Summary

- We expect the FOMC to resume lowering the fed funds rate at its September meeting with a 25 bps rate cut that would bring the policy rate to a range of 4.00%-4.25%.

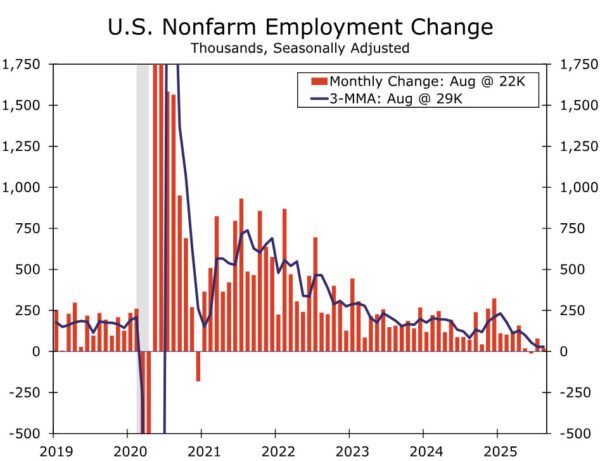

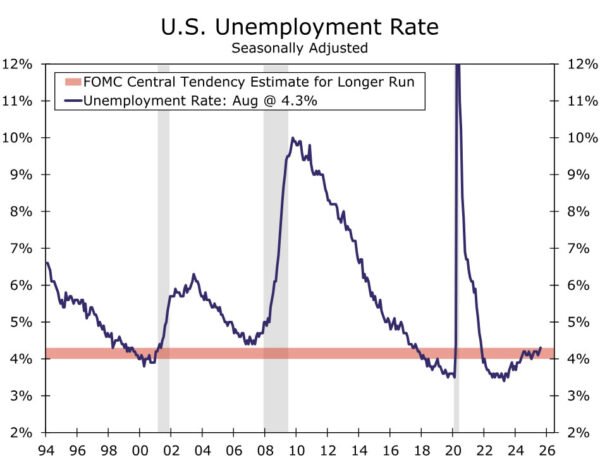

- A more precarious picture of the labor market has become apparent since the FOMC last met in July. The three-month average pace of payroll gains is now reported at just 29K compared to 150K when the FOMC gathered in July. Furthermore, the unemployment rate has moved up to a cycle-high of 4.3%, putting it at the top end of the FOMC’s range consistent with “full employment.”

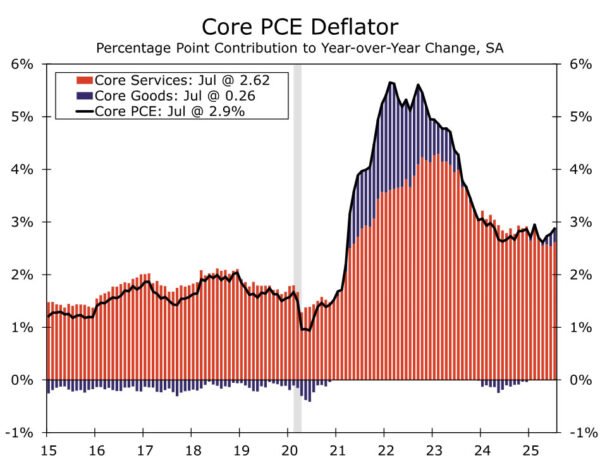

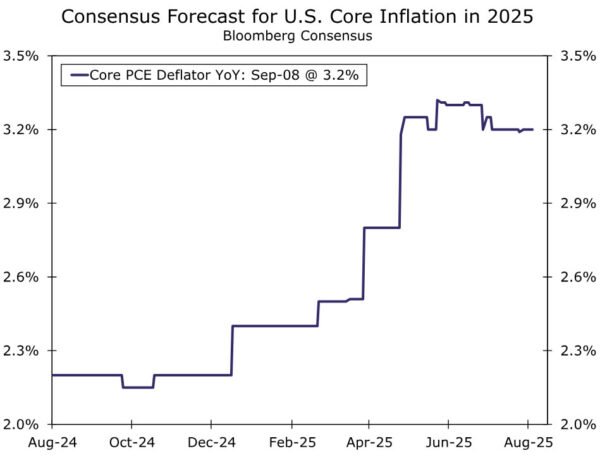

- Additional policy easing this year has been delayed due to inflation. Reflation in the goods sector alongside slower services disinflation has kept core PCE running about one percentage point above the 2% target. That said, the outlook for inflation has been little changed over the past six weeks. Our own forecast looks for core PCE to rise 3.1% on a Q4/Q4 basis this year, the same as before the July FOMC meeting.

- We think the meeting statement will mark down the FOMC’s current view of the labor market but refrain from signaling that additional rate cuts will immediately follow September’s cut. This would give the FOMC the flexibility to reduce the policy rate again at its next meeting on October 29 or proceed with additional easing more slowly.

