Markets rallied on Tuesday as the U.S. government shutdown moved closer to resolution, with the Senate passing a temporary funding measure that now heads to the House for approval, spurring optimism that delayed economic data releases will soon provide clarity on the Federal Reserve’s policy path.

Oil surged as the standout performer, while Bitcoin tumbled more than 2% amid persistent concerns over U.S.-China trade tensions. Weaker-than-expected U.K. labor market data strengthened the case for a Bank of England rate cut in December, sending sterling lower and gilt yields tumbling.

Check out the forex news and economic updates you may have missed in the latest trading session!

Forex News Headlines & Data:

- Wall Street Journal reported that China plans to prevent the U.S. military from accessing its rare earth magnets

- Australia Westpac Consumer Confidence Index for November 2025: 103.8 (94.7 forecast; 92.1 previous)

- Australia NAB Business Confidence for October 2025: 6.0 (8.0 forecast; 7.0 previous)

- Japan Bank Lending for October 2025: 4.1% y/y (3.9% y/y forecast; 3.8% y/y previous)

- Japan Current Account for September 2025: 4,483.0B (2,000.0B forecast; 3,776.0B previous)

- New Zealand Business Inflation Expectations for December 31, 2025: 2.28% (2.5% forecast; 2.28% previous)

- Japan Eco Watchers Survey Outlook for October 2025: 53.1 (49.0 forecast; 48.5 previous)

- U.K. BRC Retail Sales Monitor YoY for October 2025: 1.5% y/y (1.7% y/y forecast; 2.0% y/y previous)

-

U.K. Employment Change for September 2025: -22.0k (50.0k forecast; 91.0k previous)

- U.K. Unemployment Rate for September 2025: 5.0% (4.8% forecast; 4.8% previous)

- U.K. Average Earnings excl. Bonus (3Mo/Yr) for September 2025: 4.6% (4.6% forecast; 4.7% previous)

- U.K. Claimant Count Change for October 2025: 29.0k (15.0k forecast; 25.8k previous)

- Germany ZEW Economic Sentiment Index for November 2025: 38.5 (41.5 forecast; 39.3 previous)

- Euro area ZEW Economic Sentiment Index for November 2025: 25.0 (24.0 forecast; 22.7 previous)

- U.S. NFIB Business Optimism Index for October 2025: 98.2 (98.0 forecast; 98.8 previous)

- U.S. ADP Employment Change Weekly for October 25, 2025: -11.25k (14.25k previous)

Broad Market Price Action:

Tuesday’s session demonstrated mixed correlations and anti-Dollar sentiment as political progress in Washington mixed with rising trade tensions and weak economic signals, with commodities and equities advancing while the dollar retreated.

The S&P 500 erased early losses to close up 0.24% near 6,850. The bounce started during the U.S. session as U.S. traders had a chance to price in news of the Senate passing the shutdown-ending measure. Technology shares showed mixed performance, with Nvidia declining 2.5% on the SoftBank stake sale while Advanced Micro Devices trimmed losses after projecting accelerating sales growth.

Gold pulled back 0.27% to $4,126.50 after extending its climb above $4,140 during Asian trading hours. The precious metal’s retreat came as progress on ending the government shutdown reduced some haven demand during the U.S. session, though underlying support from Fed rate cut expectations and concerns about central bank independence likely kept the pullback at bay.

WTI crude oil emerged as the session’s biggest winner, surging 1.74% to $60.80. The energy complex rallied throughout the day, with gains building from the London session through the U.S. afternoon as shutdown resolution hopes likely improved demand outlook expectations and overshadowed persistent oversupply concerns.

Bitcoin suffered the session’s steepest decline, tumbling 2.56% to $102,891.80 after reaching a one-week high of $107,454 during the Asia session. There were no direct bitcoin or crypto news to point to, so it’s possible that some risk aversion sentiment played a role. This may be related to. This possibly may be related to a Wall Street Journal report that China plans to prevent the U.S. military from accessing its rare earth magnets, reigniting U.S.-China trade tensions, or the weak read in the ADP weekly jobs update, or possible profit taking from Sunday & Monday’s rally.

The 10-year Treasury yield closed unchanged at 4.10% with the bond market closed for Veterans Day. Treasury futures rose modestly as ADP data suggested labor market cooling, though trading volumes remained subdued due to the holiday closure.

