Markets shifted gears on Wednesday as softer U.S. producer prices, looming ECB uncertainty, and rising geopolitical tensions set the stage for Thursday’s all-important CPI release.

With Fed rate cut odds near 90% and policy divergence in play, traders are bracing for a potentially volatile session.

Check out the headlines and economic updates you may have missed in the latest trading sessions!

Headlines:

- New Zealand Visitor Arrivals for July: 6.6% y/y (2.5% y/y forecast; 0.8% y/y previous)

- Japan Reuters Tankan Index for September: 13.0 (10.0 forecast; 9.0 previous)

- Israel strikes Hamas leadership in Qatar

- Chinese insurance firms have increased their equity exposure to the highest level in at least three years

- Poland downs Russian drones in its airspace, becoming first NATO member to fire during war in Ukraine

- US federal judge temporarily blocks FOMC member Lisa Cook‘s dismissal

- China PPI Growth Rate for August: -2.9% y/y (-3.0% y/y forecast; -3.6% y/y previous)

- China Consumer Price Index for August: -0.4% y/y (-0.1% y/y forecast; 0.0% y/y previous); 0.0% m/m (0.3% m/m forecast; 0.4% m/m previous)

-

U.S. Producer Price Index for August: -0.1% m/m (0.4% m/m forecast; 0.9% m/m previous); 2.6% y/y (3.4% y/y forecast; 3.3% y/y previous)

- U.S. Core PPI for August: -0.1% m/m (0.4% m/m forecast; 0.9% m/m previous); 2.8% y/y (3.6% y/y forecast; 3.7% y/y previous)

- U.S. Wholesale Inventories for July: 0.1% m/m (0.2% m/m forecast; 0.1% m/m previous)

- Oracle surged about 43% to a record high after the company unveiled four multi-billion-dollar contracts

- Reuters reported that Trump is urging the EU to impose 100% tariffs on China, India to pressure Putin

- U.S. EIA Crude Oil Stocks Change for September 5, 2025: 3.94M (2.42M previous)

Broad Market Price Action:

The major assets traded cautiously ahead of Thursday’s US CPI data, with Wednesday’s surprise decline in producer prices – falling 0.1% versus +0.3% expected, the first drop in four months – cementing Fed rate cut expectations at 90% probability for next week’s FOMC meeting.

European equities closed mixed as Poland shot down Russian drones that violated NATO airspace, marking the alliance’s first military action during the Ukraine conflict. The CAC 40 edged up 0.15% while Germany’s DAX fell 0.36% amid regional tensions. US indices hit new records with the S&P 500 climbing 0.30% to 6,532.04, propelled by Oracle’s explosive 36% surge on AI cloud optimism, though gains were capped by Apple’s continued weakness and afternoon profit-taking.

Gold closed in the green again at $3,640, supported by dovish Fed expectations and geopolitical risks from both the Poland-Russia escalation and Israeli airstrikes in Doha. The 10-year Treasury yield dropped 4.2 basis points to 4.03%, its lowest since April, as deflating producer prices reinforced monetary easing expectations. WTI crude oil jumped 1.71% to $63.75 on Middle East tensions and NATO-Russia concerns. Bitcoin advanced modestly to $114,000, riding the risk-on sentiment from expectations of loosening financial conditions.

FX Market Behavior: U.S. Dollar vs. Majors:

