The debut of the Canary Capital XRP exchange-traded fund (ETF) is signaling renewed demand for altcoins, after the fund posted the strongest first-day performance of the more than 900 ETFs launched in 2025.

Canary Capital’s XRP (XRP) ETF closed its first day with $58 million in trading volume, marking the most successful ETF debut of 2025 among both crypto and traditional ETFs, said Bloomberg ETF analyst Eric Balchunas in a Thursday X post.

The new fund garnered over $250 million in inflows during its first trading day, surpassing the recent inflows of all other crypto ETFs.

Part of the reason behind the successful launch was the ETF’s in-kind creation model, according to ETF analyst Nate Geraci.

“A few people asking how it’s possible to have ‘only’ $59mil trading volume, but nearly $250mil inflows… The answer? In-kind creations, which don’t show up in trading volume,” wrote Geraci in a Thursday X post.

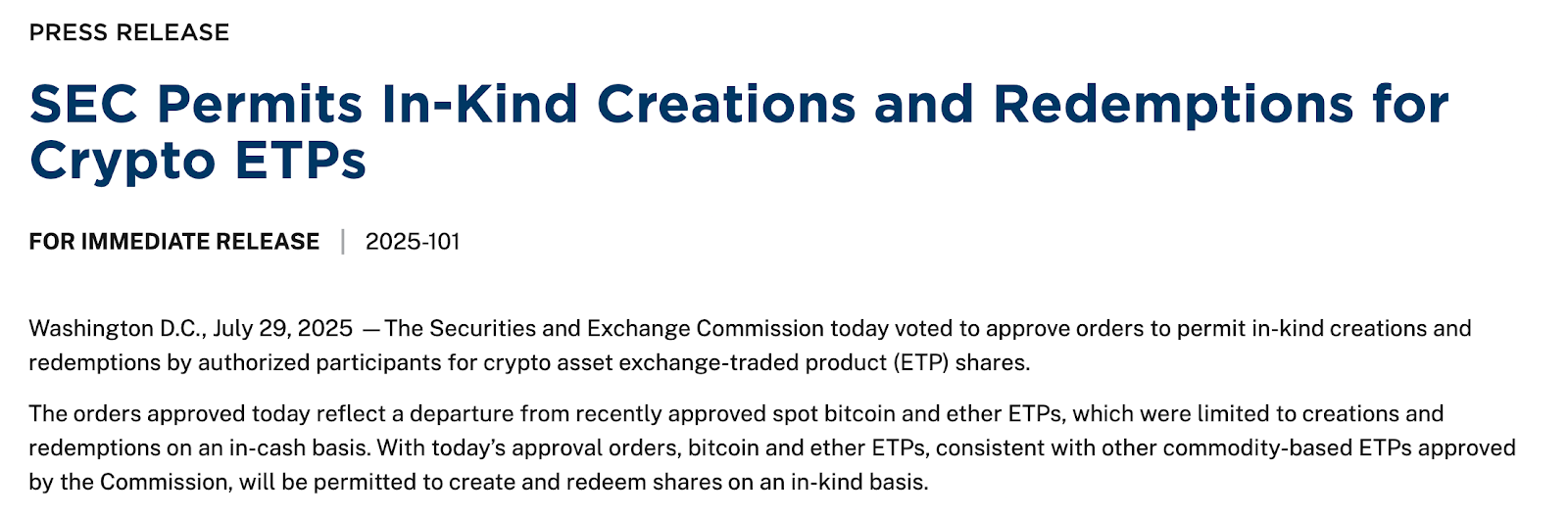

The in-kind redemption model enables the creation and redemption of ETF shares through the underlying asset, as opposed to cash-only transaction models. In this case, Canary Capital’s ETF shares can be exchanged for XRP tokens.

The US Securities and Exchange Commission (SEC) approved in-kind creation and redemption for cryptocurrency ETFs on July 29, Cointelegraph reported at the time.

Smart money traders rotate into XRP longs after ETF debut

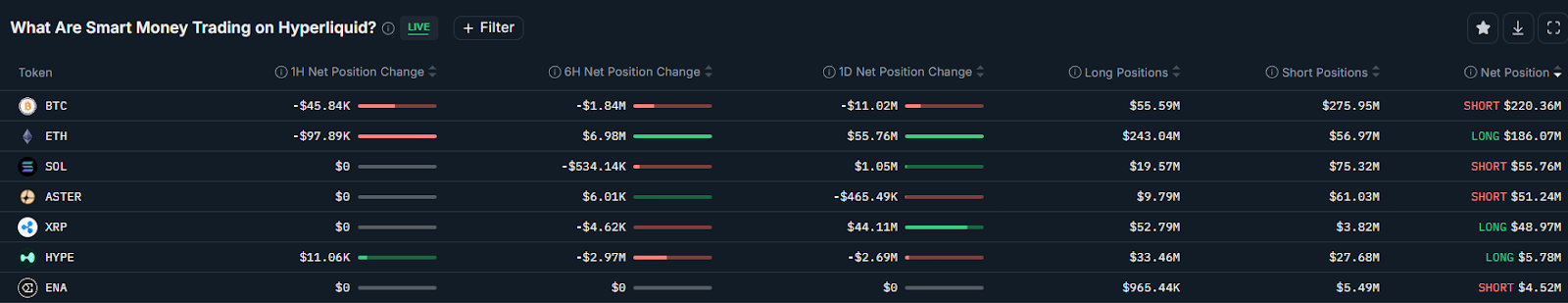

The launch of the ETF inspired a bullish rotation among the industry’s most successful traders, as tracked by returns and labeled as “smart money” traders on the crypto intelligence platform Nansen.

Related: Circle enters world’s largest financial market with onchain FX engine

Smart money traders have added $44 million worth of net long XRP positions over the past 24 hours, signaling more upside expectations for the token.

The cohort was net long on the XRP token, with a cumulative $49 million, but remained net short on the Solana (SOL) token, with $55 million worth of cumulative short positions on the decentralized exchange Hyperliquid.

Related: Metaplanet’s Bitcoin gains fall 39% as October crash pressures corporate treasuries

“XRP is holding near $2.30, showing relative stability but still feeling the effects of declining liquidity and cautious investor sentiment,” Ryan Lee, chief analyst at Bitget exchange, told Cointelegraph.

“For now, the setup looks like a healthy reset, not the end of the cycle, with both SOL and XRP well-positioned to lead the next wave once confidence snaps back.”

Spot Bitcoin ETFs saw $866 million worth of negative outflows on Thursday, their second-worst day on record, after the $1.14 billion daily outflows on Feb. 25, 2025, according to Farside Investors.

Magazine: Father-son team lists Africa’s XRP Healthcare on Canadian stock exchange