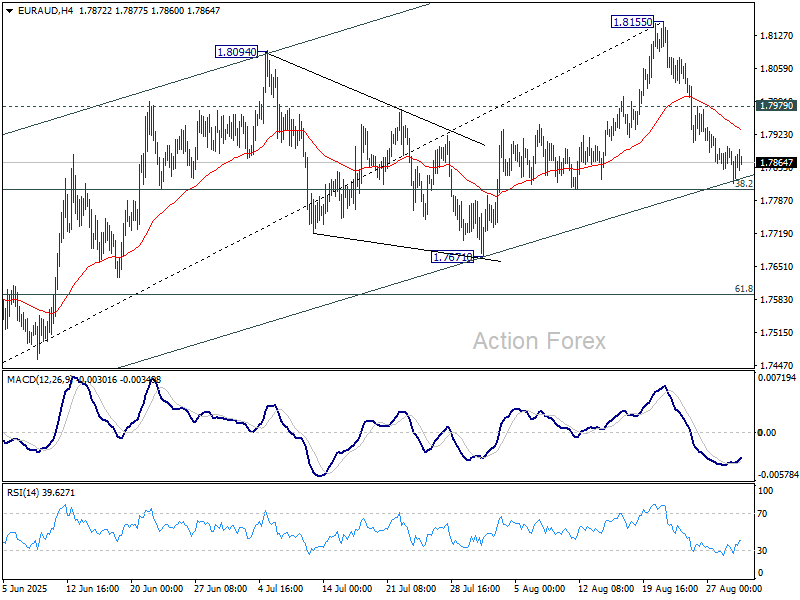

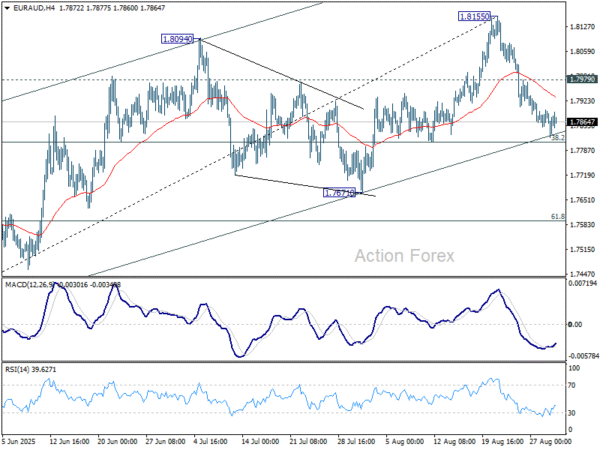

EUR/AUD’s extended decline last week indicates short term topping at 1.8155. But momentum diminished just ahead of 38.2% retracement of 1.7245 to 1.8155 at 1.7807, as seen in 4H MACD. Initial bias is turned neutral this week first. On the downside, sustained break of 1.7807 should confirm that whole rise from 1.7245 has completed. Corrective pattern from 1.8554 should then be in its third leg. Further decline should be seen to 61.8% retracement at 1.7593. On the upside, break of 1.7979 resistance will retain near term bullishness and bring retest of 1.8155 resistance instead.

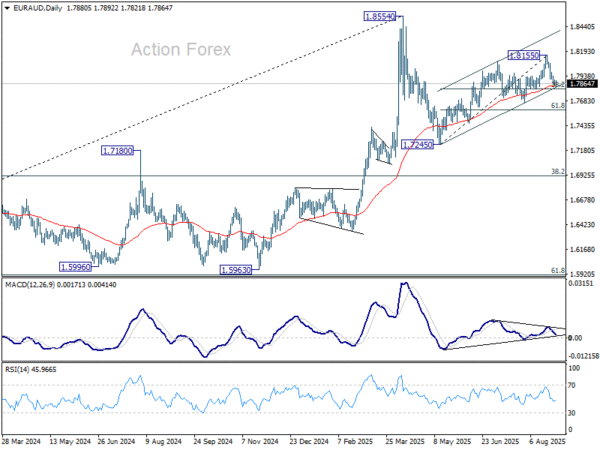

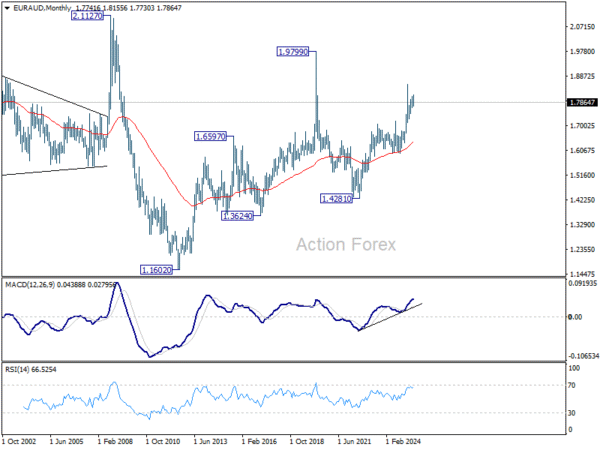

In the bigger picture, price actions from 1.8554 medium term top are seen as a corrective pattern. Such pattern could extend further with another falling leg. But even in that case, downside should be contained by 38.2% retracement of 1.4281 (2022 low) to 1.8554 at 1.6922 to bring rebound. Uptrend from 1.4281 is expected to resume at a later stage.

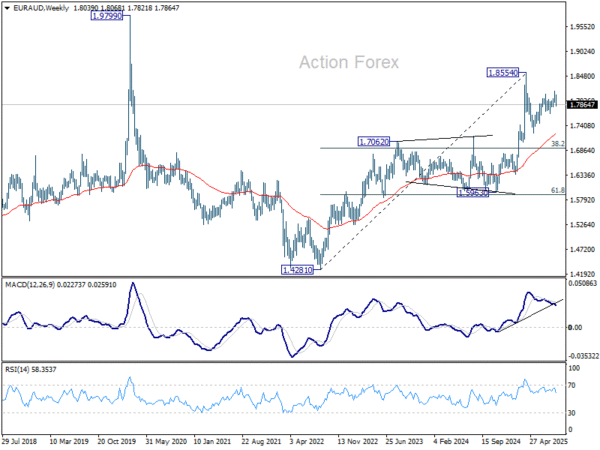

In the longer term picture, rise from 1.4281 is seen as the second leg of the pattern from 1.9799 (2020 high), which is part of the pattern from 2.1127 (2008 high). As long as 55 M EMA (now at 1.6419) holds, this second leg could still extend higher.