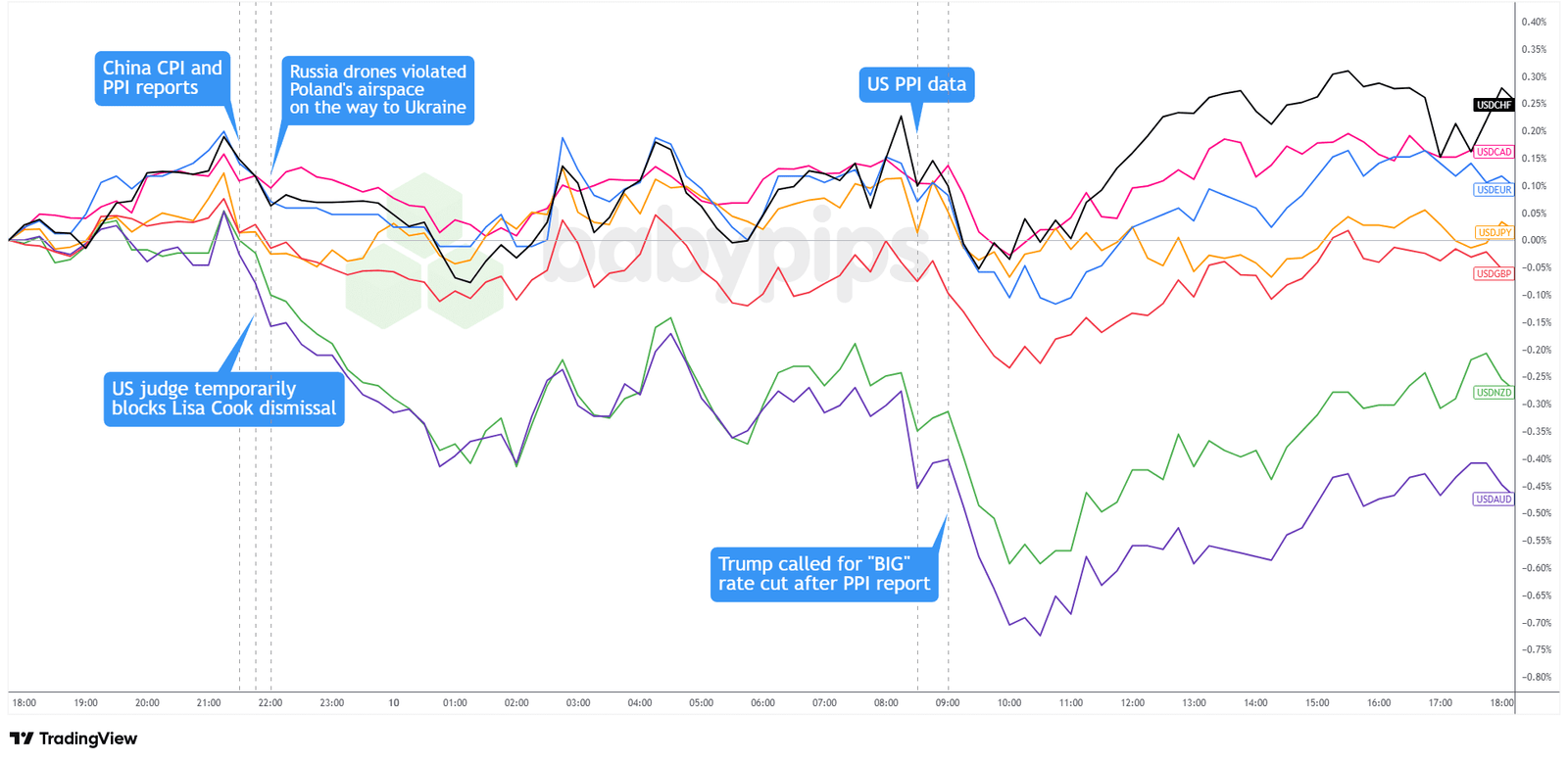

Overlay of USD vs. Majors Chart by TradingView

The dollar traded mixed on Wednesday, as geopolitical tensions and softer inflation data pulled the currency in different directions. The Greenback started range-bound against most majors, though antipodean currencies found early support from China’s deflation data showing CPI at -0.4% y/y and reports of Chinese insurers boosting equity holdings to record levels. Additional pressure came from a federal judge temporarily blocking Trump’s attempt to remove Fed Governor Lisa Cook, preserving her FOMC voting rights for next week’s meeting.

European hours brought modest dollar volatility as markets digested the Poland-Russia drone incident alongside Israeli airstrikes in Doha. The unexpected decline in US producer prices, falling 0.1% versus +0.3% expected, initially sparked speculation of a potential 50 basis point Fed cut, with Trump’s social media criticism of Powell adding to bearish sentiment.

However, the dollar demonstrated resilience into the London close, recovering despite the 10-year Treasury yield dropping to 4.03%. By day’s end, the Greenback finished higher against traditional havens and the euro while losing ground to risk-sensitive currencies like GBP, AUD, and NZD.

Upcoming Potential Catalysts on the Economic Calendar

- Australia Consumer Inflation Expectations for September at 1:00 am GMT

- Australia RBA Connolly Speech at 1:30 am GMT

- Euro Area ECB Interest Rate Decision for September at 12:15 pm GMT

- U.S. Consumer Price Index Growth Rate for August at 12:30 pm GMT

- U.S. Initial Jobless Claims for September 6, 2025 at 12:30 pm GMT

- Euro Area ECB Press Conference at 12:45 pm GMT

- U.S. Monthly Budget Statement for August at 6:00 pm GMT

- U.S. Fed Balance Sheet for September 10, 2025 at 8:30 pm GMT

- New Zealand Business NZ PMI for August at 10:30 pm GMT

- New Zealand Electronic Retail Card Spending for August at 10:45 pm GMT

- New Zealand Electronic Card Retail Sales for August at 10:45 pm GMT

London traders will be glued to the ECB decision and Lagarde’s press conference, which could shake up the euro just as U.S. CPI drops into the mix.

In the U.S., the inflation print and jobless claims will steer Fed policy expectations, while later U.S. budget and balance sheet updates may fine-tune positioning. Meanwhile, antipodean traders will be eyeing New Zealand’s PMI and retail spending data for fresh momentum.

As always, look out for global trade developments and geopolitical headlines that could influence overall market sentiment. Stay nimble and don’t forget to check out our Forex Correlation Calculator when taking any trades!