FX Market Behavior: U.S. Dollar vs. Majors:

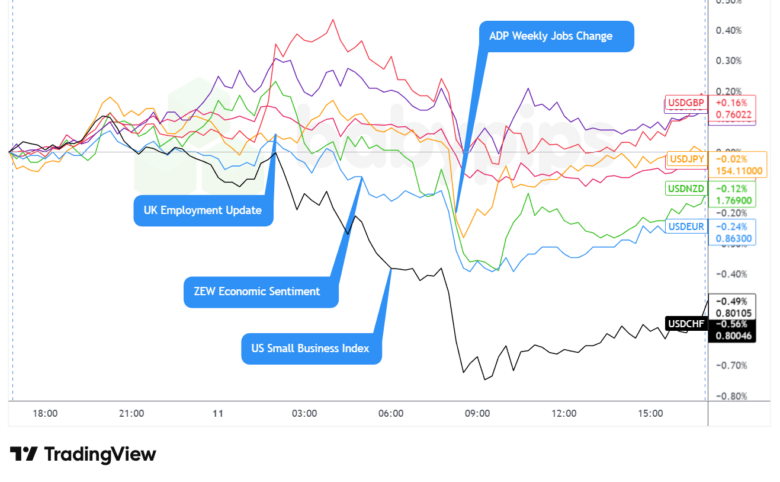

Overlay of USD vs. Majors Forex Chart by TradingView

The U.S. dollar traded mixed but arguably net underperformer on Tuesday, experiencing divergent momentum across trading sessions as rising trade tensions and weak private-sector employment data outweighed earlier shutdown resolution hopes.

During the Asian session, the greenback posted net gains against major currencies as traders likely continued to price in shutdown resolution hops. However, the dollar’s strength proved short-lived as it possibly reacted to news that China may be hatching a plan to keep the U.S. military from getting its rare-earth magnets, according to the Wall Street Journal, raising trade tensions between the two superpowers once again.

The London session saw continued Dollar weakness as that seemed to outweigh weaker-than-expected U.K. employment report and soft German ZEW sentiment data. The euro gained ground despite the ZEW miss, rising as ECB members maintained their balanced inflation assessment. Sterling faced pressure, declining as market pricing for a December Bank of England rate cut jumped from 61% to 81% following the disappointing jobs data. The Swiss franc outperformed, strengthening against the dollar to 0.8005 on hopes for a U.S.-Switzerland trade deal that could lower tariffs from 39% to potentially 15%.

During the U.S. session, the dollar saw increased pressure at the open, correlating with the ADP weekly employment report showing employers shed 11,250 jobs in the four-week period through October 25, a sharp reversal from the prior week’s gains. However, the greenback stabilized and rebounded slightly through the rest of the session as traders likely awaited the House vote on the shutdown-ending measure.

Upcoming Potential Catalysts on the Economic Calendar

- Australia RBA Jones Speech at 10:15 pm GMT

- Japan Reuters Tankan Index for November 2025 at 12:00 am GMT

- Australia Home Loans for September 30, 2025 at 12:30 am GMT

- Japan Machine Tool Orders for October 2025 at 6:00 am GMT

- Germany Inflation Rate Final for October 2025 at 7:00 am GMT

- China Monetary Developments for October 2025

- Euro area ECB Schnabel Speech at 10:45 am GMT

- Euro area ECB Guindos Speech at 11:40 am GMT

- U.S. MBA 30-Year Mortgage Rate & Applications for November 7, 2025 at 12:00 pm GMT

- U.K. BoE Pill Speech at 12:05 pm GMT

- Canada Building Permits for September 2025 at 1:30 pm GMT

- U.S. Fed Williams Speech at 2:20 pm GMT

- U.S. Fed Paulson Speech at 3:00 pm GMT

- U.S. Fed Waller Speech at 3:20 pm GMT

- U.S. Fed Bostic Speech at 5:15 pm GMT

- U.S. Fed Miran Speech at 5:30 pm GMT

- Canada BoC Summary of Deliberations at 6:30 pm GMT

- U.S. API Crude Oil Stock Change for November 7, 2025 at 9:30 pm GMT

Wednesday’s calendar centers on central bank commentary and the critical House vote on the shutdown-ending measure. Markets will scrutinize speeches from multiple Federal Reserve members—Williams, Paulson, Waller, Bostic, and Miran—for insights into the policy outlook once delayed economic data becomes available. Any dovish signals regarding labor market concerns could pressure the dollar further and support risk assets.

The House vote, scheduled for 4 p.m. Eastern, represents the key near-term catalyst. If approved, the reopening could trigger a wave of delayed data releases, with Deutsche Bank noting that based on the 2013 shutdown timeline, the September jobs report could arrive as early as next week. This data deluge will be critical for Fed rate cut expectations, with traders positioning for potential revelations of labor market weakness that were masked during the 42-day closure.

On the U.S.-China trade front, markets remain sensitive to any developments following reports that China plans to restrict rare earth magnet exports to the U.S. military. Fresh escalation or de-escalation signals could drive volatility, particularly in commodities and currencies tied to global trade flows.

Bank of England commentary from Deputy Governor Pill will be closely watched following Tuesday’s weak U.K. employment data, which pushed December rate cut expectations above 80%. Any dovish lean could extend sterling’s weakness, while hawkish pushback might provide temporary support. The Canada BoC Summary of Deliberations will offer insight into the central bank’s thinking on inflation and growth trade-offs as the economy navigates U.S. shutdown spillover effects and ongoing trade uncertainty.

Stay frosty out there, forex friends, and don’t forget to check out our Forex Correlation Calculator when planning to take on risk!