- ECB decided to leave the policy rate unchanged at 2.00% at today’s meeting as fully expected by both markets and analyst.

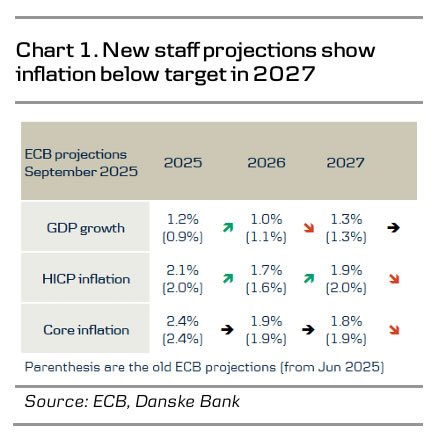

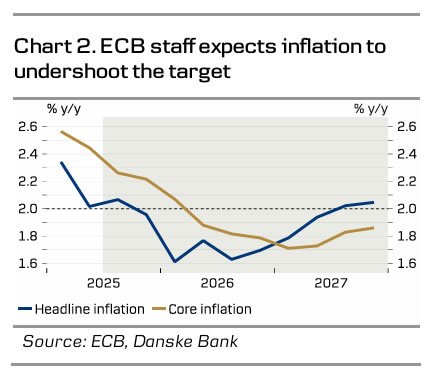

- The staff projections featured a dovish twist as the inflation forecast for 2027 was lowered to 1.9% y/y (from 2.0% y/y) and core inflation to 1.8% (from 1.9%).

- Lagarde downplayed the revisions to inflation and said the growth outlook was balanced for the first time since September 2023 leading to an overall hawkish market reaction.

- We do not expect any policy rate changes from the ECB in 2025 or 2026.

As widely expected, the ECB decided to keep the policy rates unchanged at today’s meeting, leaving the deposit rate at 2.00%. The most significant information from the meeting was the new staff projections that lowered the core inflation forecast for 2027 to 1.8% y/y (from 1.9%) and headline to 1.9% y/y (from 2.0%). The forecast for 2027 should be seen as “medium-term inflation” since it is mainly affected by monetary policy and not temporary factors such as swings in global commodity prices. Following an initial dovish market reaction to the new projections, Lagarde struck a hawkish tone at the press conference, fully erasing the previous move. She downplayed the downward revision to the inflation forecast noting that this was primarily due to a stronger euro and that the deviation from 2% was minor. Moreover, the GC now sees the risks to the growth outlook as being balanced after having highlighted downside risks to growth since September 2023. In our view, this adds to the hawkish arguments for the ECB being on hold as they are more confident in the outlook. The risk of a final cut remains as the ECB could be surprised on the downside by data, particularly if domestic demand does not evolve as expected, although this is not our base case.

Otherwise, the staff projections showed a growth forecast that was revised up for 2025 to 1.2% y/y (from 0.9%) due to better-than-expected growth in the first half of the year while the expectation was unchanged for 2027. Core inflation was unchanged in 2025 and 2026 and headline slightly higher in 2025 at 2.1% (from 2.0%) due to previous inflation being higher than expected. Hence, the upward revision in 2025 was expected due to previous data while the downward inflation revision in 2027 came as a surprise. Lastly, the ECB repeated the previous guidance that the GC will “follow a data-dependent and meeting-by-meeting approach to determining the appropriate monetary policy stance“.

We keep our call that the ECB will not make any policy rate changes in 2025 or 2026. With growth holding up better than expected core inflation above the 2% target due to sticky wage growth, and the outlook for fiscal easing in 2026 we do not expect the ECB to deliver a final cut in the coming six months, contrary to market expectations. At the same time, we believe hikes in 2026 are premature due to inflation most likely being below target by then and the German economy having sufficiently room to increase production without fuelling inflation.