EUR/USD is holding near its highest levels since 2021 as traders await two pivotal events today: ECB policy decision and U.S. CPI data.

The ECB is set to hold its deposit rate at 2.00%, marking a second consecutive pause. Investors will be listening closely for any hint from President Christine Lagarde that policymakers are ready to park rates for the long haul.

The U.S.-EU trade agreement, which capped tariffs at 15%, has given the central bank more breathing space. If updated projections show limited fallout from tariffs and the Governing Council signals satisfaction with the current stance, Euro could draw support from the perception that the easing cycle is finished.

On the U.S. side, August CPI is expected to show headline inflation rising to 2.9% from 2.7%, with core CPI steady at 3.1%. The report is the final major data input before next week’s FOMC, where markets see a 25bps cut as the base case.

Political noise around the Fed has grown louder. After weaker-than-expected PPI figures yesterday, US President Donald Trump again lashed out at Chair Jerome Powell, calling him a “total disaster” and demanding immediate deep cuts.

Markets currently expect a series of back-to-back 25bps cuts in September, October, and December, bringing rates down to 3.50–3.75% by year-end. A downside surprise in CPI would reinforce that view and might even revive discussion of a larger move in September.

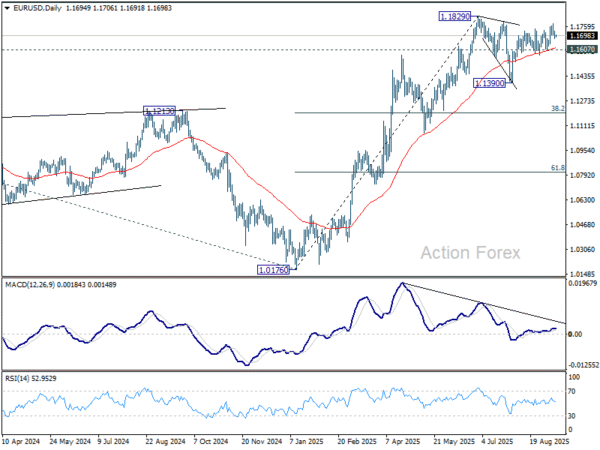

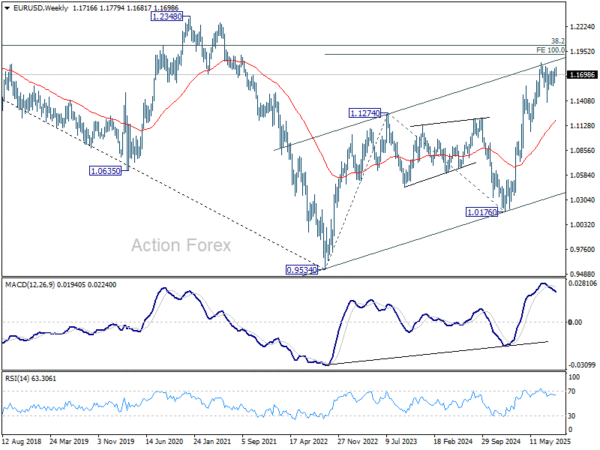

Technically, for EUR/USD, further rise is expected as long as 1.1607 support holds. Firm break of 1.1829 will resume larger up trend to 100% projection of 0.9534 to 1.1274 from 1.0176 at 1.1916. Then EUR/USD will face the real test at 1.2 psychological level.

Meanwhile, break of 1.1607 will delay the bullish case, and extend the corrective pattern from 1.1829 with another dip back towards 1.1390 support in the near term.