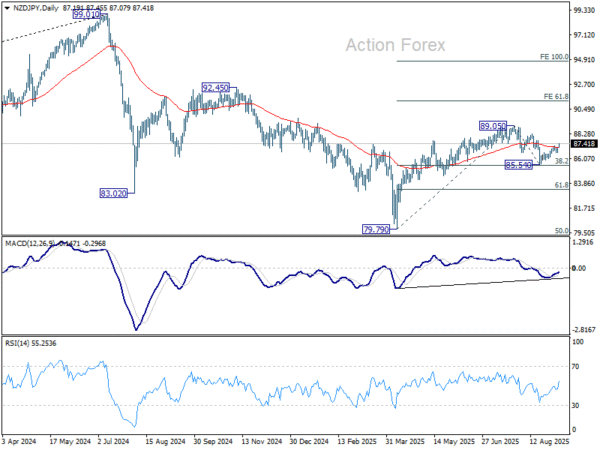

Technically, NZD/JPY’s rally from 85.54 resumed today. The break of 55 D EMA (now at 87.10) suggests that correction from 89.05 has completed after defending 38.2% retracement of 38.2% retracement of 79.79 to 89.05 at 85.51.

Further rise is expected as long as 86.61 support holds. Break of 88.33 resistance will indicate that whole up trend from 79.79 is ready to resume through 89.05 short term top.