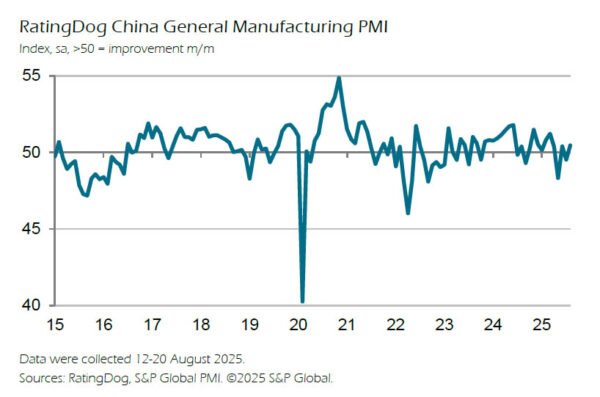

China’s manufacturing sector showed a modest improvement in August, with the RatingDog Manufacturing PMI rising from 49.5 to 50.5, beating expectations of 49.9 and returning to expansion. However, RatingDog described the uptick as a “breath of relief rather than a sustained rally,” reflecting cautious optimism. By contrast, the official NBS survey offered a more subdued view, with manufacturing inching up from 49.3 to 49.4 and non-manufacturing steady at 50.3.

The RatingDog report highlighted firmer new orders, which pushed inventories of raw materials and finished goods higher. Export demand remains weak but showed slower contraction. Yao cautioned that external demand may have been pulled forward while domestic demand stays soft, limiting the scope for sustained output gains without stronger local consumption.

Meanwhile, input costs continued to climb under the “Anti-involution” policy backdrop, and those upstream pressures are now filtering into output prices, ending an eight-month streak of falling charges. With profit recovery still slow, the durability of the latest rebound depends on whether exports can stabilize further and domestic demand begins to catch up.