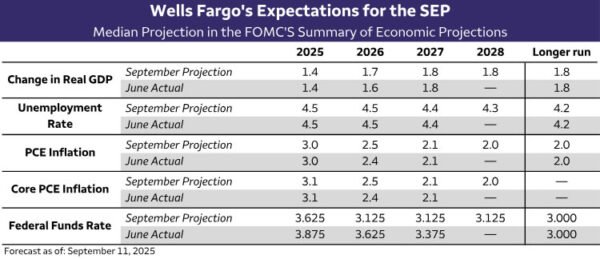

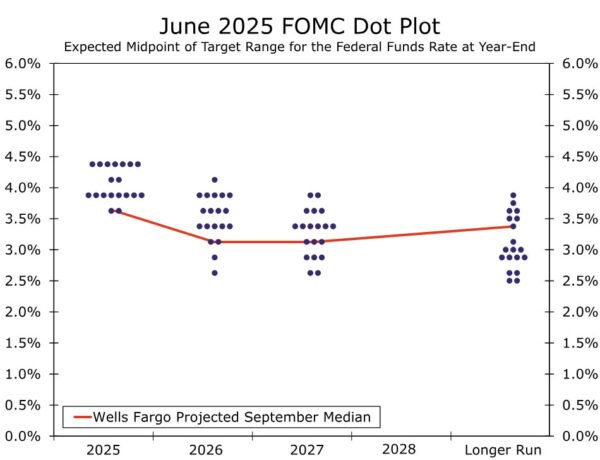

- We expect the updated dot plot to signal more easing through the remainder of this year and next (Table). The composition of the Committee looks set to tilt in a more dovish direction with Stephan Miran on track to be confirmed prior to the meeting. However, the more significant driver of the revision, in our view, is the combination of increased risk to full employment and the generally stable inflation outlook. We think the median dot for 2025 will move down to project 75 bps of cuts compared to 50 bps of cuts in June. For 2026, we anticipate the median dot will fall 50 bps from the June SEP projection of 3.625% to 3.125%, implying an additional 25 bps cut next year. We do not expect any changes to the median longer-run estimate.

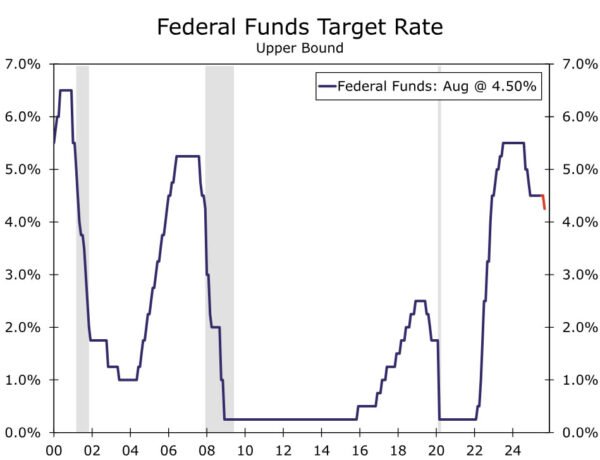

- Our base case forecast for the federal funds rate is three 25 bps rate cuts at the three remaining FOMC meetings of the year, followed by two 25 bps rate cuts at the March and June FOMC meetings before a prolonged hold at 3.00%-3.25%. For further reading on our fed funds projections and broader economic outlook, see our recently released monthly economic outlook.

Phase II of the FOMC’s Rate Cutting Cycle Begins

The FOMC held the fed funds rate steady at the conclusion of its July 30th meeting, the Committee’s fifth straight hold. The decision reflected still-elevated inflation and a constructive view of the jobs market based on the data in hand at that time. That said, the decision was not unanimous; Governors Waller and Bowman dissented in favor of a 25 bps cut.

We expect the FOMC to resume lowering the fed funds rate at its September meeting with a 25 bps cut that would bring the policy rate to a range of 4.00%-4.25% (Figure 1). Although the FOMC has been on hold for the past eight months, a bias toward further easing has persisted. Both the March and June dot plots showed that most officials expected rates to be lower later this year, as the current policy rate is set above even the highest estimates of the longer-run, “neutral” rate.

Additional policy easing this year has been delayed due to inflation. Consumer price growth has been above the FOMC’s 2% target for more than four years, leaving policymakers concerned that the prolonged overshoot could still de-anchor inflation expectations. The implementation of widescale tariffs has stoked these concerns further and has contributed to inflation turning higher again. Goods prices have been the driving force behind the upturn, but services inflation has also been sticky (Figure 2). Reflation in the goods sector alongside slower services disinflation has kept core PCE inflation running about one percentage point above the 2% target. That said, the outlook for inflation has been little changed over the past six weeks. Our own forecast looks for the core PCE delator to rise 3.1% on a Q4/Q4 basis this year, unchanged from our estimate prior to the July FOMC meeting.

