Summary

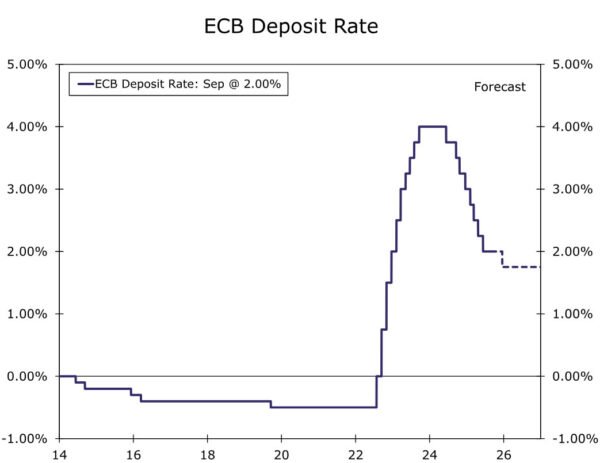

- The European Central Bank (ECB) held its Deposit Rate steady at 2.00% at today’s monetary policy announcement, keeping its monetary policy stance on hold for the second meeting in a row. The accompanying statement was neutral in tone and offered little in the way of forward guidance on future policy moves.

- The ECB made only modest revisions to its economic projections, raising its economic growth outlook modestly, while lowering its forecast for underlying inflation very slightly. The ECB projects underlying inflation at 2.4% for 2025, 1.9% for 2026, and 1.8% for 2027. The fact that the central bank’s medium-term inflation forecasts are below the 2% inflation target, and the 2027 forecast was revised lower, are modestly dovish signals in our view. The dovish signal from the economic projections was largely offset however by comments from ECB President Lagarde. She said that growth risks were balanced, and suggested the disinflationary process for the Eurozone is now over.

- Despite the overall neutral tone of today’s announcement, we expect the evolving growth, wage and inflation trends will still see the ECB deliver one final 25 bps rate cut, to 1.75%, at its December meeting. We expect growth to soften in the coming quarters, reflecting slower employment and income growth, and still subdued sentiment and confidence. Meanwhile, wage and labor cost pressures continue to show a gradual deceleration, which we view as consistent with core inflation converging to target and leading to modest further monetary easing.

European Central Bank Pauses For a Second Meeting

The European Central Bank (ECB) held its Deposit Rate steady at 2.00% at today’s monetary policy announcement, keeping its monetary policy on hold for the second meeting in a row. The ECB offered little in the way of new guidance, while making only marginal changes to its economic projections. Overall, our outlook for ECB monetary policy remains unchanged, and we still see potential for modest further monetary easing.

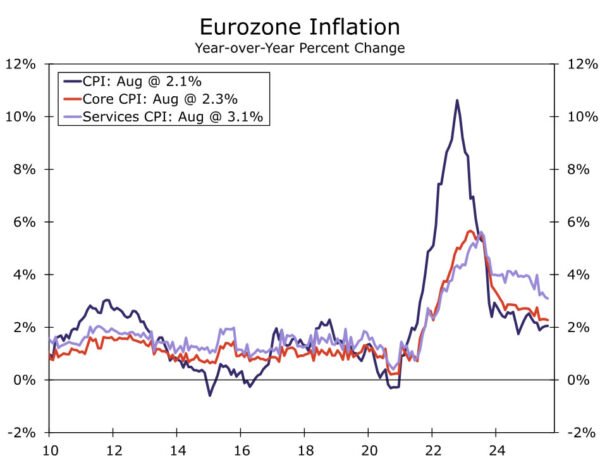

Today’s announcement was perhaps even more concise than usual, with the ECB simply saying its “assessment of the inflation outlook is broadly unchanged.” That is reflected in the ECB’s updated economic projections, which saw a modest upgrade to the growth outlook, and a very mild downgrade to the underlying inflation outlook. The central bank forecasts GDP growth of 1.2% for 2025 (previously 0.9%), 1.0% for 2026 (previously 1.1%) and 1.3% for 2027 (unchanged). With regard to underlying inflation (CPI excluding food and energy), the ECB forecasts underlying inflation of 2.4% in 2025 and 1.9% in 2026 (both unchanged) and 1.8% in 2027 (previously 1.9%). Despite only minor changes, we view the updated inflation forecasts in particular as noteworthy. The minor downward revision to the 2027 inflation forecast is, in our view, a modestly dovish signal. Moreover, with both the 2026 and 2027 underlying inflation forecasts below the ECB’s 2% inflation target, it leaves open the possibility of further easing, without guaranteeing it. The dovish signal from the economic projections was largely offset however by comments from ECB President Lagarde. She said that growth risks were balanced, and suggested the disinflationary process for the Eurozone is now over.

