Disclosure: This is a paid article. Readers should conduct further research prior to taking any actions. Learn more ›

I. The Consensus Has Arrived: Crypto Belongs to AI Agents

Google recently launched the Agent Payments Protocol (AP2), bringing together crypto heavyweights including Ethereum Foundation, Mysten Labs, and MetaMask.

A clear consensus is crystallizing: cryptocurrency will become the native economic language of AI Agents.

At this critical inflection point, Surge is emerging as the most promising catalyst in the Sui ecosystem.

This paradigm requires three fundamental monetary characteristics: efficiency, global reach, and programmability. Traditional fiat — shackled by centralized clearing and cross-border friction — simply cannot support the millisecond transactions and cross-platform collaboration that AI Agents demand.

What fiat cannot deliver, crypto was built to provide: decentralized settlement, smart contract orchestration and instant payments.

AI gives agents the ability to think. Crypto gives them the ability to transact.

These inherent properties make cryptocurrency the ideal monetary system for AI Agents. From high-frequency algorithmic trading to cross-platform service settlements by personal AI assistants, crypto enables precise value quantification and secure resource transfer at scale.

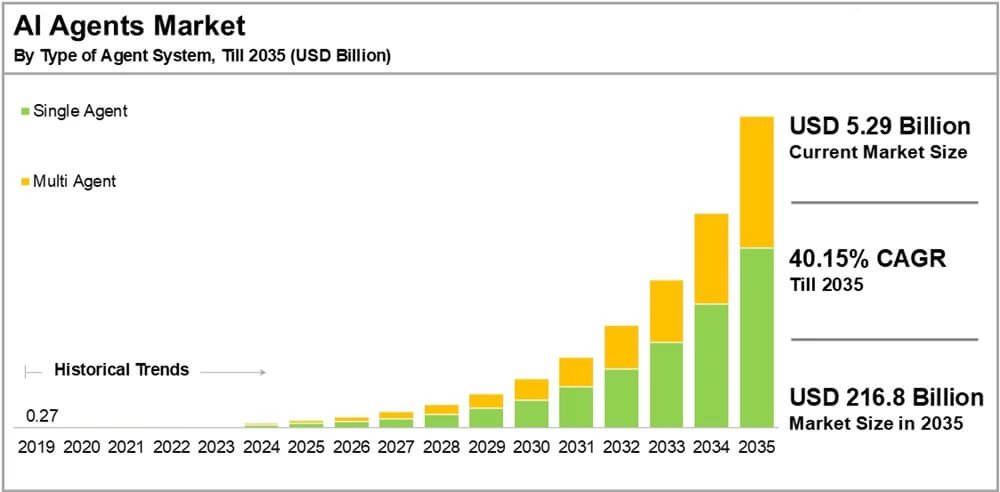

Research firm Type of System projects the AI Agent market will explode from 5.29 billion in 2023 to 216.8 billion by 2035 — a compound annual growth rate exceeding 40%.

We’re standing at an unprecedented threshold.

As Sui’s first AI Agent Launchpad, Surge is fundamentally rethinking how assets launch while incubating genuinely valuable AI projects — providing the critical infrastructure this emerging economy needs.

II. The Problem: Why 90% of AI Projects Die Post-Launch

AI Agent projects face inherent challenges: extended development cycles, steep technical barriers, and lengthy validation periods.

The crypto industry’s broken launch infrastructure compounds these difficulties, pushing promising projects toward failure.

The dysfunction stems from three critical misalignments:

1. Timeline Misalignment: When Fundraising Timelines Kill Product Development

“No matter how strong your tech is, the market won’t give you time to prove it.”

This reality haunts nearly every AI project.

Traditional VC fundraising consumes 6-12 months from initial conversations to capital deployment, forcing AI teams to spend critical bandwidth on investor management rather than product development.

Once funded, teams with unconstrained treasuries often fall into expansion traps — bloating headcount with non-essential hires and burning capital on premature marketing while core algorithm development stalls.

By the time tokens launch, the gap between inflated early valuations and undelivered products becomes impossible to ignore. Community investors walk away. The result is predictable: tokens crash on launch day, and technically sound projects die before reaching product-market fit.

