Crypto whales and long-term holders are cashing out, exerting constant selling pressure on markets, and keeping crypto prices suppressed, similar to market dynamics following the 2000s dot-com stock market crash, according to analyst Jordi Visser.

Visser said the current price action in the crypto market is reminiscent of the period following the 2000 dot-com stock market bubble, which crashed stocks by up to 80%, followed by 16 years of consolidation before they regained their previous highs.

This meant that venture capitalists, who invested in tech during the crash, were forced to hold their investments due to mandated lock-up periods as they treaded water and then desperately sold into the markets as soon as they were able to, Visser said. He added:

“Many stocks were trading below their IPO prices. We have a similar situation going on right now. VC and insider investors, desperate for liquidity or redemption, sold into every rally. That’s what’s happened to me for Solana, Ethereum, for every altcoin, and for Bitcoin.”

Visser clarified that it would not take 16 years for crypto prices to rebound, but was using the 2000s dot-com aftermath to illustrate the sell-side pressure dynamics at play, and said crypto is nearing the end of this consolidation phase, with a maximum of 1 year left.

The analysis came amid fears that a crypto and Bitcoin (BTC) bear market kicked off in October, causing several analysts and investment firms to revise their most bullish price predictions by lowering their forecasts.

Related: $100B in old Bitcoin moved, raising ‘OG’ versus ‘trader’ debate

Has Bitcoin bottomed out around the $100,000 level?

The price of BTC shows signs of bottoming out around $100,000, according to some analysts, but others fear a potential drop to $92,000 if selling pressure continues to mount.

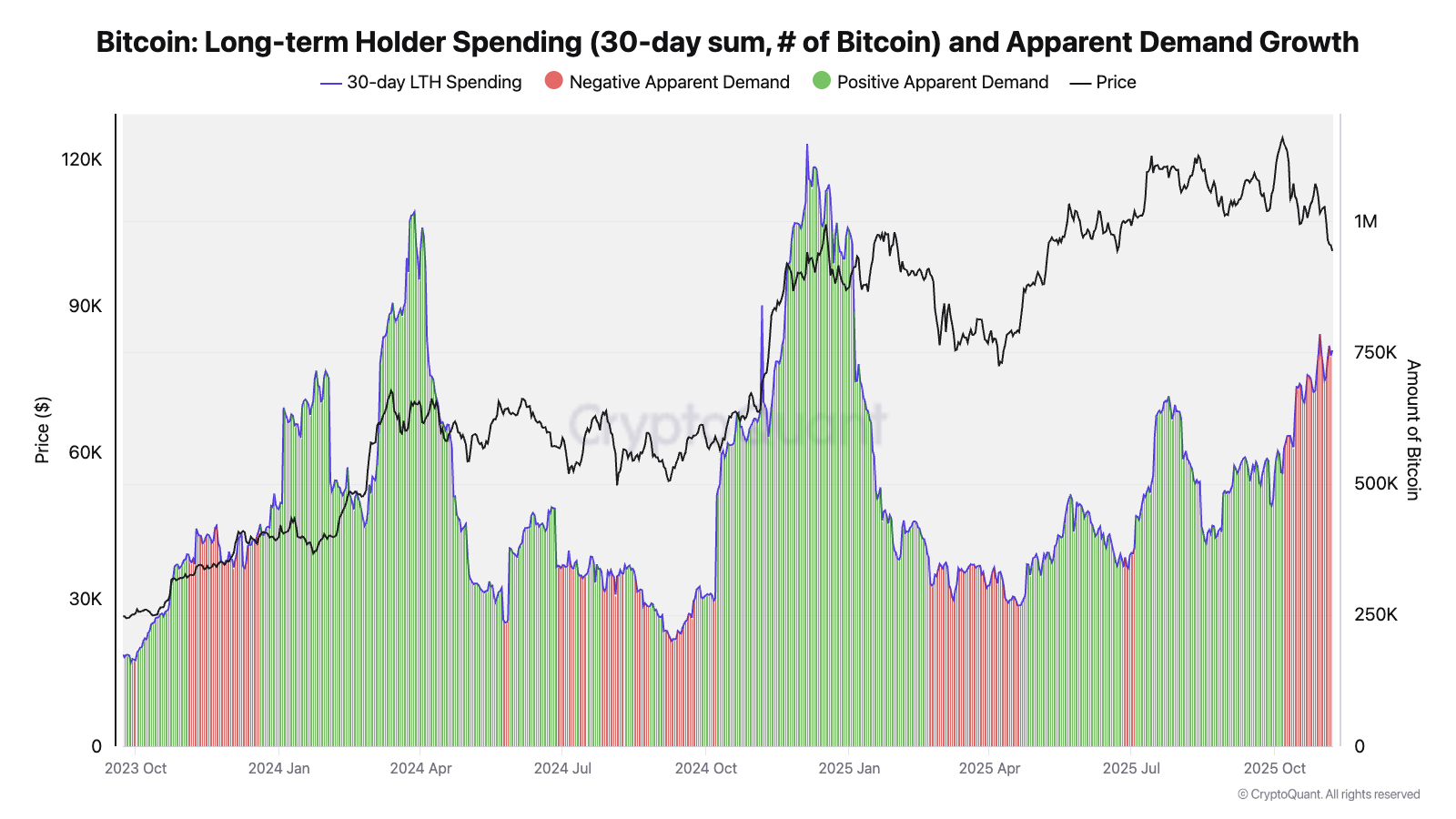

Whales and long-term holders typically cash in at all-time highs, and whale selling is not a problem in and of itself, CryptoQuant analyst Julio Moreno said.

The sell-side pressure from whales and long-term holders only suppresses asset prices if new demand is not there to soak up the BTC supply being dumped on the markets.

“Since October, long-term holder selling has increased; nothing new here, but demand is contracting, unable to absorb long-term holder supply at a higher price,” Moreno said.

Magazine: Altcoin season 2025 is almost here… but the rules have changed