U.S. markets embraced a familiar “bad news is good news” narrative on Tuesday, with equities surging and the dollar slumping as a trio of disappointing economic reports reinforced expectations that the Federal Reserve will cut interest rates in December.

Check out the forex news and economic updates you may have missed in the latest trading session!

Forex News Headlines & Data:

- Tomoko Yoshino, the leader of Japan’s largest labor union group, urged the government to do more to ensure that workers’ wage gains outpace inflation

- Germany GDP Growth Rate Final for September 30, 2025: 0.0% q/q (0.0% q/q forecast; -0.3% q/q previous)

- U.K. CBI Distributive Trades for November 2025: -32.0 (-25.0 forecast; -27.0 previous)

- U.S. ADP Employment Change Weekly for November 8, 2025: -13.5k (-2.5k previous)

- Canada Wholesale Sales Prel for October 2025: -0.1% (0.3% forecast; 0.6% previous)

- U.S. Retail Sales for September 2025: 0.2% m/m (0.3% m/m forecast; 0.6% m/m previous); 4.3% y/y (3.9% y/y forecast; 5.0% y/y previous)

-

U.S. PPI for September 2025: 0.3% m/m (0.5% m/m forecast; -0.1% m/m previous); 2.7% y/y (2.6% y/y forecast; 2.6% y/y previous)

- U.S. Core PPI for September 2025: 0.1% m/m (0.2% m/m forecast; -0.1% m/m previous); 2.6% y/y (2.8% y/y forecast; 2.8% y/y previous)

- U.S. CB Consumer Confidence for November 2025: 88.7 (94.2 forecast; 94.6 previous) – biggest drop since April

- U.S. S&P/Case-Shiller Home Price change for September 2025: -0.5% m/m (-0.4% m/m forecast; -0.6% m/m previous); 1.4% y/y (1.6% y/y forecast; 1.6% y/y previous)

- U.S. House Price Index for September 2025: 0.0% m/m (0.3% m/m forecast; 0.4% m/m previous); 1.7% y/y (1.5% y/y forecast; 2.3% y/y previous)

- U.S. Pending Home Sales for October 2025: 1.9% m/m (-0.4% m/m forecast; 0.0% m/m previous); -0.4% y/y (-2.4% y/y forecast; -0.9% y/y previous)

- U.S. Business Inventories for August 2025: 0.0% m/m (0.1% m/m forecast; 0.2% m/m previous)

- U.S. Retail Inventories Ex Autos for August 2025: 0.0% m/m (0.3% m/m forecast; 0.1% m/m previous)

- U.S. Richmond Fed Manufacturing Index for November 2025: -15.0 (-1.0 forecast; -4.0 previous)

- U.S. Dallas Fed Services Index for November 2025: -2.3 (-6.0 forecast; -9.4 previous)

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Tuesday’s session delivered a textbook demonstration of markets inverting traditional economic logic, as a trifecta of disappointing U.S. data sparked a rally in risk assets while hammering the dollar and bond yields.

The S&P 500 staged an impressive recovery, climbing 0.84% to close at 6,764.5 after swinging between modest gains and losses during the Asian and early London sessions. The index caught fire immediately following the 8:30 AM & 10:30 AM ET data dumps, with the rally accelerating through the afternoon as traders positioned for a December Fed rate cut. The strength was broad-based, with particular support from technology and healthcare sectors.

Gold traded essentially flat on the day, slipping just 0.08% to settle around $4,130 per ounce. Despite the dollar’s weakness, which would typically support the precious metal, gold appeared to face profit-taking after its early week surge from $4,050 area. The yellow metal’s resilience in holding near these elevated levels suggests underlying support from Fed rate cut expectations, but possibly capped on optimistic developments in the Ukraine-Russia war story.

WTI crude oil declined 1.31% to $57.80, with the selloff correlating closely with reports throughout the session of significant progress in Russia-Ukraine peace negotiations. President Trump’s afternoon announcement that “tremendous progress” had been made on a peace deal, with the framework narrowed from 28 to 19 proposals, likely weighed on energy prices as traders priced in reduced risk of supply disruptions from the conflict.

Bitcoin returned to its November decline, falling another 2.19% to $86,802 as the cryptocurrency remained on track for its worst monthly performance since 2022. The continued weakness in crypto occurred despite the broader risk-on environment, suggesting Bitcoin-specific headwinds—including institutional outflows, and profit-taking by long-term holders following earlier 2025 gains—are overwhelming any support from declining real yields.

The 10-year Treasury yield plunged 0.72% to finish just below 4.0%, marking a significant technical level breach. The sharp decline in yields correlated with the soft retail sales and PPI data, then accelerated following the consumer confidence collapse at 10:00 AM ET. The move lower was sustained through the afternoon session as traders dramatically increased their December Fed rate cut probabilities, with markets now pricing roughly 84% odds of a 25-basis-point reduction.