The fun part: “Everything will be clear on TGE”

2. Expertise Misalignment: Brilliant Engineers ≠ Effective GTM in Crypto

AI founders typically excel at algorithm development and product design but lack critical expertise in crypto asset architecture, tokenomics, and community building. Meanwhile, community investors eager for early access to quality AI projects face severe information asymmetry — either missing genuinely innovative teams or becoming exit liquidity for vaporware.

This capability gap prevents strong projects from securing the right support while keeping sophisticated capital on the sidelines.

3. Trust Misalignment: The Transparency Problem in AI Development

AI development’s inherent opacity creates fundamental trust issues. Algorithm progress is difficult to verify. Fund allocation lacks transparency. Performance metrics can be manipulated. Traditional launch models provide no meaningful oversight, widening this trust gap further.

Communities are left with unanswerable questions: Is the team actually shipping? Are funds being deployed effectively? Are there hidden token unlocks? This perpetual uncertainty prevents the formation of long-term conviction.

These compounding misalignments trap quality AI assets in a destructive cycle: short runways, high trust costs, and unrealized value. Surge was built to break this pattern.

III. The Solution: Redefining Asset Launch for Long-Term Success

Surge isn’t just another launchpad — it’s a fundamental redesign of launch incentives.

Through three core mechanisms, it aligns project objectives with community interests, creating a new paradigm for how AI assets launch and grow.

1. FDV Milestone Unlocks: Making Growth the Only Path to Liquidity

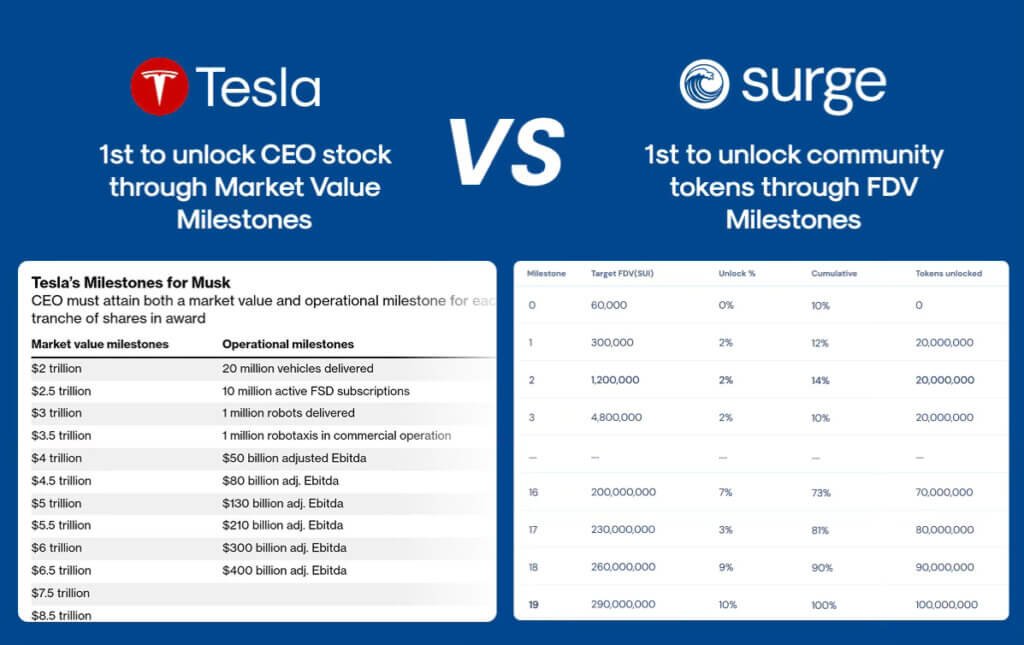

The founding team behind Surge — composed of experienced traders and quantitative analysts with deep backgrounds in both traditional finance and crypto markets — designed Surge Launch v1.0 with a novel approach. Under this model, 90% of insider tokens, including those allocated to teams, advisors, and early investors, remain locked until the project hits specific Fully Diluted Valuation (FDV) targets. The system gates token unlocks behind 19 distinct FDV milestones, which can also include technical achievements like model accuracy thresholds, user growth metrics, or validated use case deployments.

Think of it as Tesla’s performance-based compensation structure for Elon Musk — except implemented on-chain with cryptographic guarantees.

This design eliminates dump-on-launch scenarios entirely. In the early stages, unlock percentages stay minimal, forcing teams to prioritize product development and value creation over token sales. As the project gains genuine traction and FDV grows, unlock ratios gradually increase. This creates a virtuous cycle where project growth drives community gains, which in turn reinforces team incentives. Everyone wins together.