The ECB also said it is determined to ensure that inflation stabilizes at its 2% target and, in a familiar refrain, said it “will follow a data-dependent and meeting-by-meeting approach” and that it is “not pre-committing to a particular rate path.” The importance of the underlying inflation outlook was also reinforced by the ECB’s comment that its decision will be based, among other things, by “the dynamics of underlying inflation and the strength of monetary policy transmission.”

We Still Expect a Final ECB Rate Cut Later This Year

While the ECB held rates steady at today’s meeting, we believe the evolving growth, wage and inflation trends could still see the central bank deliver one final 25 bps rate cut, to 1.75%, at its December meeting. That would take the ECB’s policy rate towards the “accommodative end” of what view as the neutral range, of between 1.75% to 2.25%. We expect a slower pace of economic growth over the second half of 2025 and still see some downside risks to the growth outlook, while we also think wage and price fundamentals remain consistent with a gradual disinflationary trend toward the 2% inflation target.

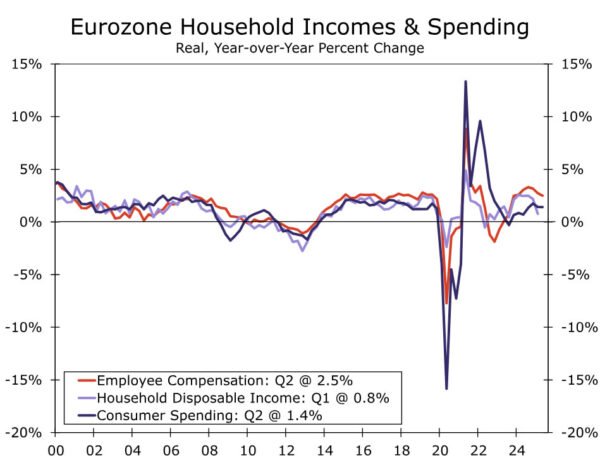

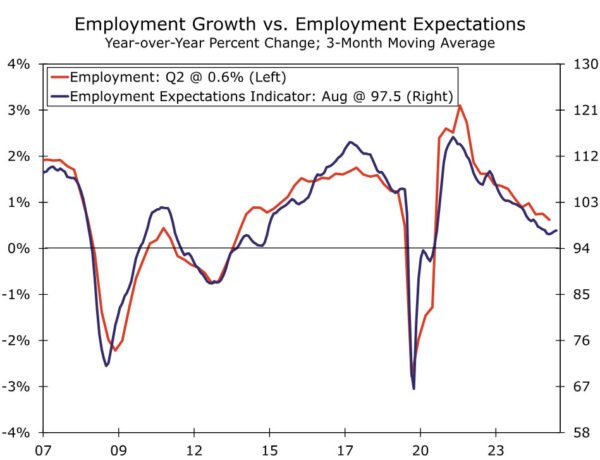

Eurozone Q2 GDP grew by just 0.1% quarter-over-quarter, after a 0.6% gain in Q1. While that headline result might overstate the degree of weakness (our estimate of underlying final domestic demand rose 0.3% in Q2), there are still reasons to expect a slower pace of growth over the next few quarters. Income trends have begun to soften, as Q2 real employee compensation slowed to 2.5% year-over-year, while Q1 real household disposable income rose by even less, with a 0.8% gain. Slow income growth, combined with an overall cautious consumer (as reflected in unusually elevated savings rates in recent quarters) will likely be consistent with only a modest pace of Eurozone consumer spending, at best, in the coming quarters. Reinforcing the slowing income trend is a deceleration in job growth. Eurozone Q2 employment rose by just 0.6% year-over-year, and forward-looking employment indicators suggest a slight further slowing in job growth remains possible.

