Key Highlights

- EUR/USD corrected gains after it faced hurdles near 1.3550.

- It traded below a rising channel with support at 1.3465 on the 4-hour chart.

- Gold prices rallied further and climbed above the $3,450 resistance.

- EUR/USD remained stable above 1.1600 and 1.1580.

GBP/USD Technical Analysis

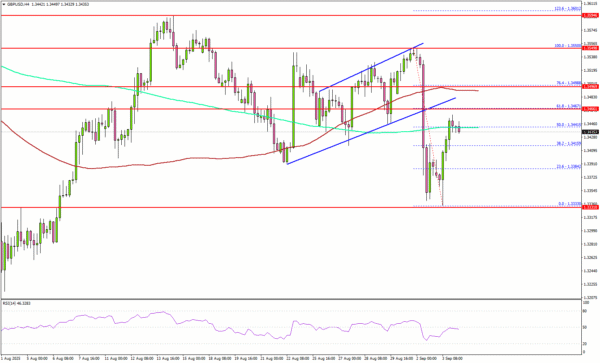

The British Pound struggled near 1.3550 and corrected gains against the US Dollar. GBP/USD dipped below the 1.3500 and 1.3450 levels.

Looking at the 4-hour chart, the pair traded below a rising channel with support at 1.3465. The pair even settled below the 100 simple moving average (red, 4-hour) and the 200 simple moving average (green, 4-hour).

A low was formed at 1.3333 and the pair is now correcting losses. There was a move above the 1.3400 level and the 50% Fib retracement level of the downside correction from the 1.3550 swing high to the 1.3333 low.

The pair is now facing resistance near the 1.3450 level. The next key hurdle sits near the 76.4% Fib retracement level of the downside correction from the 1.3550 swing high to the 1.3333 low and the 100 simple moving average (red, 4-hour) at 1.3500.

A close above 1.3500 could set the pace for another increase. In the stated case, the pair could rise toward 1.3550, above which the bulls could aim for a move toward 1.3600. Any more upsides could send GBP/USD toward 1.3680.

On the downside, immediate support is 1.3380. The next key area of interest might be 1.3320. Any more losses could send the pair toward the 1.3250 support zone.

Looking at Gold, the bulls remain in action as they were able to push the price above the $3,450 resistance zone.

Upcoming Key Economic Events:

- US ISM Services Index for August 2025 – Forecast 51.0, versus 50.1 previous.

- US Initial Jobless Claims – Forecast 230K, versus 229K previous.