The past week in global markets has been anything but routine. What began as cautious positioning around economic data turned into a full-scale rethink of Fed policy and global growth prospects. Currency traders, bond investors, and equity markets were all forced to adjust as the numbers told a weaker story than anyone hoped for.

At the center of it all stood the U.S. jobs report. Instead of offering reassurance that the economy was holding up, the data marked another blow to confidence. For the Federal Reserve, the message was unmistakable: easing is no longer optional but necessary. Futures markets responded instantly, pushing expectations for multiple rate cuts further into the year.

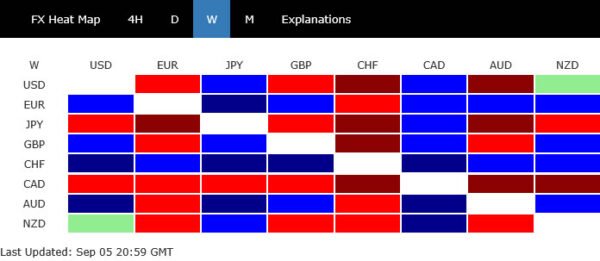

Currency markets captured the story vividly. The dollar’s slide reshuffled the performance table, sending Swiss Franc and Euro to the top while leaving Loonie and Yen at the bottom. Domestic themes added another layer — from Canada’s disappointing jobs to Britain’s fiscal woes — but the common thread was that Dollar weakness magnified all other moves.

In equities, the tug of war between policy relief and growth concerns grew more intense. Optimism over easier Fed conditions helped push benchmarks to new records intraday, but those gains quickly faded. Investors seem less willing to buy the promise of liquidity when the economic foundation looks increasingly fragile.

Gold, however, thrived in the uncertainty. With Dollar under pressure and real yields tumbling, the metal surged to record levels, positioning itself as the standout performer of the week. The move toward the 4000 psychological mark no longer looks distant, and safe-haven demand is clearly back in play.

Labor Cracks Widen; Market Leans Toward Back-to-Back Fed Cuts

The US August jobs report delivered another shockingly weak print, setting Fed-easing expectations firmer than at any point this year. Non-farm payrolls rose just 22k, well below the modest 78k consensus, while the jobless rate ticked up to 4.3%, a near four-year high.

Beneath the headline, the revision story was arguably more damaging for sentiment. June was marked down to -13k, the first monthly job loss since the pandemic, while July was nudged up to 79k—hardly a meaningful rebound when paired with August’s soft gain.

Taken together, the data argue that the labor market is cooling faster than Fed officials anticipated. The narrative has shifted from “soft landing” toward “insurance required,” with growing pressure on policymakers to provide timely support.

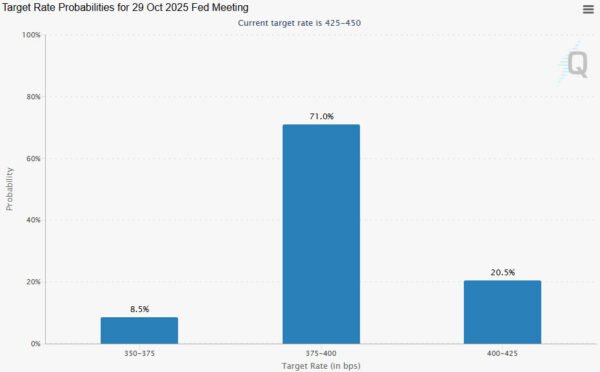

Rates markets moved quickly. Fed funds futures now fully price a 25bp cut at this month’s FOMC, with about 11% odds attached to a 50bp move. If next week’s core CPI slows unexpectedly, the probability of a jumbo cut would likely rise further.

Importantly, the market isn’t stopping at September. Odds of a back-to-back 25bp reduction in October have climbed to around 80%, reflecting the view that the Fed is behind the curve and must catch up if labor slack widens.

That makes the September SEP and dot plot pivotal. The question is whether the median still implies two cuts for 2025—or shifts toward three—and how far officials mark down growth and the longer-run policy rate.

Politics adds another wrinkle. The White House has reportedly shortlisted Kevin Hassett, Kevin Warsh, and Christopher Waller to succeed Chair Powell; all three align with the administration’s pro-easing agenda, reinforcing the market’s conviction that policy will turn looser.

With the policy debate reframed, attention now turns to market transmission—Treasury yields and Dollar will tell us how quickly easier policy gets priced.

10-Year Yield Slides Below 4.1%, Dollar at Risk of Deeper Fall

The reaction in Treasuries was swift and decisive after the weak payrolls. 10-year yield plunged through the 4.1 threshold to close at 4.086, marking its lowest levels in months. Traders rushed into bonds on bets that the Fed will move faster and harder to counter cooling labor demand.

Technically, 10-year yield is hovering near the bottom of its near term falling channel, with 4.000 handle also acting as psychological support. Stabilization may occur around current levels, but the near term outlook will stay bearish as long as 4.205 support-turned-resistance holds.

Sustained break below 4.000—particularly if accompanied by dovish Fed projections at the September meeting—could accelerate the slide. Next target is 161.8% projection of 4.629 to 4.205 from 4.493 at 3.807, which is slightly below 3.886 structural support.

The medium-term backdrop also leans negative with rejection by 55 W EMA (now at 4.300). Fall from 4.809 could be seen as the third leg of the corrective pattern from 4.997 (2023 high). This implies scope for further losses through 3.603 to 38.2% retracement of 0.398 (2020 low) to 4.997 at 3.240 in the medium term, before finding a bottom.

Meanwhile, Dollar’s selloff wasn’t catastrophic, as Dollar Index closed the week at 97.76, well above the July low at 96.37. But the index is clearly under pressure after multiple rejections at 55 D EMA (now at 98.40). Deeper fall is mildly in favor to retest on 96.37 in the near term. Whether that level holds may depend heavily on the Fed’s updated projections.

Upside recovery, meanwhile, looks limited. A break above 98.83 would extend the corrective structure off 96.37, but gains would likely stall beneath 100.25 resistance.

For the longer term picture, Dollar Index continues to hover slightly above long-term channel bottom that has defined the uptrend since 2008, now sitting around 96.0. Sustained break of the channel would open up deeper down trend to 61.8% retracement of 70.69 (2008 low) to 114.77 (2022 high) at 87.52.

Stocks Struggle Despite Fed Easing Bets

US equities gave back early gains on Friday, with DOW, S&P 500, and NASDAQ all finishing lower despite briefly touching record intraday levels. The pullback highlights investor unease that Fed easing may not fully insulate earnings from a slowing labor market and rising tariff pressures.

For equity bulls, the question is no longer whether the Fed will cut, but whether those cuts will arrive fast enough to cushion corporate profits.

Technical signals continues suggest fatigue after recent record runs. S&P 500 is losing momentum as reflected in D MACD. The index also struggles to break decisively above 61.8% projection of 3491.58 to 6147.43 from 4835.04 at 6476.35.

The market is also running into the ceiling of its long-term rising channel, currently near 6690, further restraining bullish momentum. Even if stocks attempt another leg higher, the path looks constrained.

On the downside, break of 6360.58 support could trigger profit-taking and accelerate a correction. Sustained fall below the 55 D EMA (now at 6304.35) would confirm a medium-term correction, with risks extending toward 55 W EMA (now at 5877.73).

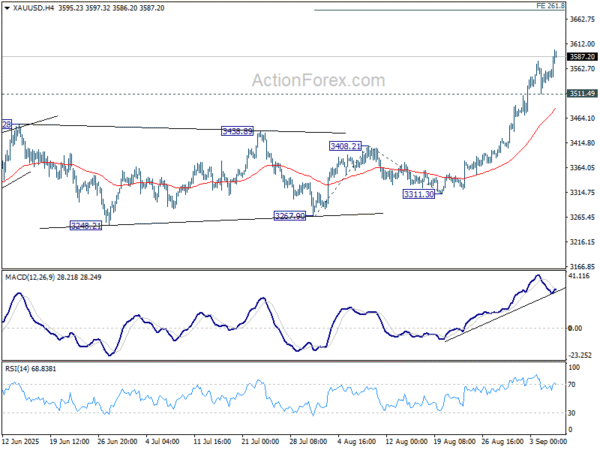

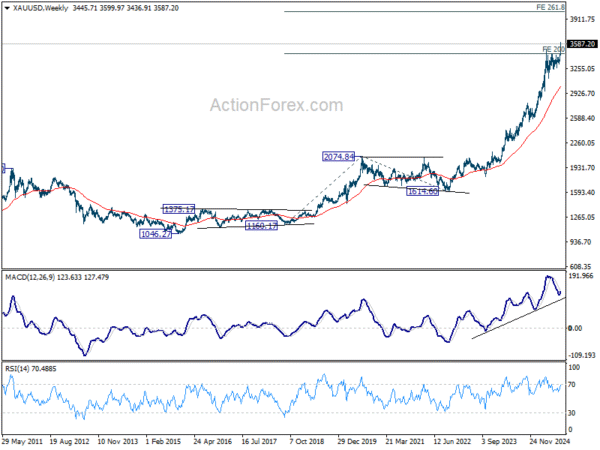

Gold Surges to Record, Eyes 4000 Next

Gold’s reaction to NFP was much more clear-cut. While there was brief intraweek retreat, Gold quickly jumps after after the data and closed at new record high. For the near term, outlook will now stay bullish as long as 3511.49 support holds. Next target is 261.8% projection of 3267.90 to 3408.21 from 3311.30 at 3678.63.

More importantly, Gold has now taken out 200% projection of 1160.17 to 2704.87 from 1614.60 at 3443.94 decisively. The current up trend would now be targeting 261.8% projection at 4009.20, which is close 4000 psychological level, in the medium term.

EUR/USD Weekly Outlook

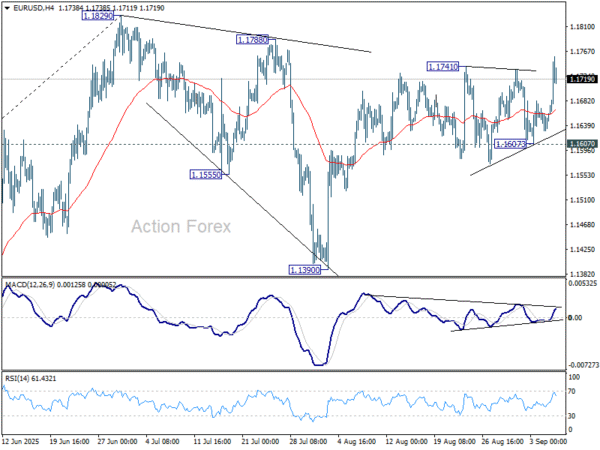

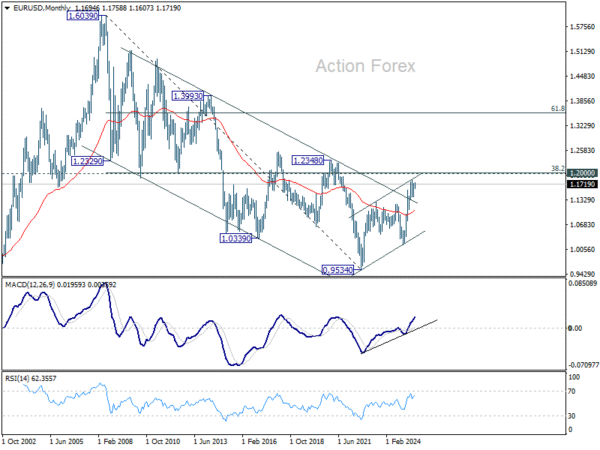

EUR/USD’s rise from 1.1390 resumed late last week by breaching 1.1741. The development aligns with the case that correction from 1.1829 has completed with three waves down to 1.1390. Initial bias is now on the upside this week for retesting 1.1829 first. Firm break there will resume larger up trend. For now, risk will stay on the upside as long as 1.1607 support holds, in case of retreat.

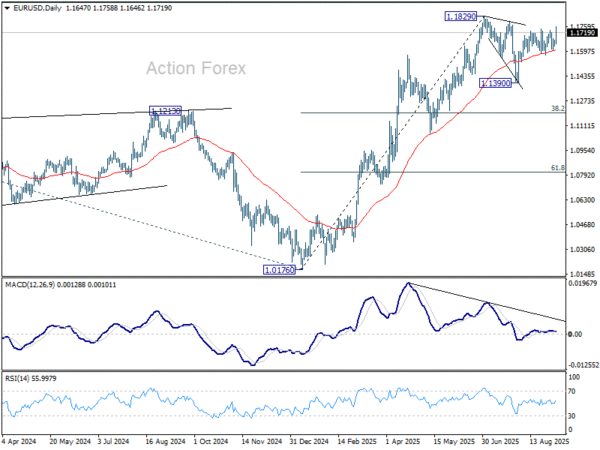

In the bigger picture, rise from 0.9534 (2022 low) long term bottom could be correcting the multi-decade downtrend or the start of a long term up trend. In either case, further rise should be seen to 100% projection of 0.9534 to 1.1274 from 1.0176 at 1.1916. This will remain the favored case as long as 1.1604 support holds.

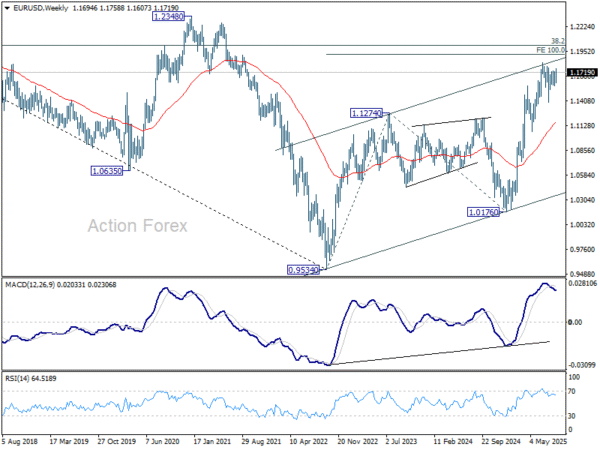

In the long term picture, a long term bottom was in place already at 0.9534, on bullish convergence condition in M MACD. Further rise should be seen to 38.2% retracement of 1.6039 (2008 high) to 0.9534 at 1.2019. Rejection by 1.2019 will keep the price actions from 0.9534 as a corrective pattern. But sustained break of 1.2019 will suggest long term bullish trend reversal, and target 61.8% retracement at 1.3554.