The labor market through much of this year has looked to be in line with the FOMC’s mandate of maximum employment, with the unemployment rate hovering at, or slightly below, the Committee’s median longer run estimate of unemployment (4.2%). But, a more precarious picture of the labor market became apparent with the July jobs report released just two days after the FOMC’s last meeting. The marked slowdown in hiring in that report was reaffirmed with the August employment report released on September 5. The three-month average pace of payroll gains is now reported at just 29K compared to 150K when the FOMC gathered in July (Figure 3). Preliminary benchmark revisions from the BLS released on September 9 suggest that job growth in the 12 months ending March 2025 averaged only 73K, half its currently published pace. Furthermore, the unemployment rate has moved up to a cycle-high of 4.3%, putting it at the top end of the FOMC’s range consistent with “full employment.” (Figure 4)

With the labor market on shakier ground, more members appear ready to join Governors Waller and Bowman in support of reducing the fed funds rate even as inflation remains above target. Notably, in his address at Jackson Hole, Chair Powell opened the door for a rate cut in September by stating that the downside risks to employment are rising and that this shift in the balance of risks to the FOMC’s mandates “may warrant adjusting our policy stance.” Other voting members also appear to have grown more concerned. Even before the poor August jobs report, St. Louis Fed President Musalem, who is generally considered a hawk, said that “putting most of the weight on the inflation goal runs the risk of not providing enough support to maintain a full employment labor market at a time when downside risks have risen.”

Not everyone on the Committee seems fully convinced that it is appropriate to begin lowering rates at the September meeting. Chicago Fed President Goolsbee, speaking after the August jobs report, said that he is still undecided about his support for a rate cut and noted the need to look at the inflation side of the mandate too. We think it is possible that he or Kansas City President Schmid dissents in favor of keeping the fed funds rate unchanged. If current Chair of the Council of Economic Advisers Stephen Miran is confirmed in time to participate in the meeting, which seems probable at this point in time, we think it is possible he could dissent in the opposite direction, perhaps preferring a 50 bps rate cut to make up for the hold at the July meeting. Governors Bowman or Waller also could dissent in favor of a 50 bps move, although we consider this a less likely outcome.

In terms of changes to the post-meeting statement, we think the new meeting statement will mark down the Committee’s current assessment of the labor market. We expect the characterization of “solid” to be abandoned and for the statement to note that the unemployment rate has moved up while hiring has slowed. With inflation still “somewhat elevated,” we believe the statement will be cautious in signaling that additional rate cuts will follow September’s anticipated move. We doubt it will reference the pace of additional cuts ahead, e.g., as “gradual” or “measured.” Rather, we suspect the statement will continue to indicate that future adjustments will depend on additional data and changes in the outlook. This would give the Committee the flexibility to reduce the policy rate again at its next meeting on October 29 or proceed with additional easing more slowly.

Summary of Economic Projections to Show More Easing Ahead

More insight into how FOMC participants see the path of the policy rate unfolding will be available in the Summary of Economic Projections (SEP). We expect the updated dot plot to signal more easing through the remainder of this year and next. In the prior SEP released in June, the median projection for the fed funds rate at year-end implied a total of 50 bps of rate cuts. We think the median will shift down to 75 bps of cuts this year (Figure 5). For 2026, we anticipate the median dot will fall 50 bps from the June SEP projection of 3.625% to 3.125%, implying an additional 25 bps cut during the next calendar year. The projections for 2027 and the first look at 2028 likely will be widely dispersed given the longer time horizon, yet we anticipate the median each year also will register 3.125%, consistent with the policy rate returning to a more neutral stance by the end of the forecast horizon. We do not expect any changes to the median longer-run estimate.

The lower median projections for the fed funds rate in 2025 and 2026 could be fostered by a more dovish composition of the Committee if Stephan Miran is confirmed in time to participate in the September meeting. However, the more significant driver, in our view, is the combination of greater risk to employment amid a generally stable outlook for inflation the past few months despite ongoing uncertainty around the inflationary impact of changes to tariff policy (Figure 6). We anticipate the median Q4/Q4 estimates for headline and core PCE inflation in 2025 will remain unchanged in the September SEP at 3.0% and 3.1%, respectively. The inflation estimates for 2026 may tick up a tenth or so as the slow adjustment to tariffs keeps inflation elevated slightly longer, although at around 2.5%, that would still leave inflation making strides back toward the Committee’s target next year.

We expect the median estimate for the unemployment rate to remain at 4.5% at the end of this year and next, as the sharp slowdown in payroll growth recently has coincided with weaker labor force growth. While this would not mark a change from the last SEP, we suspect the Committee’s risk assessments to their unemployment projections will be further tilted toward the upside. The 2025 median projection for GDP is also likely be left unchanged after growth appears to have rebounded strongly in Q2 from its dip at the start the year. That said, 1.4% growth on a Q4/Q4 basis would still be below the Committee’s estimate of potential growth (1.8%) and consistent with underlying inflation easing after the initial price pressures from tariffs have passed.