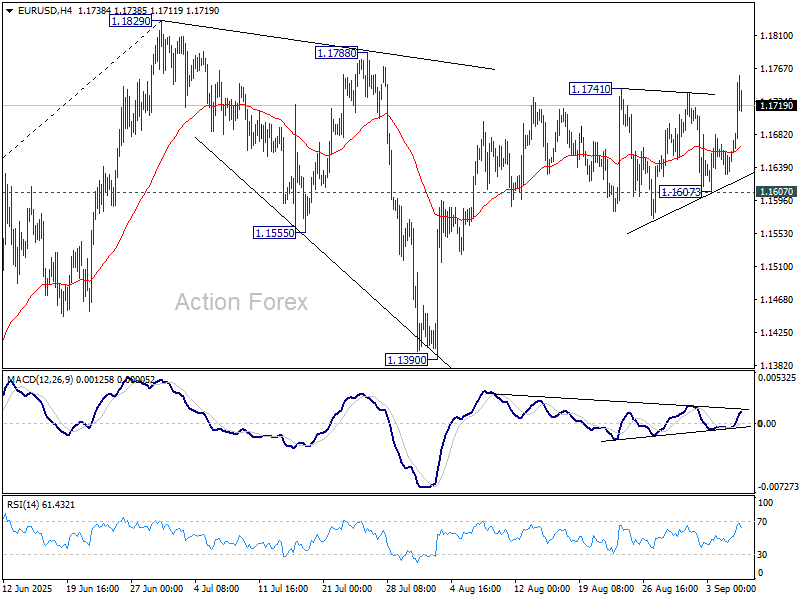

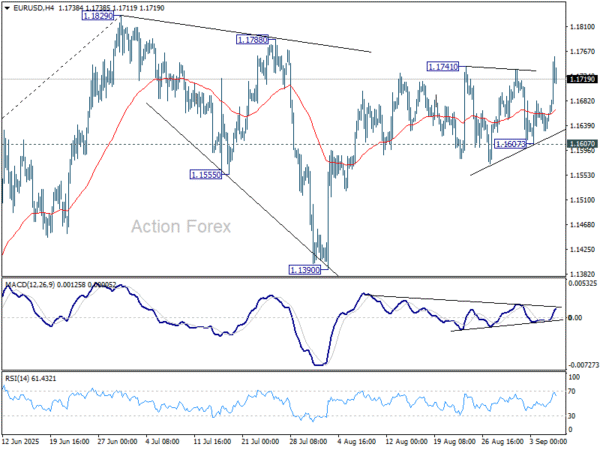

EUR/USD’s rise from 1.1390 resumed late last week by breaching 1.1741. The development aligns with the case that correction from 1.1829 has completed with three waves down to 1.1390. Initial bias is now on the upside this week for retesting 1.1829 first. Firm break there will resume larger up trend. For now, risk will stay on the upside as long as 1.1607 support holds, in case of retreat.

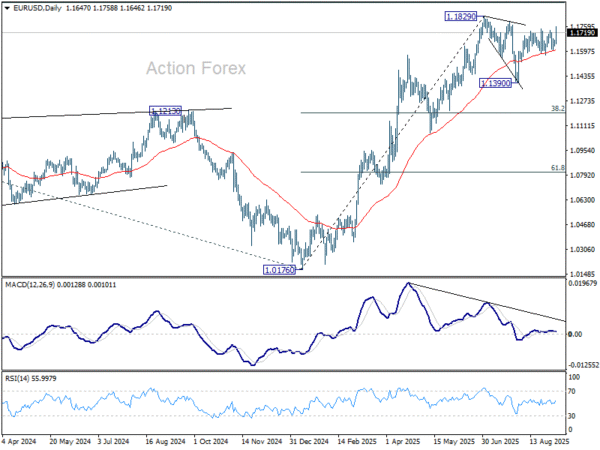

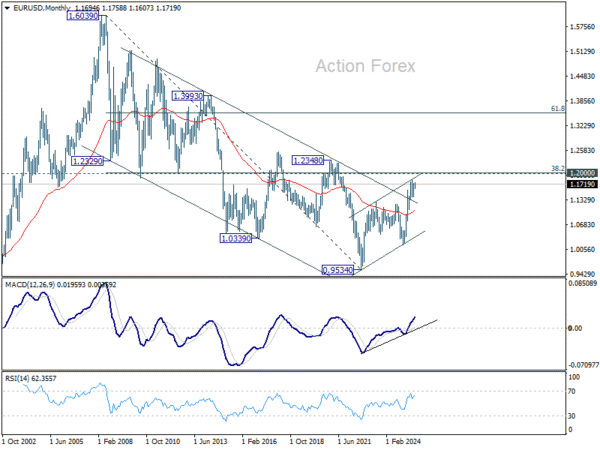

In the bigger picture, rise from 0.9534 (2022 low) long term bottom could be correcting the multi-decade downtrend or the start of a long term up trend. In either case, further rise should be seen to 100% projection of 0.9534 to 1.1274 from 1.0176 at 1.1916. This will remain the favored case as long as 1.1604 support holds.

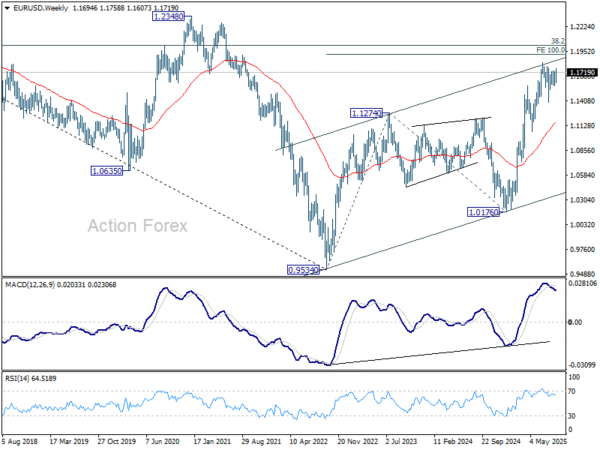

In the long term picture, a long term bottom was in place already at 0.9534, on bullish convergence condition in M MACD. Further rise should be seen to 38.2% retracement of 1.6039 (2008 high) to 0.9534 at 1.2019. Rejection by 1.2019 will keep the price actions from 0.9534 as a corrective pattern. But sustained break of 1.2019 will suggest long term bullish trend reversal, and target 61.8% retracement at 1.3554.