- ECB likely on hold; markets fully priced for no move.

- Headline inflation path could edge up; expectations ticked to 2.5%.

- Activity improving (PMI > 50); base case remains status quo at a 2% deposit rate.

Baseline for Thursday: hold

The European Central Bank will likely keep interest rates unchanged this Thursday and leave them at their current levels. The setup is favorable: inflation now appears closer to the 2% target than the ECB’s earlier assumptions suggested, and growth prospects are gradually improving. In such conditions, policymakers can feel comfortable with the deposit rate at 2%.

Market pricing and messaging

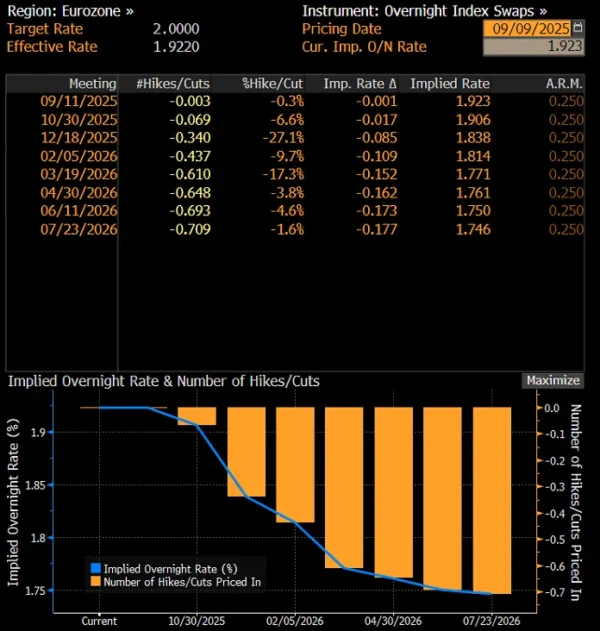

Markets do not expect a cut on Thursday. In a Bloomberg survey, all economists anticipate no change in policy settings, and Overnight Index Swaps likewise price in no move. Talk of further reductions later in the year is kept alive by a few more “dovish” voices on the Governing Council, and Reuters has reported that some internal discussions leave room to revisit cuts. In my view, however, the ECB will concentrate on stabilizing monetary conditions this year and will not make any major changes to policy parameters.

OIS-implied market pricing of the future path of ECB interest rates. Source: Bloomberg.

Inflation path and expectations

It’s not out of the question that the ECB raises its inflation path. The current projection envisages a further slowdown in price dynamics, with a temporary trough at 1.4% in Q1 2026 and a return to 2% in early 2027. An upward revision could stem from forecasts of higher crude oil prices and a higher path for energy costs, which would feed directly into inflation. Household inflation expectations have also ticked up: the median rose to 2.5% (from 2.4% previously). At first glance that’s a small move, but economically it can matter. Remember that household expectations are a key transmission channel over the longer horizon, shaping wage, pricing, and consumption decisions even before actual inflation moves. That’s why central banks work hard to keep 3–5-year expectations firmly anchored near target. In this context, even a small shift in the median from 2.4% to 2.5% may be important—a directional signal that expectations are edging away from target, raising the risk of “de-anchoring.”

Chart showing the ECB main refinancing rate, CPI inflation, and core CPI inflation (year over year). Source: Bloomberg.

Activity is improving: PMI and trade backdrop

Euro-area activity is picking up. The composite PMI has risen for three consecutive months, reaching 51.0—typically a sign of modest recovery over a 3–6-month horizon. The rebound is especially visible in manufacturing, where the subindex recently moved above 50 for the first time in three years. Cautious optimism may reflect better financing conditions, which at least partly offset U.S. trade barriers. The tariff agreement—while implying higher duties than before—reduces trade-policy uncertainty. President Christine Lagarde has emphasized that the tariff level is “close to the June assumptions.”

PMI indicators for the euro-area economy. Source: Bloomberg.

What to expect on Thursday

We may see a slight upward revision to the GDP growth projection for Q3 and, by extension, for the full year, alongside a modest lift in the headline inflation path toward target. The core inflation projection will likely stay broadly unchanged and continue converging to 2%. This picture offers no compelling case for rapid easing or renewed tightening. The most coherent strategy is to maintain the status quo—watch the data—and run policy at a level the ECB is comfortable with, i.e., a 2% deposit rate.