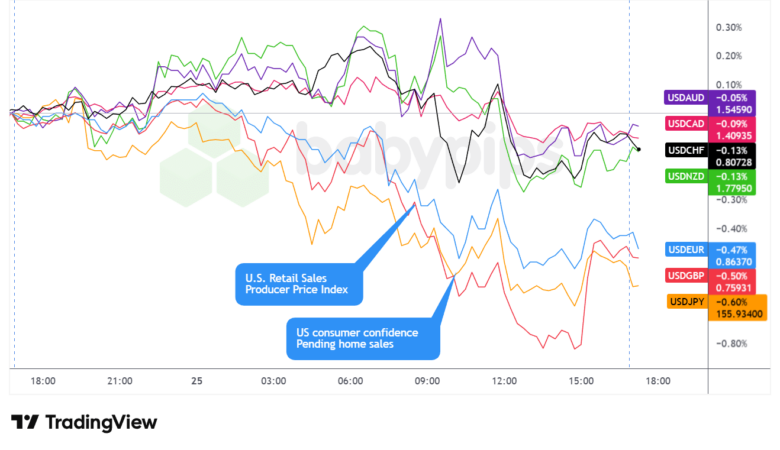

FX Market Behavior: U.S. Dollar vs. Majors:

Overlay of USD vs. Majors Forex Chart by TradingView

The U.S. dollar suffered a comprehensive defeat on Tuesday, ending the session as the worst-performing major currency as a series of disappointing economic releases cemented expectations for a December Federal Reserve rate cut.

The greenback traded mixed during the Asian session, with narrow ranges dominating as traders awaited the delayed September data releases and fresh November indicators. There were no meaningful catalysts from the region, with only minor consumer sentiment headlines from Australia and South Korea failing to move markets.

The dollar’s troubles began in earnest during the London session, where the greenback posted net losses against major currencies. The initial weakness appeared to correlate with the 3:30 AM ET release of the ADP weekly employment report, which showed private employers shed 13,500 jobs per week on average for the four-week period ending November 8—a significant deterioration from the 2,500 average job loss in the prior period. This labor market softening likely prompted traders to begin positioning for weaker-than-expected data in the upcoming U.S. session.

The dollar’s selloff intensified dramatically during the U.S. session, with the greenback extending its losses through the afternoon close. The catalyst was unmistakable: at 8:30 AM ET, the release of delayed September data showed retail sales growth slowed to just 0.2% versus 0.3% expected, while producer price inflation came in softer than forecasts. Though the PPI headline slightly beat expectations, the core and ex-food-energy-trade measures disappointed.

The real knockout blow came at 10:00 AM ET when the Conference Board’s consumer confidence index cratered to 88.7 from 94.6, marking the biggest monthly decline since April and missing estimates by a wide margin. The collapse in confidence—driven by anxiety about jobs, the economy, and mentions of the recent federal government shutdown—seemed to outweigh any residual dollar support and reinforced the narrative that the Fed would need to ease policy in December.

The dollar’s inability to find support even as global growth concerns persist and geopolitical risks remain elevated underscores how thoroughly markets have pivoted to pricing Fed easing as the dominant near-term driver for the greenback.

Upcoming Potential Catalysts on the Economic Calendar

- Australia Consumer Price Index Growth Rate for October 2025 at 12:30 am GMT

- RBNZ Interest Rate Decision for November 26, 2025 at 1:00 am GMT

- Australia RBA Smith Speech at 1:50 am GMT

- New Zealand RBNZ Press Conference at 2:00 am GMT

- Japan Leading Indicators Index for September 2025 at 5:00 am GMT

- Swiss Economic Sentiment Index for November 2025 at 9:00 am GMT

- ECB Financial Stability Review at 9:00 am GMT

- U.S. MBA 30-Year Mortgage Rate for November 21, 2025 at 12:00 pm GMT

- U.S. MBA Mortgage Applications for November 21, 2025 at 12:00 pm GMT

- U.K. Autumn Budget 2025

- U.S. Durable Goods Orders for September 2025 at 1:30 pm GMT

- U.S. Initial Jobless Claims for November 22, 2025 at 1:30 pm GMT

- Chicago PMI for November 2025 at 2:45 pm GMT

- EIA Crude Oil Stocks Change for November 21, 2025 at 3:30 pm GMT

- ECB Lane Speech at 4:05 pm GMT

- ECB President Lagarde Speech at 5:00 pm GMT

- U.S. Fed Beige Book at 7:00 pm GMT

Wednesday’s calendar is absolutely stacked with top-tier market movers that could drive significant volatility, particularly in currency markets. The session kicks off with Australia’s October CPI data, which will be scrutinized for signs of whether inflation pressures are easing enough to give the RBA room to consider policy adjustments. This is followed immediately by the Reserve Bank of New Zealand’s monetary policy decision and press conference, where markets will be watching for any shift in the RBNZ’s policy stance given recent economic softness.

The European session brings the highly anticipated U.K. Autumn Budget, where Treasury Chief Rachel Reeves is expected to unveil fiscal measures aimed at addressing the budget deficit. Following Tuesday’s weak CBI distributive trades data and ongoing concerns about U.K. economic growth, markets will be parsing the budget details for their implications on Bank of England policy—particularly whether tax-heavy measures might necessitate more aggressive BOE rate cuts in 2026 to offset growth headwinds.

The U.S. session delivers a double dose of delayed September data with durable goods orders and the critical weekly initial jobless claims report. Following Tuesday’s weak ADP employment data and the collapse in consumer confidence, these labor market figures take on outsized importance as the final major data points before the December Fed meeting. Any further signs of labor market deterioration could push December rate cut probabilities even higher and extend the dollar’s weakness.

The afternoon also brings speeches from ECB officials Lane and Lagarde, along with the Fed’s Beige Book, which could provide additional color on economic conditions heading into year-end.

With so many high-impact events concentrated in a single session—spanning monetary policy decisions, fiscal policy announcements, and key U.S. labor data—Wednesday has all the ingredients for sharp moves across FX pairs, particularly in the Pacific currencies (AUD, NZD) during the Asian session, sterling during European hours, and the dollar during U.S. trading.

Stay frosty out there, forex friends, and don’t forget to check out our Forex Correlation Calculator when planning to take on risk!