All attention is on U.S. non-farm payrolls today, with markets bracing for heightened volatility. Consensus expectations point to job growth of 78k in August, an uptick in the unemployment rate to 4.3%, and average hourly earnings at 0.3% mom. Risks appear skewed to the downside for Dollar, with potentially larger reaction if the data disappoints.

While some policymakers, including Chicago Fed President Austan Goolsbee, remain undecided, the broader consensus is that the Fed will cut rates by 25 bps later this month. A slightly stronger-than-expected NFP print could temper expectations for additional easing but is unlikely to derail the September cut.

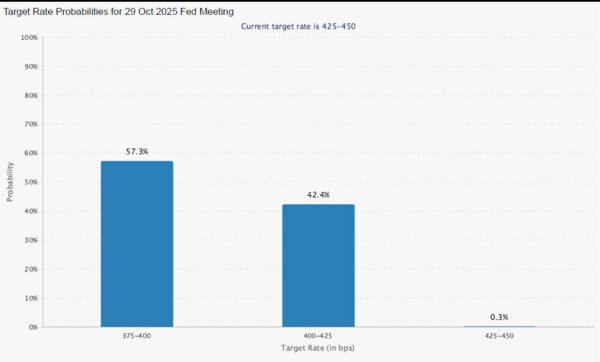

In fact, a robust report would most likely reduce odds of a follow-up move in October, currently priced at just above 50%. Any Dollar bounce on strong payrolls may prove temporary, as the Fed remains on a path toward lower rates, albeit at a slower pace.

Conversely, a weaker-than-expected report could spark fears that the Fed is already falling behind the curve. In such a scenario, traders may begin to price in the possibility of a 50 bps cut this month—currently given a zero chance—or boost bets on back-to-back cuts in October and December. That would almost certainly trigger renewed dollar selling.

Supporting the downside risk narrative, recent labor indicators have softened. The ISM services employment subindex held at 46.5, while manufacturing employment edged only slightly higher to 43.8. The ADP private payrolls report showed just 54k new jobs in August, down sharply from 106k in July. Initial jobless claims have also trended higher, with the four-week average rising to 231k from 221k.

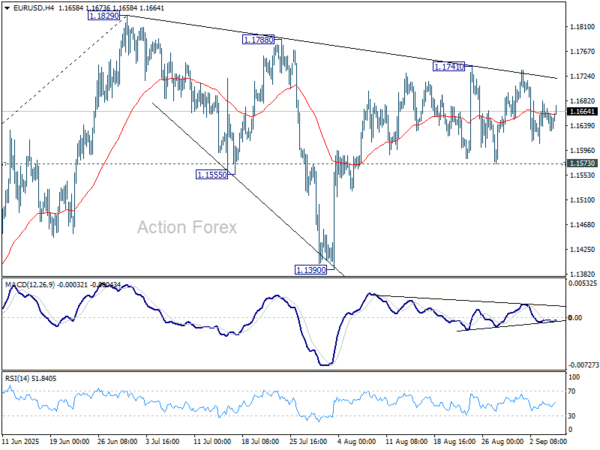

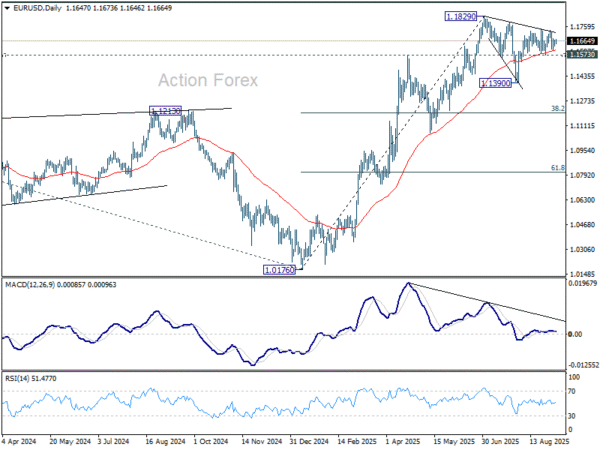

For EUR/USD, technicals reinforce the potential for Dollar weakness. The pair remains supported by its 55 Day EMA, consolidating between 1.1573 and 1.1741. Break above 1.1741 would pave the way toward 1.1829to resume the larger up trend from 1.0176.

Alternatively, a break below 1.1573 would extend the corrective pattern from 1.1829 with another falling leg back towards 1.1390 support. Uptrend resumption is only delayed in this case.