The major assets flipped into risk-on mode after weak U.S. jobless claims overshadowed hotter CPI numbers, sealing in Fed cut expectations.

Equities rallied to record highs, bond yields slipped, and the dollar tumbled as traders priced a more aggressive easing cycle from the Fed.

Check out the headlines and economic updates you may have missed in the latest trading sessions!

Headlines:

- New Zealand Manufacturing Sales for Q2 2025: -0.6% y/y (4.5% y/y forecast; 10.0% y/y previous)

- U.K. BRC Retail Sales Monitor for August: 2.9% y/y (1.6% y/y forecast; 1.8% y/y previous)

- U.S. API Crude Oil Stock Change for September 5, 2025: 1.25M (0.62M previous)

- New Zealand Visitor Arrivals for July: 6.6% y/y (2.5% y/y forecast; 0.8% previous)

- U.K. RICS House Price Balance for August: -19.0% (-13.0% forecast; -13.0% previous)

- Japan BSI Large Manufacturing for September 30, 2025: 3.8% q/q (3.5% q/q forecast; -4.8% q/q previous)

- Japan Producer Price Index Growth Rate for August: -0.2% m/m (0.1% m/m forecast; 0.2% m/m previous); 2.7% y/y (2.8% y/y forecast; 2.6% y/y previous)

- Australia Consumer Inflation Expectations for September: 4.7% (3.9% forecast; 3.9% previous)

- International Energy Agency (IEA) sees higher oil surplus in 2025 after latest OPEC+ production hike

- Euro Area ECB Interest Rate Decision for September 11, 2025: 2.15% (2.15% forecast; 2.15% previous)

- U.S. Initial Jobless Claims for September 6, 2025: 263.0k (240.0k forecast; 237.0k previous)

-

U.S. Consumer Price Index for August: 0.4% m/m (0.3% m/m forecast; 0.2% m/m previous); 2.9% y/y (2.8% y/y forecast; 2.7% previous)

- U.S. Core Consumer Price Index for August: 3.1% y/y (3.1% y/y forecast; 3.1% y/y previous); 0.3% m/m (0.3% m/m forecast; 0.3% m/m previous)

- ECB President Christine Lagarde said they’re “in a good place,” but stressed a data-dependent, meeting-by-meeting approach, without committing to a rate path

- IMF said the Fed has scope to “cautiously” begin lowering interest rates

- US President Trump asked a federal appeals court to pause the block against firing FOMC member Cook

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

The major assets saw a risk-on pivot on Thursday as unexpectedly weak U.S. labor market data overshadowed slightly elevated inflation readings, cementing Fed rate cut expectations and propelling major U.S. equity indices to fresh record highs.

The catalyst emerged when initial jobless claims surged to 263,000, the highest since October 2021, creating sufficient dovish momentum to drive the S&P 500 up 0.9% while the Dow Jones surged 1.4%. Japan’s Nikkei continued its remarkable run, climbing 1.1% to another record high as regional optimism spread. European equities responded positively to the ECB’s steady policy stance, with major indices gaining 0.3-0.8% as President Lagarde maintained balanced rhetoric.

Treasury yields reflected the easing narrative, with the 10-year briefly breaching below 4.00% before settling at 4.02%. Gold paradoxically edged lower to $3,635 despite the dovish Fed backdrop, while bitcoin remained resilient near $114,500. WTI crude tumbled 2% to $62.30 as the International Energy Agency raised supply forecasts, overshadowing any demand optimism from potential rate cuts.

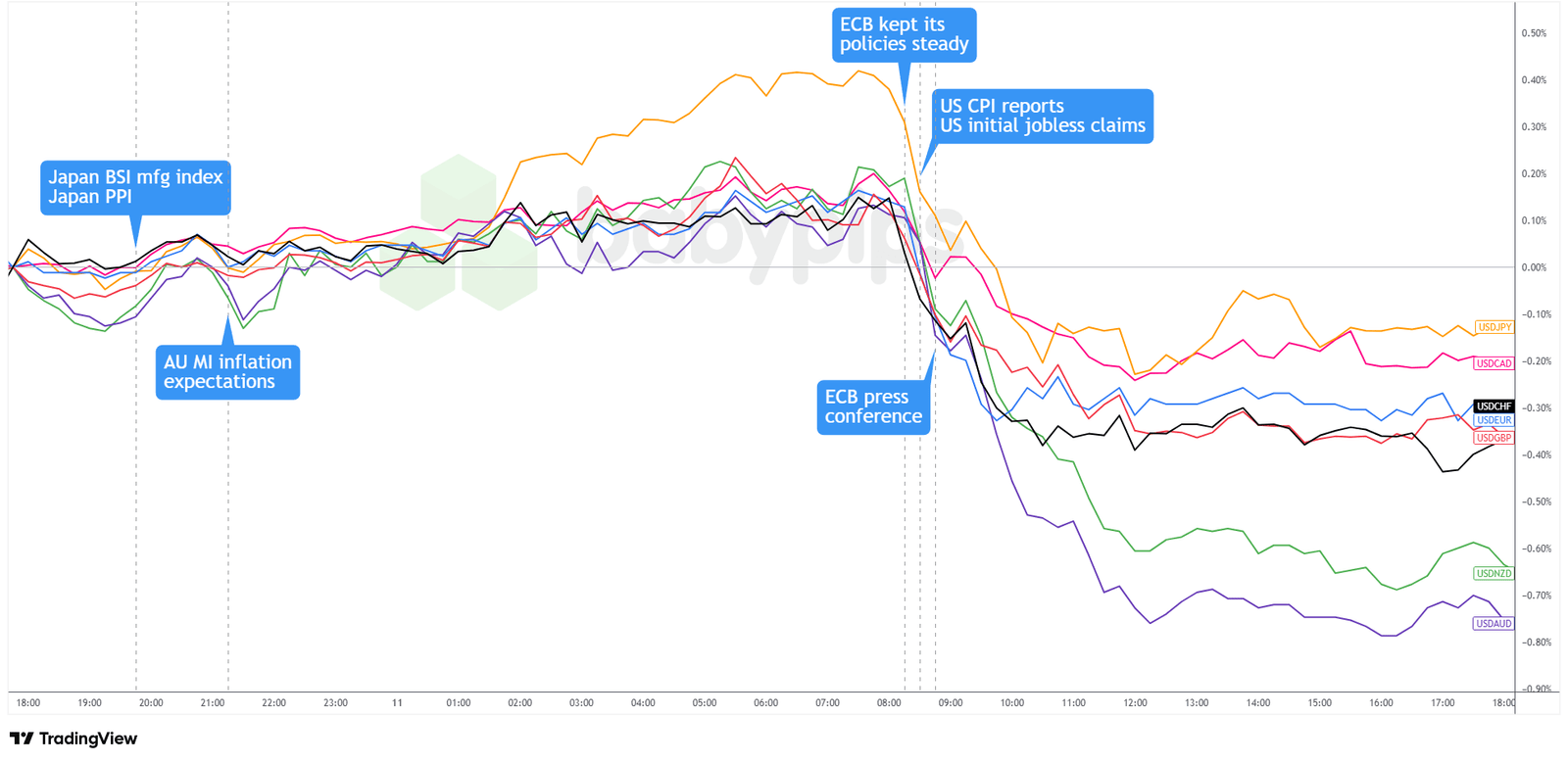

FX Market Behavior: U.S. Dollar vs. Majors:

Overlay of USD vs. Majors Chart by TradingView

The dollar traded defensively through Asian hours as regional risk appetite improved, then attempted stabilization during early European trading as participants positioned ahead of key U.S. data releases. The ECB’s decision to hold rates steady initially provided modest euro support, though major pairs remained range-bound awaiting the U.S. inflation and employment reports.

The decisive shift materialized following the U.S. data releases, where the shocking jobless claims print immediately triggered broad dollar weakness despite CPI printing slightly above expectations at 0.4% monthly. The Greenback’s retreat accelerated through the US session as markets fully priced three quarter-point Fed cuts through year-end, pushing the euro through key resistance levels while commodity currencies surged on the shifting monetary policy narrative.

The Australian dollar emerged as the session’s outperformer, reaching November 2024 highs as the combination of dollar weakness and risk-on sentiment proved irresistible. Sterling and the yen also capitalized on the dollar’s vulnerability, though the yen maintained its relative underperformance among majors.

By day’s end, the dollar had recorded broad losses, reflecting markets’ conviction that the Fed’s easing cycle would prove more aggressive while other major central banks are about done with their monetary adjustments.

Upcoming Potential Catalysts on the Economic Calendar

- Japan Capacity Utilization Rate for July at 4:30 am GMT

- Japan Industrial Production Final for July at 4:30 am GMT

- Germany Inflation Rate Final for August at 6:00 am GMT

- U.K. GDP for July at 6:00 am GMT

- U.K. Balance of Trade for July at 6:00 am GMT

- U.K. Manufacturing & Industrial Production for July at 6:00 am GMT

- U.K. Construction Output for July at 6:00 am GMT

- Germany Bundesbank Nagel Speech at 8:15 am GMT

- U.K. NIESR Monthly GDP Tracker for August at 11:00 am GMT

- Canada Building Permits for July at 12:30 pm GMT

- Canada Capacity Utilization Rate for Q2 2025 at 12:30 pm GMT

- U.S. University of Michigan Consumer Sentiment Index & Inflation Expectations for September at 2:00 pm GMT

Traders are in for another busy couple of trading sessions, starting with the U.K. GDP and manufacturing data which will likely test whether Sterling can hold yesterday’s dollar-driven gains.

In the U.S., the UoM sentiment data takes on heightened importance after yesterday’s stagflationary mix of sticky 2.9% inflation and near four-year high jobless claims, with inflation expectations potentially challenging aggressive Fed cut pricing that has pushed the dollar to 2025 lows against multiple currencies.

As always, look out for global trade developments and geopolitical headlines that could influence overall market sentiment. Stay nimble and don’t forget to check out our Forex Correlation Calculator when taking any trades!