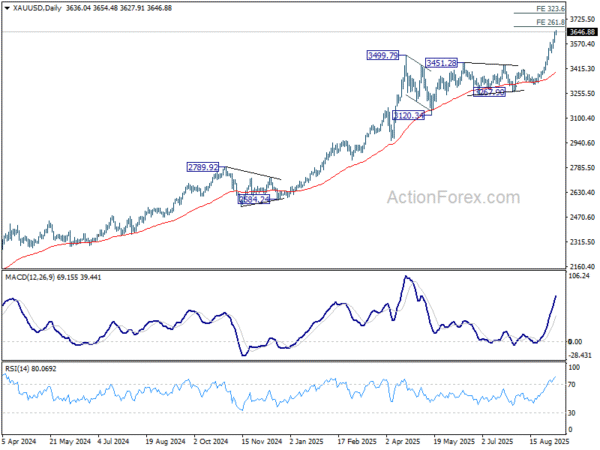

The benchmark U.S. 10-year yield extended its recent slide on Monday, dropping to a five-month low. At the same time, Gold surged to another record high, reflecting strong demand for safety and conviction that inflation data due this week could steer the Fed toward faster easing.

Markets are squarely focused on the August PPI release on Wednesday, followed by Thursday’s CPI, which will be critical in shaping expectations ahead of next week’s FOMC meeting. Any evidence of cooling inflation risks could soften Fed hawks’ resistance to faster rate cuts. While a 50bps move in September remains unlikely, the statement and dot plot could flag a steeper path of easing.

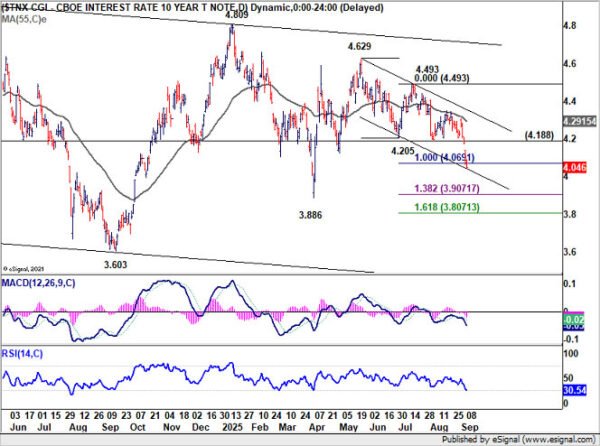

That possibility is keeping pressure on U.S. yields. Key attention is on the 4% mark for the 10-year yield. A clean break below this psychological level could spur an even deeper slide

Technically, 10-year has already broken through 100% projection of 4.629 to 4.205 from 4.493 at 4.069, with no sign of bottoming yet. It is also pressing against the lower bound of its near-term falling channel. Sustained break there will indicate further acceleration to 138.2% projection at 3.907 next, with prospect of diving to 3.886 support. In any case, outlook will stay bearish as long as 4.188 support turned resistance holds.

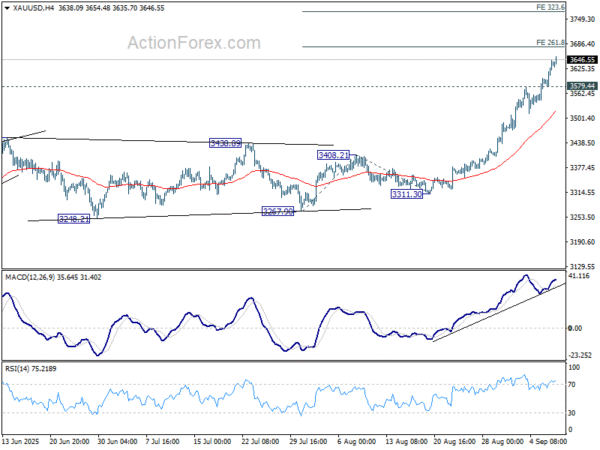

Gold, meanwhile, remains in a phase of upward re-acceleration, as indicated by 4H MACD. It’s on track to 261.8% projection of 3267.90 to 3408.21 from 3311.30 at 3678.63. Overbought condition as seen in 4H RSI could limit upside there on first attempt. But break of 3579.44 support is needed to indicate temporary topping first.

Meanwhile, if the 10-year yield breaks below 4% in the coming days, Gold’s rally could extend further, eyeing 323.6% projection at 3765.34 before a peak is established. For now, both Treasuries and bullion look unstoppable, with inflation data set to determine the next leg of momentum.