2. Community-Led Fundraising: Transforming Retail From Exit Liquidity to Partners

Surge completely reimagines the VC-dominated fundraising model. AI teams can now access seed funding directly from on-chain communities. This creates benefits on both sides: small teams bypass months of investor roadshows, secure launch capital quickly, and focus entirely on technical execution. Community members, meanwhile, get access to quality projects at seed valuations with returns directly tied to project success.

More importantly, this fundamentally changes the community’s role. Instead of being late-stage exit liquidity, community members become early-stage co-builders. They monitor progress, provide real-world feedback, and help drive product-market fit. The result is a genuine partnership between technical teams and engaged users, rather than builders racing against speculative traders.

3. Trust Infrastructure: Replacing Promises With Consensus

To solve AI development’s black box problem, Surge implements a comprehensive accountability system built around community governance and transparency. All raised funds flow into a community-driven treasury managed through on-chain voting. Community members monitor fund deployment in real-time, with every expense recorded transparently on-chain. This means teams can’t arbitrarily withdraw capital — instead, the community validates spending decisions, ensuring resources align with stated milestones and development priorities.

Simultaneously, all critical project data — development progress, token unlock schedules, and treasury operations — gets recorded on Sui’s blockchain in real-time. Anyone can verify team actions through block explorers at any moment.

This combination of community oversight and transparent operations eliminates the trust vacuum that plagues traditional launches. Every team action leaves verifiable on-chain evidence. Every community dollar has a clear, traceable path. The relationship shifts from adversarial to collaborative.

As Surge put it in an August AMA with industry founders: “Good launches let communities sleep at night.” That is exactly the standard that Surge is building toward.

IV. Why Sui?

If AI Agents will define the next decade’s economy and crypto provides the infrastructure for value transfer, then Sui and Surge together form the engine powering this transformation.

Most people haven’t fully grasped what makes Move’s design philosophy different from Solidity or Rust. By eliminating contract authorization patterns, it makes reentrancy attacks structurally impossible. The asset-first programming model represents genuine first-principles thinking about digital ownership.

Move gives Sui three critical advantages: financial-grade security, throughput in the tens of thousands of transactions per second, and institutional-quality infrastructure. These are precisely what AI Agents need for high-frequency transactions, complex contract execution, and cross-platform collaboration.

The institutional validation tells the story. Circle’s IPO filing revealed Sui as its largest crypto holding. Grayscale has launched dedicated investment products for Walrus and DeepBook. This isn’t hype — it’s sophisticated capital recognizing Sui as the bridge between traditional finance and crypto, creating exactly the foundation that AI Agent deployment requires.

Surge addresses a critical gap in Sui’s ecosystem: AI asset issuance and incubation. But it does more than provide infrastructure — it acts as a quality filter. The FDV milestone system screens for teams truly committed to long-term building. Community co-creation directs targeted resources to the right projects. Transparent trust mechanisms reduce coordination costs across the entire ecosystem.

Here’s the most compelling part: AI assets incubated through Surge integrate seamlessly into Sui’s growing application layer. These assets can participate in DeFi protocols to fund compute purchases for AI agents. They can be staked with AI projects to earn revenue shares. They can serve as settlement tokens enabling autonomous transactions between different agents.

This creates a complete value loop. Assets enable use cases, use cases generate value, and value flows back to assets. This flywheel effect will accelerate AI Agent adoption across Sui.

V. Conclusion

The possibilities are endless. History is being written in real-time.

At the inflection point of AI Agent economics, Surge has evolved beyond mere launch infrastructure. It’s becoming the foundational layer that determines how quality AI assets enter markets, grow sustainably, and deliver lasting value.

The convergence of AI and crypto isn’t speculation — it’s economic restructuring happening right now. Surge enables the complete lifecycle: launch, growth, and value realization for AI assets.

For AI builders: This is your path to escape fundraising theater and focus on technical excellence.

For community investors: This is your entry point into next-generation AI+Web3 value creation.

A new economic layer powered by AI Agents is emerging. The quality assets filtered and incubated through Surge will become the foundational currency of this era.

Build with Sui. Launch with Surge. The convergence is here.

The future starts now.

About Surge: