Traders are getting back to their desks after a prolonged weekend – Both the United States and Canada were celebrating Labor Day yesterday.

The week prior to Labor Day tends to see slower movement and thinner volumes and despite recent volatility, this year was not an exception.

Rangebound conditions have dominated currency markets since Powell’s change of tone which shook up rate expectations for the FED – The upcoming Federal Reserve meeting, coming up on September 18, is close to a promised cut (90% of a 25 bps cut priced in).

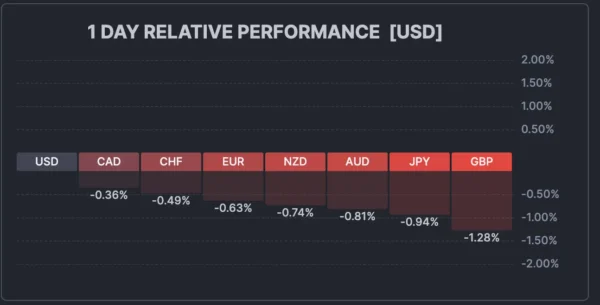

Volatility is now back on its feet to kick off the month.

With the UK Government bonds opening the week with fresh concerns, a huge selloff in Gilts is leading another rout in the Bond market – With the GBP hurting at the same time.

These concerns combined with a failure from bears to push the Greenback below its prior week range, and rising geopolitical tension around the globe are hurting sentiment.

US Index futures (pre-open for Equities) are in the red and cryptocurrencies attempted a rebound which got rejected – The US Dollar on the other hand is shining.

A past week Dollar Index analysis had emitted the hypothesis that bears had the fundamentals to take control of the action, but their hesitancy paints another picture.

Is a longer-run rebound close?

We’ll take a look at that right now.

An overlook at the daily picture in the FX Market

FX Market overview – September 2, 2025 – Source: Finviz

Dollar Index technical outlook

DXY Daily chart

Dollar Index Daily chart, September 2, 2025 – Source: TradingView

The US Dollar is putting up a strong bull candle ahead of today’s ISM US Manufacturing report (coming up at 10:00 A.M.)

Despite the current data having the potential to influence the current flows, it seems that currency markets are more looking at US bond yields that are strengthening while Index futures are weakening – this underpins the USD.

Hanging around the higher timeframe 98.00 Pivot zone, the rebound is exacerbated by hesitant USD sellers – with bets on a lower dollar increasing since Jackson Hole, you can expect a failed move to see reversals like the one from today.

RSI is still neutral but rising, however one thing to keep in mind is that the Friday Non-Farm Payrolls report will have the most influence on the future price action for all markets and particularly in the US.

DXY 4H chart

Dollar Index 4H chart, September 2, 2025 – Source: TradingView

Looking closer to the 4H Chart, it seems that rangebound conditions still have a high possibility of holding – As I write this piece, mean-reversion USD sellers have appeared at the upper bound of the prior week range.

Held in a range between 97.60 lows to around 98.80 since the 11th of August, participants have tried without success to provide meaningful direction to the Greenback.

As always, the Non-Farm Payrolls report is making every participants hold their breath.

Levels to watch for the Dollar Index (DXY):

Support Levels:

- 98.00 Pivot (key for immediate momentum, immediate support)

- Lower bound of the upward channel 97.60 to 97.80

- 2025 Lows Major support 96.50 to 97.00

Resistance Levels:

- US Dollar range Highs 98.82

- 98.50 to 98.80 Resistance Zone

- Mid-line of the ascending channel and psychological level 99.50

- 100.00 Main resistance zone

Dollar Index 1H chart

Dollar Index 1H chart, September 2, 2025 – Source: TradingView

It will be interesting to spot if players want to prolong the already extensive moves in FX after the upcoming US ISM Manufacturing report.

Don’t forget to log in for our headline piece.

Safe Trades and successful week!