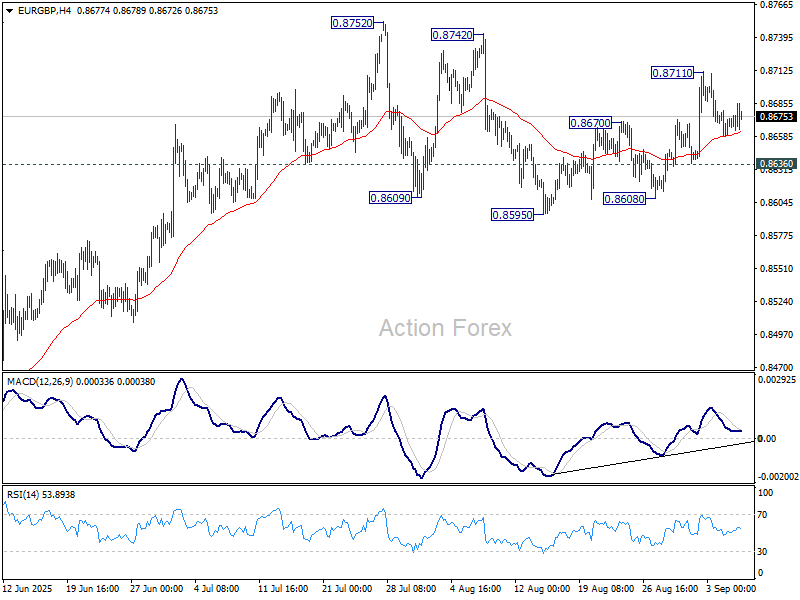

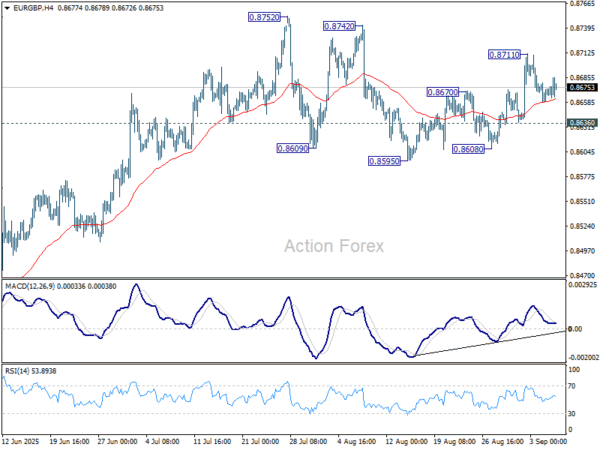

EUR/GBP’s rebound form 0.8595 resumed and jumped to 0.8711 last week, but retreated since then. Initial bias stays neutral this week and further rise is mildly in favor as long as 0.8636 minor support holds. Above 0.8711 will bring retest of 0.8752 high. However, break of 0.8636 will extend the pattern from 0.88752 with another falling leg, and target 0.8959 support.

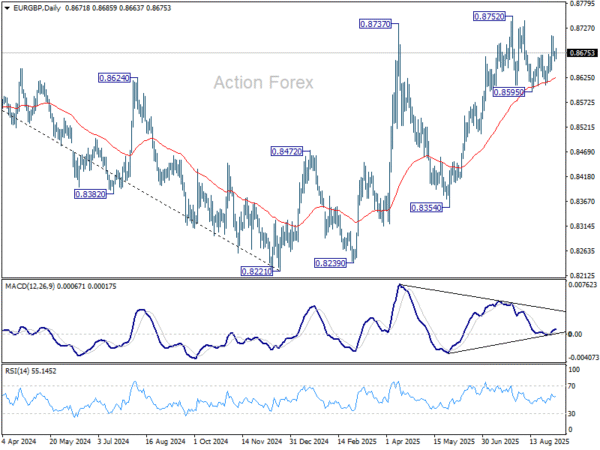

In the bigger picture, the structure from 0.8221 medium term bottom are not impulsive enough to suggest that it’s reversing the down trend from 0.9267 (2022 high). But even if it’s a correction, further rise could still be seen to 61.8% retracement of 0.9267 to 0.8221 at 0.8867. Nevertheless, sustained trading below 55 W EMA (now at 0.8513) will argue that the pattern has completed and bring retest of 0.8221 low.

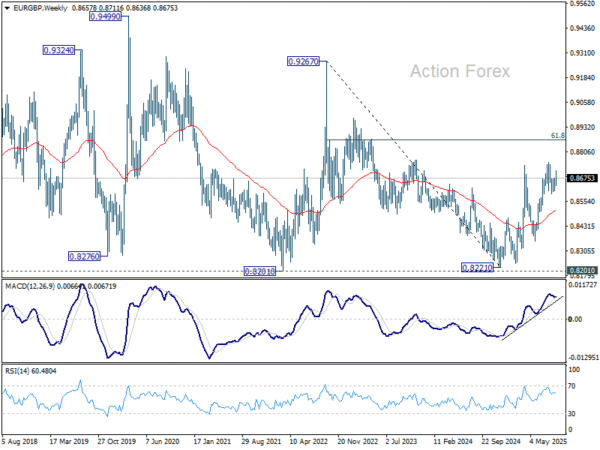

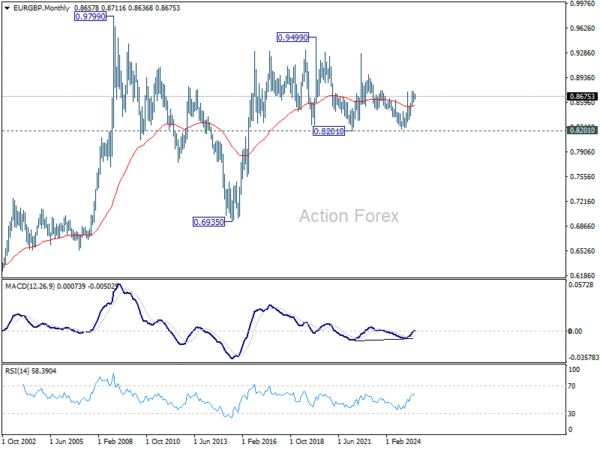

In the long term picture, price action from 0.9499 (2020 high) is seen as part of the long term range pattern from 0.9799 (2008 high). Range trading should continue between 0.8201 and 0.9499, until there is clear signal of imminent breakout.