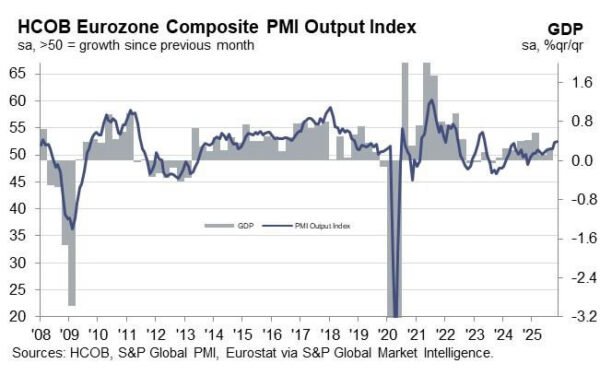

Eurozone business activity lost a little momentum in November as PMI Composite edged down from 52.5 to 52.4. Manufacturing slipped back into contraction at 49.7, down from 50.0, a five-month low. Services inched up from 53.0 to an 18-month high of 53.1.

Hamburg Commercial Bank’s Chief Economist Cyrus de la Rubia noted that manufacturing remains “marooned in a no-man’s land of directionlessness,” with soft demand showing up in yet another decline in new orders. He warned the sector is still “months, possibly even several quarters” away from a sustained turnaround, pointing to deteriorating conditions in both Germany and France. Indeed, Germany’s PMI Manufacturing fell from 49.6 to 48.4 and France dropped from 48.8 to 47.8.

By contrast, services continue to provide a much-needed buffer. Germany’s service-sector growth slowed (down from 54.6 to 62.7) but stayed comfortably positive. France returned to expansion (up from 48.0 to 50.8). With the services sector carrying far more weight in the Eurozone economy, the currency bloc is still on track for faster growth in Q4 compared with Q3.