The major assets were a mixed bag on Tuesday as traders juggled weak jobs data, geopolitical tensions, and shifting rate cut expectations.

Stocks rose and gold hit fresh records before easing back, while the dollar staged a late rebound.

Check out the headlines and economic updates you may have missed in the latest trading sessions!

Headlines:

- New Zealand Manufacturing Sales for Q2 2025: -0.6% y/y (4.5% y/y forecast; 10.0% y/y previous)

- Chinese yuan hits 10-month high against dollar amid Fed rate cut expectations and strongest PBOC midpoint setting since November

- Japan LDP to hold full-scale Presidential election after Ishiba resignation

- Russia strikes eastern Ukraine village, killing at least 24, in latest aerial strike

- U.K. BRC Retail Sales Monitor for August: 2.9% y/y (1.6% y/y forecast; 1.8% y/y previous)

- Australia Westpac Consumer Confidence Index for September: 95.4 (99.4 forecast; 98.5 previous)

- Australia NAB Business Confidence for August: 4.0 (8.0 forecast; 7.0 previous)

- Japan Machine Tool Orders for August: 8.1% y/y (3.9% y/y forecast; 3.6% y/y previous)

- France Industrial Production for July: -1.1% m/m (-1.8% m/m forecast; 3.8% m/m previous)

- U.S. NFIB Business Optimism Index for August: 100.8 (100.7 forecast; 100.3 previous)

- U.S. BLS revision shows annual hiring was overstated by 911,000 jobs in the 12 months through March (vs. -682K expected)

- US Treasury Secretary Bessent said the Fed is “choking off growth with high rates” after BLS revision

- EIA expects oil prices to weaken through Q1 2026 as supply exceeds demand

- French President Macron appoints Defense Minister Sébastien Lecornu as new Prime Minister

Broad Market Price Action:

The major assets were all over the charts on Tuesday as markets navigated a complex backdrop of weak labor data and geopolitical tensions.

European stocks closed mixed as traders positioned ahead of the ECB meeting while digesting corporate developments. The DAX fell 0.37% amid broader caution, while the CAC 40 managed modest gains of 0.19% and the FTSE outperformed with a 0.23% advance, boosted by a 9% surge in Anglo American following its $50 billion merger announcement with Teck Resources.

Wall Street shrugged off the historic 911,000 downward revision to payrolls data, with all three major indices hitting fresh record highs. The S&P 500 climbed 0.27% as traders solidified expectations for Fed rate cuts. Japanese markets also celebrated, with the Nikkei hitting another record high following PM Ishiba’s resignation announcement.

Gold hit fresh record territory above $3,674 but closed lower at $3,628 as USD demand improved during the US session, partially offsetting earlier safe-haven flows from Middle East tensions. The 10-year Treasury yield rose 2.8 basis points to 4.08%, likely as bond traders took profits ahead of the U.S. inflation data.

WTI crude oil gained 0.6% following an Israeli attack in Qatar, while expectations of Russia sanctions and OPEC’s smaller-than-anticipated 137,000 bpd output increase provided additional support. Bitcoin declined 0.6% to $111,400, showing relative weakness despite broader risk-on sentiment.

FX Market Behavior: U.S. Dollar vs. Majors:

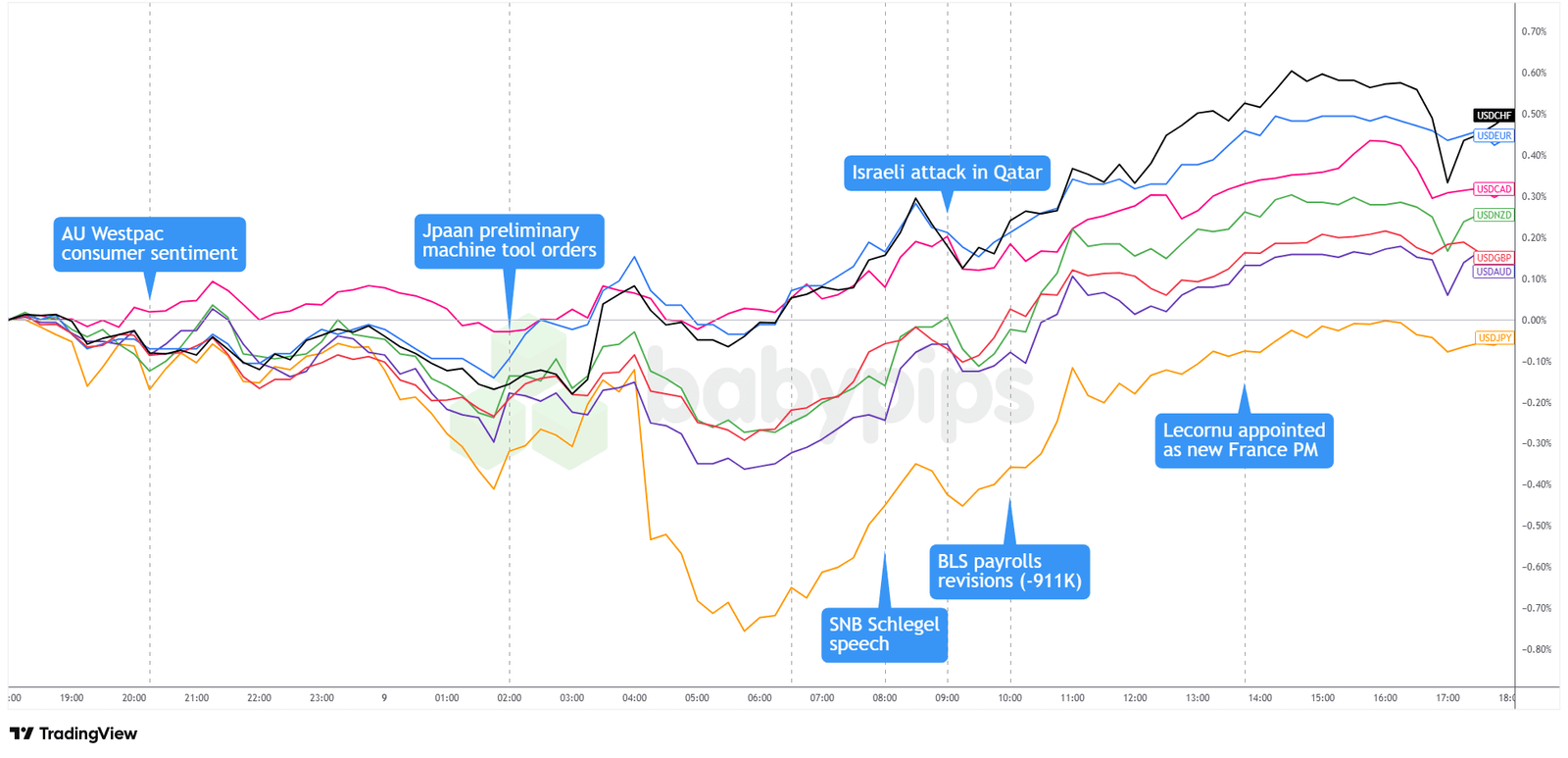

Overlay of USD vs. Majors Chart by TradingView

The U.S. Dollar experienced a volatile session against major currencies, starting on weak footing as Asian traders celebrated the Nikkei hitting fresh record highs and the Chinese yuan reaching 2025 spot market highs amid growing Fed rate cut expectations.

Early weakness persisted into the London session as markets digested overnight developments. However, momentum began shifting mid-session as Israel’s attack in Qatar sparked safe-haven demand and traders positioned ahead of key ECB decisions and Wednesday’s crucial US CPI data.

The dollar’s recovery accelerated during the US session despite the historic 911,000 BLS payrolls revision released during U.S. session. As 10-year Treasury yields surged and safe-haven flows provided unexpected support, the currency showed resilience. Markets had been braced for even worse employment data, with the initial 20-pip drop on the revision headlines quickly reversing as geopolitical tensions dominated sentiment.

By session close, the dollar had recovered against most majors except the Japanese yen, which benefited from its own safe-haven appeal and speculation about potential BOJ rate hikes following Prime Minister Ishiba’s resignation announcement.

Upcoming Potential Catalysts on the Economic Calendar

- U.S. API Crude Oil Stock Change for September 5, 2025 at 8:30 pm GMT

- New Zealand Visitor Arrivals for July at 10:45 pm GMT

- China CPI & PPI growth rates for August at 1:30 am GMT

- Swiss SNB Schlegel Speech at 11:45 am GMT

- U.S. PPI Growth Rate for August at 12:30 pm GMT

- U.S. EIA Crude Oil Stocks Change for September 5, 2025 at 2:30 pm GMT

- Japan Reuters Tankan Index for September at 11:00 pm GMT

- U.K. RICS House Price Balance for August at 11:01 pm GMT

- Japan PPI Growth Rate for August at 11:50 pm GMT

- Japan BSI Large Manufacturing for September 30, 2025 at 11:50 pm GMT

Markets may tread cautiously in London as traders position around China’s inflation data and SNB policy remarks.

In the U.S. session, PPI and oil stock reports could guide Fed expectations and energy-linked currencies, setting the tone before awaited U.S. CPI reports later this week.

As always, look out for global trade developments and geopolitical headlines that could influence overall market sentiment. Stay nimble and don’t forget to check out our Forex Correlation Calculator when taking any trades!