The European Central Bank (ECB) kept its deposit rate unchanged at 2.00% on Thursday, marking the second consecutive pause after eight cuts since June 2024.

The unanimous decision came as inflation hovers around the bank’s 2% target and economic risks appear more balanced following recent trade agreements.

Key Takeaways

- ECB held all three key rates unchanged: deposit rate at 2.00%, main refinancing at 2.15%, marginal lending at 2.40%

- Decision was unanimous, marking second consecutive pause after eight cuts since June 2024

-

Inflation projections: 2.1% in 2025 (up from 2.0%), 1.7% in 2026 (up from 1.6%), 1.9% in 2027 (down from 2.0%)

- Core inflation forecast: 2.4% in 2025, 1.9% in 2026, 1.8% in 2027

- Growth projections: 1.2% in 2025 (up from 0.9%), 1.0% in 2026 (slightly lower), 1.3% in 2027 (unchanged)

- Lagarde: “The disinflationary process is over,” and ECB remains “in a good place.”

- ECB maintains data-dependent, meeting-by-meeting approach with no pre-commitment to rate path

- Growth risks are now “more balanced” with trade uncertainty “clearly diminished” after trade agreements

Link to European Central Bank Statement (September 2025)

In her presser, ECB President Christine Lagarde delivered hawkish messaging, declaring that “the disinflationary process is over” and reiterating that the ECB continues to be “in a good place” with inflation sitting at their 2% target.

Most significantly, she characterized risks to economic growth as “more balanced” than before, while noting that trade uncertainty has “clearly diminished” following recent EU-U.S. trade agreements that set 15% tariffs on most goods.

Despite this, Lagarde continued to emphasize that the ECB will “follow a data-dependent and meeting-by-meeting approach” to determining policy, explicitly stating they’re “not pre-committing to a particular rate path.”

The ECB’s updated projections showed mixed signals, raising 2025 inflation to 2.1% while cutting the 2027 forecast to 1.9%, which is below their 2% target. However, Lagarde downplayed this undershoot, stating that “minimal deviations” wouldn’t necessarily justify policy action. Growth forecasts were upgraded to 1.2% for 2025, though 2026 was trimmed to 1.0%.

Link to ECB Press Conference (September 2025)

Market Reactions

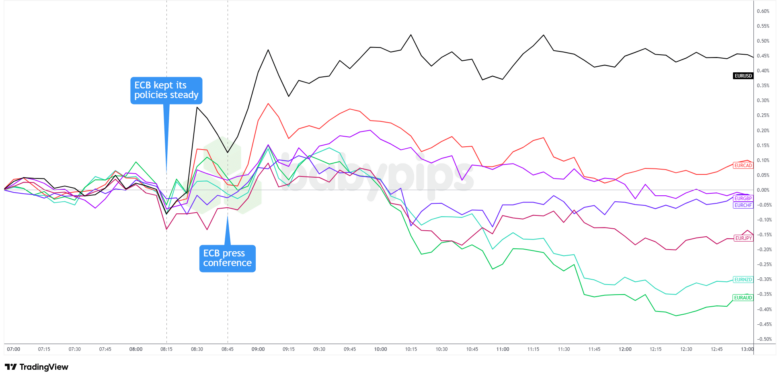

Euro vs. Major Currencies: 5-min

Overlay of EUR vs. Major Currencies Chart by TradingView

The euro saw increased volatility before the ECB decision, likely as traders positioned ahead of the closely-watched U.S. CPI report. EUR initially weakened following the rate announcement, but quickly reversed higher as soft U.S. jobless claims data weighed on the dollar, boosting the shared currency against major counterparts.

The euro extended gains through Lagarde’s press conference, with traders scaling back rate-cut expectations. Markets now price less than 50% odds of another ECB cut through June 2026, down from 60% pre-meeting. However, the rally faded hours before the London close when risk appetite surged, dragging EUR lower against commodity currencies and Sterling even as it maintained gains versus safe havens.

The euro finished mixed – higher against USD, JPY, and CAD but lower against CHF, AUD, NZD, and GBP – reflecting its middle-ground status between safe havens and risk-sensitive currencies in the shifting market environment.