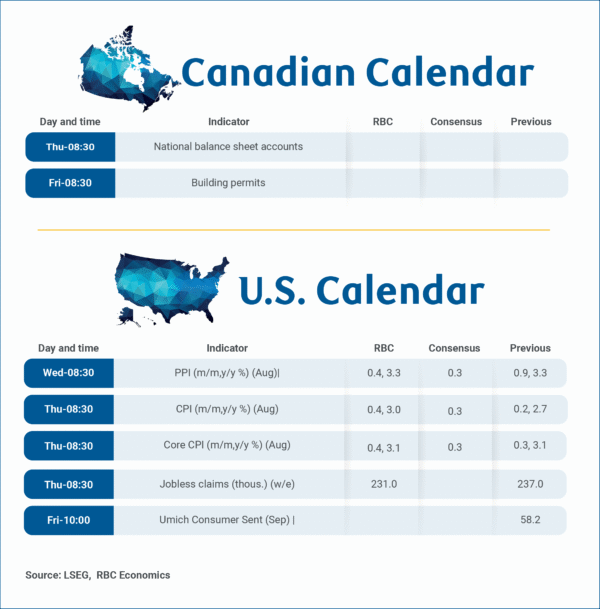

National balance sheet accounts data for Q2 on Thursday should show Canadian household net worth edged higher with a rebound in equity markets boosting financial asset values in a quiet week for Canadian data releases.

The S&P/TSX Composite Index climbed 7.8% following a weak Q1. However, part of this growth will likely be offset by declining property values. CREA’s MLS Home Price Index slipped by 1.2%, reversing gains from the previous quarter. The debt service ratio also likely increased modestly in Q2 amid growth in both household mortgage and non-mortgage loans.

Building permits data on Friday for July will also be watched for signs of resilience persisting in homebuilding nationally. But, permits have trended lower since February, and relative strength in national housing starts has reflected significant regional divergences with substantial underperformance in Ontario.

Last inflation reading before Fed decision

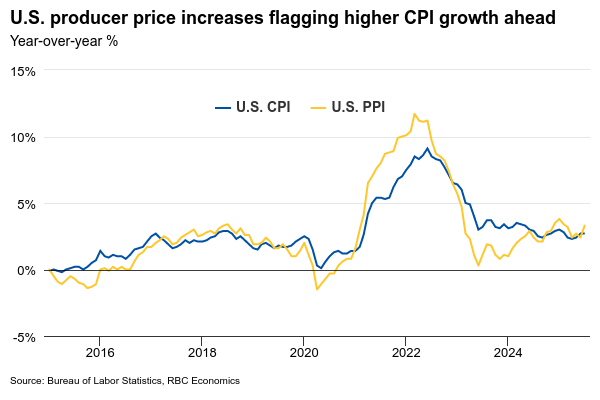

In the U.S., the focus will shift to the consumer price index report for August ahead of September’s FOMC meeting. It follows August employment numbers that largely confirmed labour markets are cooling. We forecast headline inflation to rise to 3% year-over-year, up from 2.7% in July, driven largely by higher gasoline prices (2% month-over-month), and food prices flagged by earlier increases in producer prices.

Core price growth excluding those components is also expected to remain elevated. We expect a 0.4% month-over-month increase that would be the largest since January, and second largest in almost two years. Trade-sensitive categories such as autos, household furnishings, and recreational goods will be watched closely for further evidence on whether the impact of tariffs is becoming more pronounced.

As we highlighted previously, the timing of tariffs passing through depends on factors such as inventory levels and the degree to which businesses absorb or pass on added costs. As inventory buffers continue to erode, we see the effects of tariffs increasingly reflected in producer prices with the potential to spill over into broader inflation metrics in the months ahead.