Key Highlights

- GBP/USD started a major decline and traded below 1.3120.

- A key bearish trend line is forming with resistance at 1.3080 on the 4-hour chart.

- EUR/USD declined further below 1.1500 and tested 1.1475.

- The BoE interest rate decision is scheduled today (forecast 4%).

GBP/USD Technical Analysis

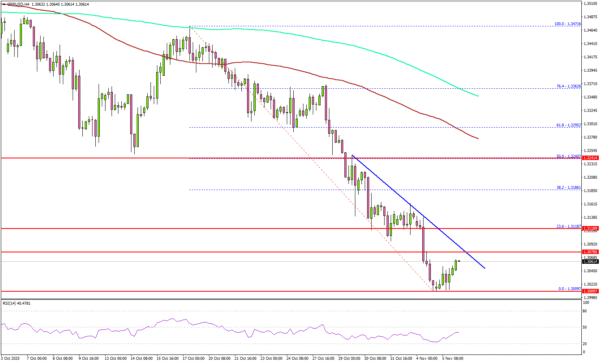

The British Pound failed to stay above 1.3200 against the US Dollar. GBP/USD declined further below 1.3120 and 1.3080 to enter a bearish zone.

Looking at the 4-hour chart, the pair settled below 1.3120, the 100 simple moving average (red, 4-hour), and the 200 simple moving average (green, 4-hour). The pair even tested 1.3000. A low was formed at 1.3009 and the pair is now consolidating losses.

If there is a recovery wave, the pair could face resistance near 1.3080. There is also a key bearish trend line forming with resistance at 1.3080. The first major resistance is 1.3120.

A close above 1.3120 resistance might push the pair to 1.3180 and the 50% Fib retracement level of the downward move from the 1.3471 swing high to the 1.3009 low. Any more gains could set the pace for a steady increase toward 1.3240.

On the downside, the pair might find support at 1.3020. The main support might be 1.3000. A close below the 1.3000 zone could start a major pullback toward 1.2880. Any more losses might open the doors for a test of 1.2750.

Looking at EUR/USD, the pair extended losses below 1.1500 and might struggle to recover above 1.1550 in the near term.

Upcoming Key Economic Events:

- BoE Interest Rate Decision – Forecast 4%, versus 4% previous.

- US Initial Jobless Claims – Forecast 223K, versus 218K previous.