While most cryptocurrency investors welcomed the market recovery following the potential end of the US government shutdown, some short sellers were caught off guard by the rebound.

The crypto market recovery saw popular high-leverage trader James Wynn’s main Hyperliquid account liquidated multiple times during the past 24 hours, with his wallet’s value sinking to just $5,422, according to Hyperdash data.

The unexpected recovery liquidated Wynn 12 times in the last 12 hours, resulting in 45 liquidations over the past two months, according to blockchain data platform Lookonchain.

Before the crypto market recovery, Wynn was running multiple Bitcoin (BTC) leveraged short positions, which are de facto bets on the price of Bitcoin declining.

Related: China’s budget AI bots smash ChatGPT in crypto trading face-off

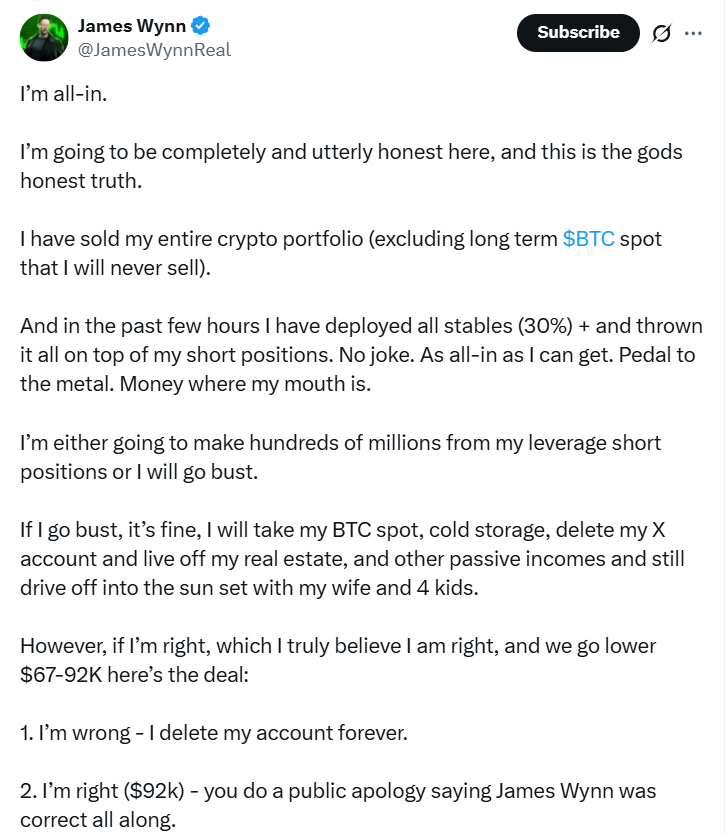

Wynn goes “all-in” despite liquidation, bets on Bitcoin decline to $92,000

Despite the mounting losses, Wynn continued doubling down on his short positions.

Wynn said he has transferred all his stablecoin funds into his short positions, expecting a decline in Bitcoin below $92,000 despite optimism over the potential end of the US government shutdown.

“In the past few hours, I have deployed all stables (30%) + and thrown it all on top of my short positions. No joke. As all-in as I can get,” said Wynn in a Monday X post, adding:

“I’m either going to make hundreds of millions from my leverage short positions or I will go bust,” added the pseudonymous trader.

Related: Michael Saylor’s Strategy kickstarts November with $45M Bitcoin buy

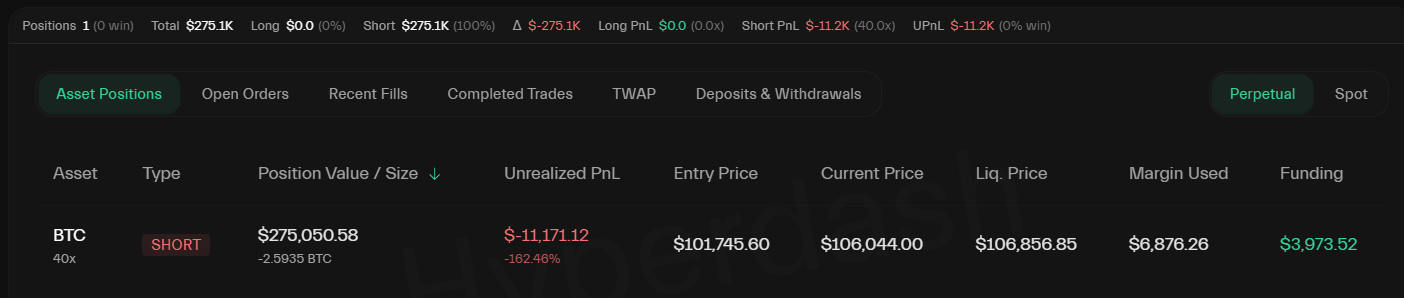

At the time of writing, Wynn’s main account had a 40x leveraged short position worth $275,000 in Bitcoin, which would face liquidation if Bitcoin’s price recovers above $6,856.

Wynn opened the short position when Bitcoin was trading below $101,800 and faced an unrealized loss of $11,147 as of 11:20 am UTC on Monday, according to Hyperdash data.

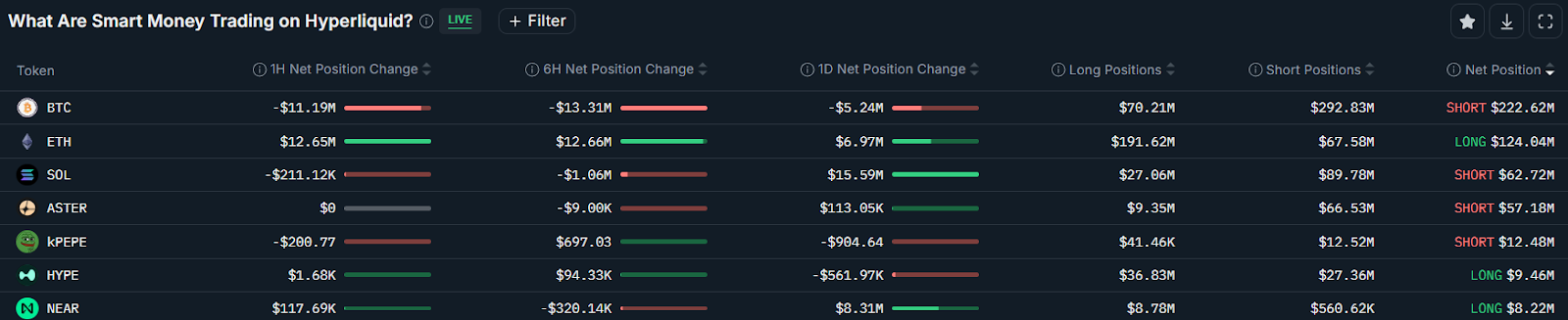

The industry’s most successful traders, tracked as “smart money” traders on Nansen’s blockchain intelligence platform, are also positioning for more potential downside for Bitcoin.

Most smart money traders were running short positions on Bitcoin, as the net perpetual short position on Hyperliquid reached $223 million on Monday, with $5.2 million worth of new shorts opened in the past 24 hours, according to Nansen.

Magazine: Bitcoin to see ‘one more big thrust’ to $150K, ETH pressure builds