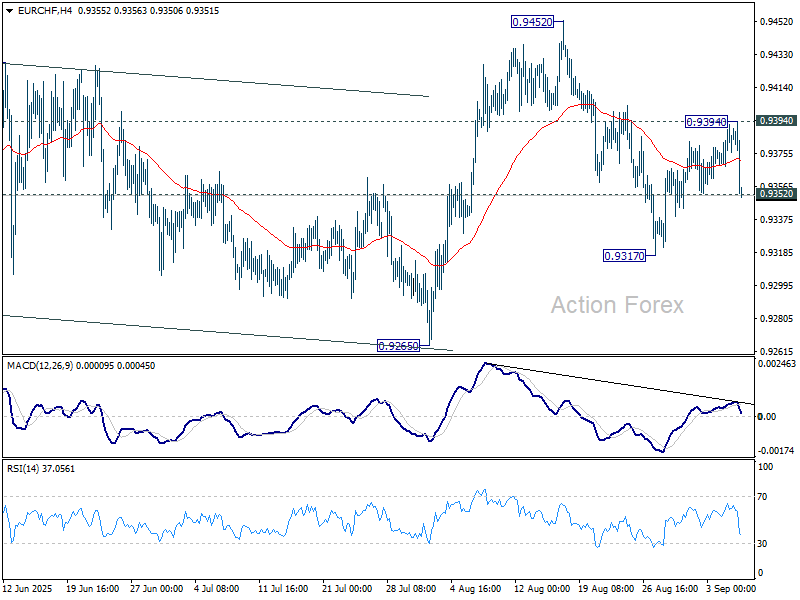

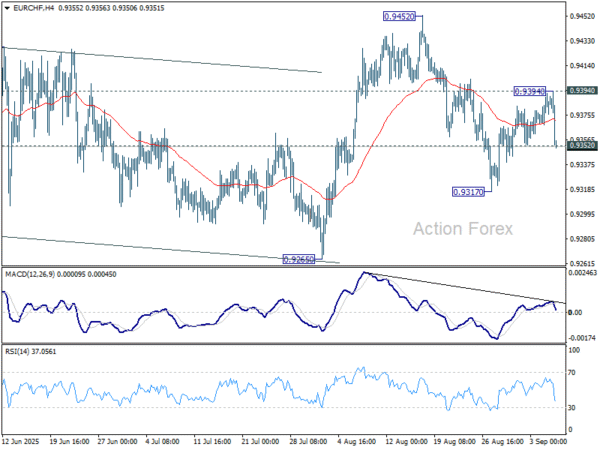

EUR/CHF recovered to 0.9394 last week but reversed from there. Late breach of 0.9352 minor support suggests the recovery has completed. Initial bias is back on the downside for retesting 0.9317 support. Also, outlook is unchanged that the corrective pattern from 0.9218 might have completed with three waves up to 0.9452 already. Break of 0.9317 will solidify this bearish case and target 0.9265 support, and then 0.9204 low. For now, risk will stay on the downside as long as 0.9394 resistance holds, in case of recovery.

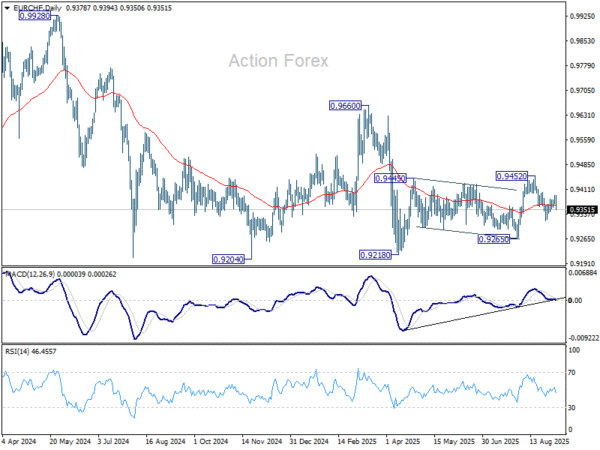

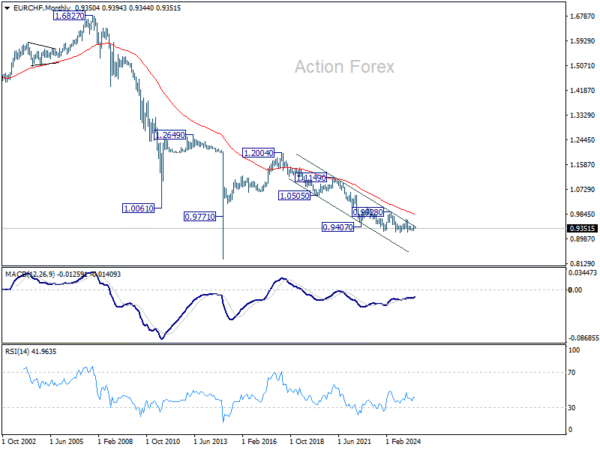

In the bigger picture, the down trend from 0.9204 (2018 high) might still be in progress considering that EUR/CHF is staying well inside the long term falling channel. However, with bullish convergence condition in W MACD, downside potential should be limited in case of another fall. Instead, firm break of 0.9660 resistance will be an important sign of medium term bullish trend reversal.

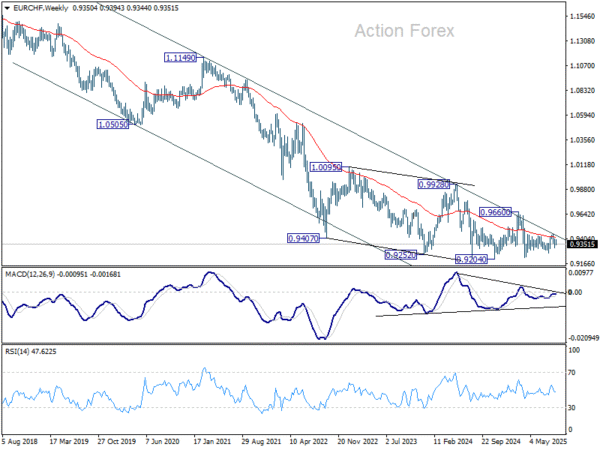

In the long term picture, overall long term down trend is still in progress in EUR/CHF. Outlook will continue to stay bearish as long as 55 M EMA (now at 0.9857) holds.