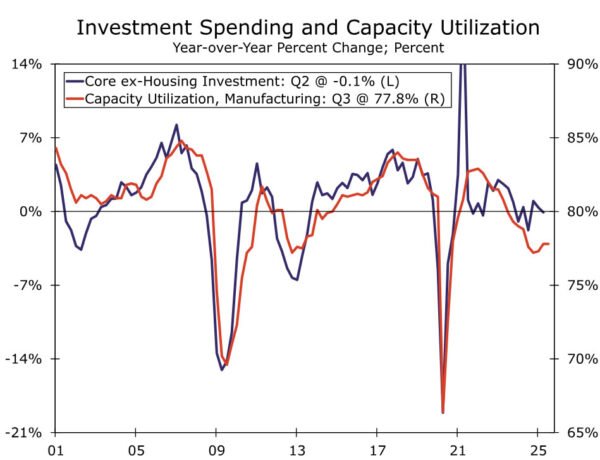

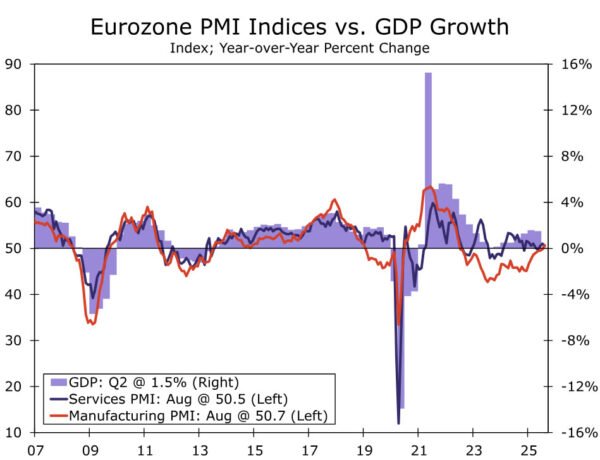

While increased defense spending could support investment spending over the medium-term, the immediate prospects for investment spending are also mixed. Our measure of core ex-housing investment dipped by 0.1% year-over-year in Q2, and low levels of capacity utilization suggest sluggish investment spending for the time being. While acknowledging that uncertainty, especially surrounding trade and tariff policy, has receded to some extent, a still somewhat unsettled environment is also a limiting factor for the near-term investment outlook. The Eurozone August manufacturing PMI rose to 50.7 while the services PMI slipped to 50.5. Neither index is at a level, however, that suggests upbeat sentiment which would be consistent with stronger investment spending. Moreover, the PMI surveys are also at levels that are historically consistent with only a modest pace of overall economic growth more broadly.

Finally, we still view wage and cost pressures as consistent with some further gradual disinflation in the quarters ahead. To be sure, wage indicators were somewhat mixed in the second quarter, as the ECB Indicator of Negotiated Wages quickened to 4.0% year-over-year, while the Q2 labor cost index also firmed to 3.7%. However, Q2 compensation per employee—the broadest wage measure—eased slightly further to 3.9%. Combined with a moderate improvement in labor productivity to 0.8% year-over-year in Q2, that has also contributed to a deceleration in unit labor cost growth to 3.1%. While the current level of unit labor cost growth remains mildly elevated, a further slowing in wages provides a clear path for unit labor cost growth and underlying inflation to both converge towards 2%, and possibly slightly below.

Overall, with the likelihood of slower economic growth ahead and in our view some potential for further disinflation to come, we lean toward the European Central Bank delivering a final 25 bps rate cut at its December meeting, to 1.75%. We think that benign CPI readings, especially core and services inflation, as well as a further slowing in wage growth, would be the most important contributors to further monetary policy easing. At the same time, wage and price indicators represent the main risk to our call for another ECB rate cut. Should wage growth, and/or core and services inflation fail to slow perceptibly in the months ahead, ECB policymakers may be more comfortable holding the Deposit Rate at the current 2.00% level for an extended period.